Today, Freedom Foods Group Ltd (ASX: FNP) announced the results of its capital raising.

FNP share price

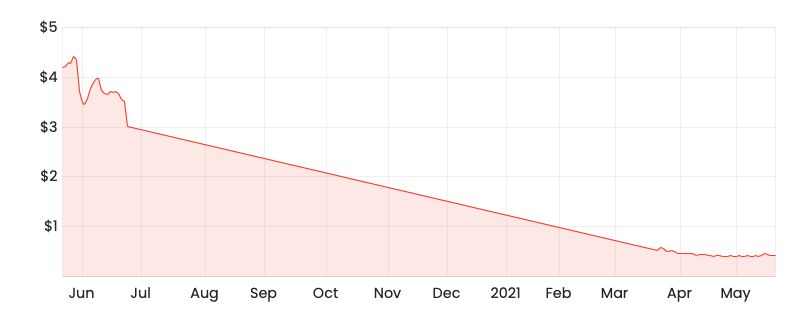

Shares are up by 5.81% to $0.455 today. However, the share price remains down 85% since the company went into a trading halt in June 2020.

Recapitalisation complete

The company previously initiated a capital raising of $265 million of unlisted, secured, subordinated convertibles notes to Arrovest Pty Ltd and other institutional and sophisticated investors. More simply, the company issued new debt, which will likely be converted to equity at a later date.

Management stated $231 million of the proceeds will be used to repay its senior debt facility. The remaining $34 million will provide working capital and be used to pay for fees relating to the recapitalisation.

Majority shareholder, Arrovest, controlled by the Perich family agreed prior to the raising, to subscribe a minimum of $135 million and a maximum of $200 million in notes.

The raising was oversubscribed by sophisticated investors by $8.9 million. As a result, Arrovest will reduce its minimum commitment to $126.1 million and sophisticated investors will subscribe to $138.9 million notes.

Post the capital raise, the Arrovest will retain a 49.3% holding in the business.

A turbulent year for shareholders

After a 9-month hiatus from the share market, the company was forced to return to shareholders cap in hand to keep the business afloat.

The discovery of accounting irregularities and subsequent revision of accounts and associated write-downs has left investors holding the bill.

Management has been revamped, with the introduction of a new chairman, directors and senior leadership appointments.

My thoughts

Given the vast majority of proceeds from the convertible notes will be put towards the repayment of existing debt, it seems odd the business would issue more debt.

Possibly, new investors preferred to retain control above equity in the event of liquidation. If the business were to become insolvent, the convertible noteholders would be paid before shareholders. However, noteholders would rank behind senior debt facilities with National Australia Bank Ltd (ASX: NAB) and HSBC.

Regardless, none of the proceeds will be used to fund growth initiatives or create new avenues for shareholder value. Effectively, new management (and major shareholder Arrovest) are asking for a second chance to get things right.

The oversubscription from wholesale investors is encouraging, and the Perich family is incentivised to rebuild the business. Personally, I’ll be watching with interest but Freedom Foods has a long way to go before it wins back the support of current let alone new investors.