Shares in ex-market darling Kogan.com Ltd (ASX: KGN) have fallen another 14% today after downgrading guidance citing warehousing and inventory complications.

Today’s share price of $8.70 is another 52-week low for the company, which now means its market valuation has tumbled by more than 65% since its high in October last year.

KGN share price

To put that another way, Kogan’s shares have gone from being up 575% from March last year to 133% today, which still isn’t too bad. But it’s unlikely too many investors got in at the bottom of the market, meaning many would be underwater today.

In downgrade cycles that exhibit relentless selling such as this, even average companies can begin to look attractive primarily from a valuation perspective. Appen Ltd (ASX: APX) is another that comes to mind.

Here, I weigh up the risks and present both a bull and a bear case for Kogan.

Bull case – not a once-off beneficiary

One of the most common concerns you’ll hear is that Kogan is likely to suffer from the reopening of trade as consumers who bought large ticket items like TVs from Kogan last year reallocate their spending to things like travel as borders reopen.

While this is likely to be true to an extent, I think it’s unlikely to be true for all new customers that have recently purchased through Kogan for the first time recently.

While a share price of $25 was probably too optimistic, the long-term growth story appears to be somewhat intact despite the short-term challenges the company is currently facing.

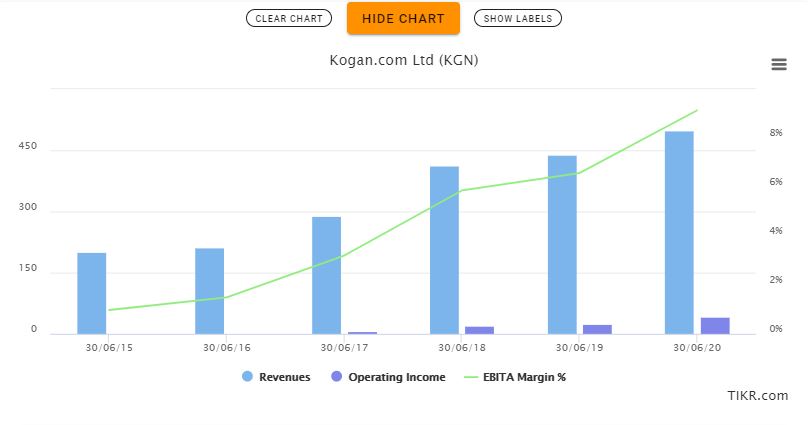

Remember that Kogan was a growing company prior to the rapid increase of demand before COVID. Revenues, earnings (profit), customer numbers were growing and EBITDA margins were expanding, demonstrating some nice operating leverage as the business continued to scale upwards.

What else?

Kogan’s product mix between exclusive brands and third-party products is an important thing to watch. Exclusive brands are sold on a higher margin and incentivise repeat purchases as they’re unable to be purchased elsewhere.

Exclusive brands seem to have been a key growth driver recently. It recorded revenue and gross profit growth in H1 FY21 of 114.9% and 174.9%, respectively. These products made up 55.9% of total gross profit across the period, and its growing popularity seems to indicate Kogan offers a compelling product offering and is building a trusted brand.

In addition, Kogan could continually benefit from the online shopping thematic even in a post-COVID economy.

Kogan bear case

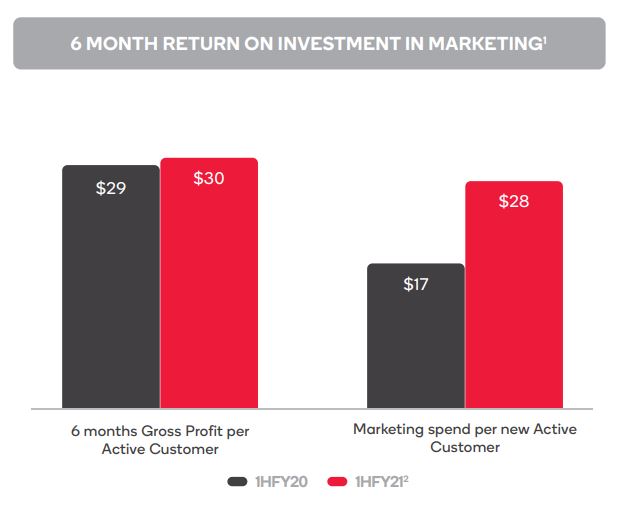

I believe one of the key risks moving forward for Kogan is rising customer acquisition costs (CAC) and how this compares against other metrics such as gross profit per customer and lifetime value.

You’d be forgiven for thinking that e-commerce businesses would have the upper hand on bricks and mortar retailers by not having to pay things like rent, wages and other overheads.

The unfortunate reality is that the barrier to entry online is so low that the market has become saturated with competition. As a result, brands like Kogan end up having to cough up extra money for marketing and advertising in order to stand out from the competition and win new customers.

This isn’t necessarily a bad thing, but only if Kogan can retain these customers and drive future conversions.

My concern with Kogan is that it’s spent a tonne of money recently on marketing and discounted products, but it seems it completely missed the mark on inventory forecasting. So now, margins are further decreased by higher than normal warehousing costs.

Management told investors increased marketing spend was a long-term investment, but I’m not entirely convinced.

The below image wouldn’t instil me with confidence if I was a shareholder. An extra $11 per customer spent on marketing has translated into just $1 in gross profit, and international borders aren’t even open yet.

What else?

Governance and reporting issues are additional reasons why I’d be cautious of investing in Kogan.

The founders sold $163 million worth of shares just the day after reporting its FY20 results. I don’t necessarily disagree with founders cashing in at some point, but the timing of the sale just doesn’t sit right with me considering its share’s fall from grace shortly after.

I find business updates that provide percentage growth figures extremely opaque, something which Kogan has recently done in its April update. The ASX had to request more information from Kogan, which it then provided actual amounts of figures.

Summary

These are just a few ways I compare both the potential upside and downside for Kogan moving forward.

While its valuation is far more attractive than it once was, buying into downgrade cycles is not something I enjoy too much. Kogan is a hold for me.

If you’re on the hunt for other ASX growth shares, I’d recommend signing up for a free Rask account to gain access to our stock reports.