Anyone else perplexed about the Appen Ltd

(ASX: APX) share price in the past year?

Its been a volatile ride for shareholders, with the share price reaching a high of $43.66 in August before cratering to a low of $10.65 in May.

With the share price rallying 17% this week, it’s apparent the market is unsure how to value the company.

This article reviews what Appen does, why it’s misunderstood by the market and how investors can get a better idea of its value.

This isn’t your typical tech company

Above all else, before investing in any company you should be able to explain what the business does. It’s the very first step in our Rask Investment Philosophy and outlined in detail in a recent episode of the Australian Finance Podcast.

Appen is often lumped together with other prominent Australian technology companies, commonly referred to as the WAAAX stocks – WiseTech Global Ltd (ASX: WTC), Afterpay Ltd (ASX: APT), Altium Limited (ASX: ALU), Appen

, and Xero Limited (ASX: XRO).

Despite being a technology company, Appen’s business model is very different from its four peers.

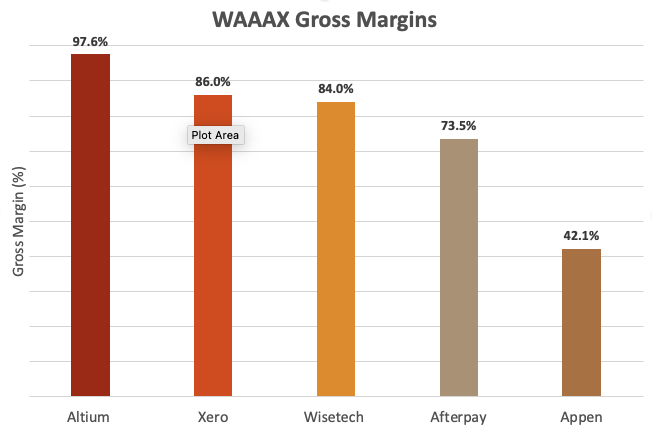

WiseTech, Altium, and Xero operate software-as-a-service (SaaS) platforms in shipping, printed circuit board design, and accounting, respectively. Afterpay is a payments company taking market share from incumbent credit providers. All four companies are incredibly scalable, illustrated by their gross margins.

Conversely, Appen is far more reliant on labour, specifically its 1,000,000 skilled contractors used for data annotation. Each project requires new labelling leading to high labour costs. This is Appen’s moat, although a narrow one. More on this later.

As a result, its gross margin is significantly lower than its peers and its profitability is limited as it scales (takes on new projects).

Since Appen predominantly works on projects related to its customer’s product life cycles, it is more cyclical than the typical SaaS company. Recurring revenue is low albeit growing, again leaving it vulnerable to customers reprioritising product developments. This has been the main driver of the recent share price fall since August as customers deferred expenditure.

So what is Appen’s competitive advantage?

As alluded to earlier, Appen’s moat is its workforce of multi-national and multi-lingual contractors located in 170 countries. Additionally, the proprietary crowd management and annotation platform create a barrier to entry for customers to develop their own software.

When a company is undertaking a large (billions of data points) artificial intelligence (AI) project which requires training data, Appen has the capabilities. Its lower-cost to employ an aggregator such as Appen rather than source contractors from various regions. A great case study involving Adobe Inc (NASDAQ: ADBE), summarising what Appen actually does can be found here.

It’s a weak moat, given it operates in a duopoly with a private company called Lionbridge Technologies.

Moreover once a training data set is developed by Appen, most of the work is done. Companies then rely on the AI algorithm to power future results, hence why the business has low recurring revenue.

Management recently noted it does not see a change in this competitive environment nor a shift to insourcing.

A criticism I hear often of Appen is “surely computers will replace Appen’s offering?”. Possibly this is true. However as management has stated, Appen’s customers are some of the smartest companies in the world. If tech giants could automate and cut Appen out, they would have, and we’d know about it.

Getting a handle on valuation

We’ve established Appen is more capital intensive than its peers, therefore, resulting in lower gross margins and less operating leverage. Furthermore, it’s vulnerable to changes in (larger) clients product development cycles.

However, this doesn’t explain why the share price has fallen close to 70% since the August high. Sure, management did concede some customers were deferring past projects to focus on new opportunities however the underlying business wasn’t 70% worse off.

The answer: the business itself has not drastically changed but the multiple prescribed by the market.

In August it was a budding tech company that had grown sales at 64% per annum since 2015. When the company revealed customers were deferring projects to focus on new opportunities, the narrative changed.

Appen became a business with mid-teens EBITDA margins growing sales at single digits.

Both of these narratives are true, but Mr Market is temperamental. When the company failed to deliver past sales growth, the multiple regressed and the share price fell.

Today Appen has an enterprise value (EV) of approximately $1.6 billion. Taking 2020 EBITDA of $108.6 million, the company currently trades at an EV/EBITDA of 14.8.

I believe this multiple is attractive. If management executes in new markets and delivers on the 34% increase in projects with large clients, I see the stock rerating upwards.

As a caveat, I don’t think the share price will be north of $40 anytime soon. So tread carefully.

For some more ideas on ASX growth shares

, I’d recommend signing up for a free Rask account to gain access to our stock reports.