In a follow-up to the bull case for Treasury Wine Estates Ltd (ASX: TWE), today I will be outlining the bear case for the business.

China – a glass of half-empty scenario?

China’s Ministry of Commerce (MOFCOM) anti-dumping tariffs of 175.6% on Australian country of origin wine ended Treasury Wine’s presence in the region.

Management has pivoted quickly, suggesting excess Chinese inventory will be redeployed in existing markets with unmet demand such as Australia.

However, there is a natural cap on demand – Australia’s population is 26 million. Under penetrated markets such as the United States and Asia ex-China could soak up demand, but this will require nurturing of supplier relationships and significant investment.

Before the tariffs, Treasury Wines sold more than $500 million of wine to China. It was the most profitable segment by a country mile, with 40% margins.

Replicating the success in China will be near-impossible. Management will have to rely on building brand awareness elsewhere and not compromising margins when offloading Chinese inventory.

Long time, no speak

During the investor day last week, CEO Tim Ford noted that “there is some cynicism in the Australian market”.

As Treasury Wines looks to offload excess inventory, the common response amongst independent retailers is “Oh, you need us again, do you?”.

Much of this angst stems from management’s decision in previous years to prioritise inventory to China.

While the bridge can certainly be mended, management may need to entice suppliers to jump back on board.

Slimmer may not be better

Treasury recently announced the divestment of its United States commercial brands

to The Wine Group.

The commercial brands are not congruent with Treasury Wines’ long-term strategy of evolving the US into a premium portfolio.

Although a small contributor to profits, the commercial portfolio represents half of the volumes in the Americas.

With a more focused portfolio, Treasury Wines may struggle to retain distribution with large retailers without the support of larger volumes, impacting both its distribution network and pricing power.

Competition

The wine industry is highly fragmented with intense competition. Big players such as E. & J. Gallo, Constellation Brands Inc (NYSE: STZ), and Pernod Ricard SA (EPA: RI) have already cemented strong competitive positions particularly in the Americas and Europe.

Treasury Wines’ plans to relocate current and future inventory to new markets won’t go unnoticed and competitors may choose to lower prices to mitigate losing market share.

Past failure to execute

The premiumisation strategy has been a focus for some time, especially in the United States.

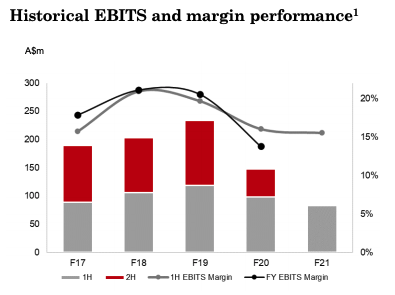

While some headway has been made, the historical EBITS and margins performance has tracked largely sideways as illustrated below.

What makes this time different? Management’s ambition of a 25% EBITS margin is yet to materialise.

By investing, you are taking management’s word that they can execute.

Summary thoughts

Despite the issues from excess inventory and existing competition, I think the Treasury Wine portfolio, in particular Penfolds, is strong enough to drive demand in current and new markets.

If management can execute, I think today offers an attractive entry price.