The EML Payments Ltd (ASX: EML) share price dropped by as much as 45% this morning. Why has the EML share price been almost cut in half?

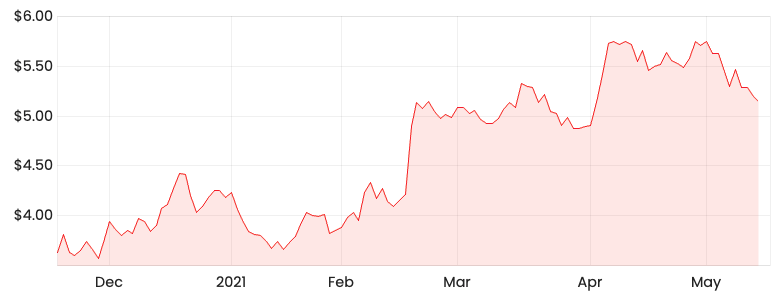

EML share price

Concerns raised by the Central Bank of Ireland

EML’s Irish regulated subsidiary, PFS Card Services (Ireland) Limited (PCSIL) received a letter from the Central Bank of Ireland (CBI) raising concerns around its Anti-Money Laundering / Counter-Terrorism Financing (AML/CTF), risk and control frameworks, and governance.

These concerns solely relate to PCSIL and not any other operations.

The company advises if CBI follow through with their proposed directions, it could have a material impact on the European operations of the PFS business, including potentially restricting PCSIL’s activities under the Irish authorisation.

PCSIL’s revenue represented around 27% of EML’s global consolidated revenue (unaudited) between 1 January 2021 to 31 March 2021.

The CBI has given PCSIL the opportunity to provide a response in relation to the concerns and it intends to complete this by 27 May 2021.

EML advises it’s too early to estimate the potential impact on its FY21 results. So, excluding the potential regulatory impact, the company said it remains on track to achieve its previous guidance for FY21.

My thoughts on EML

This news highlights the risks of making acquisitions of companies operating in different regulatory environments.

At this stage, there is not enough information to understand what potential issues that EML may need to address. In these circumstances, it is best to examine and evaluate the facts.

Given CBI has outlined proposed directions, it is more likely than not that EML will need to take steps to address the underlying concerns.

I will be waiting to evaluate EML’s further response on 27 May 2021 alongside any information to be released by the CBI. These responses will likely shed further light on the seriousness and severity of the concerns, which should act as an indicator of whether these are systemic issues.

As part of the Rask Investment Philosophy

, I prefer to think about how this news will affect the fundamentals of the business over the long term.

If you are interested in other ASX growth share ideas, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.