You don’t have to be an ethical investor to be a fan of Australian Ethical Investment Limited (ASX: AEF) shares.

The structural tailwinds are stark. 90% of Australians want their superannuation invested responsibly. Research house, Investment Trends recently conducted a survey of over 2,000 investors that noted a 34% jump in demand for environmental investing. The world’s largest hedge fund, Bridgewater Associates and the world’s largest fund manager, Blackrock, have publicly declared sustainable investing is the future.

As a result, Australian Ethical is in the driver’s seat to capitalise.

No greenwashing here

Founded in 1986, Australian Ethical is Australia’s leading ethical manager. It has $5.4 billion in funds under management across superannuation and managed funds products.

It adheres to an Ethical Charter outlining what it can and cannot invest in. Without delving into the specifics, the charter doesn’t simply preclude what it cannot invest in. It encourages fund managers to support companies driving positive change.

Australian Ethical is one of only six Fund Managers globally to be named a ‘leader’ for Ethical, Social and Governance (ESG) commitment by Morningstar – the highest rating achievable.

Moreover, 10% of profits are donated to the Australian Ethical Foundation, which supports various causes including bushfire relief efforts in January 2020 and COVID-19 relief initiatives. Since the donation is expensed, it only has a 7% impact on shareholder profits.

Attractive unit economics

Funds management is a simple business model. Australian Ethical receives management and administration fees from clients as a percentage of funds under management (FUM). Greater the FUM, greater the fees and greater the profits.

It has a fixed cost base related to the investment team, operations staff, and funds administration costs. Then it incurs some level of variable costs to accommodate growing FUM and members.

Once revenues exceed the fixed cost base, most additional revenue drops to the profit line.

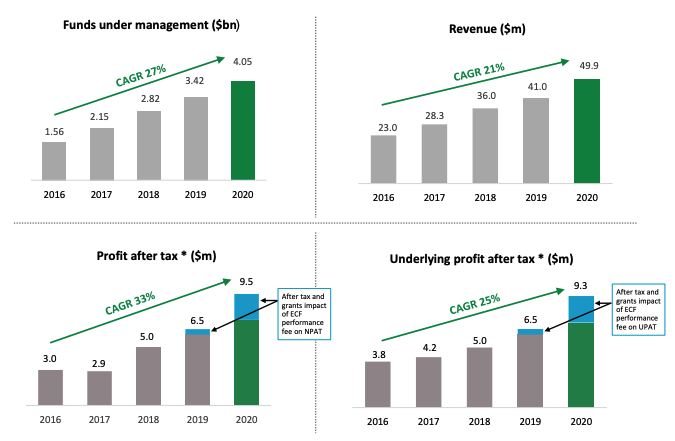

The graphic below illustrates the unit economics of Australian Ethical. Revenue has increased 21% per annum from 2016 compared to a 25% increase for underlying profit after tax (UPAT).

A couple of things to note. The operating leverage inferred from the business model isn’t particularly evident in the revenue or UPAT chart. This is due to management opting to invest profits to “enhance the digital platform, drive brand awareness and developing new products”. These investments are expensed, therefore depressing profits today.

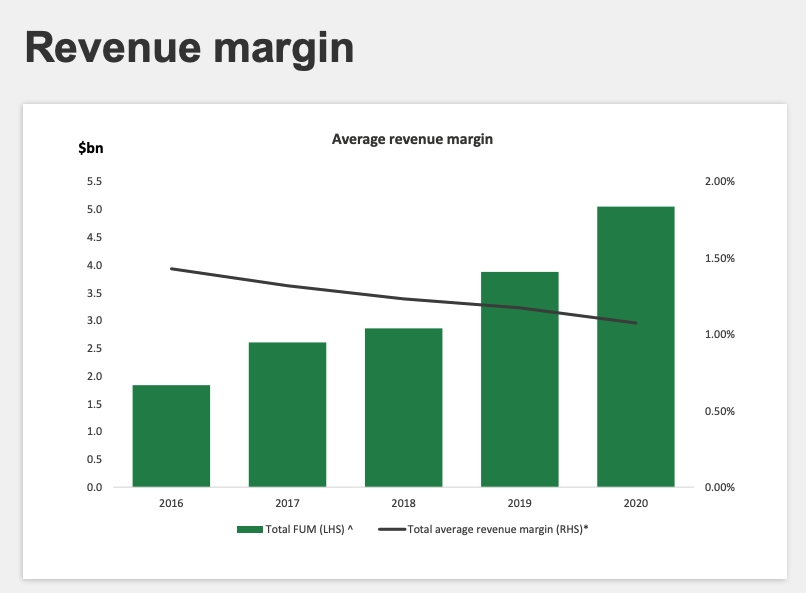

Secondly, the falling revenue margin has been a handicap on profits.

Revenue margin is important for Australian Ethical as it’s the key determinant of member fees. It’s effectively the percentage charged on FUM.

As illustrated below, the revenue margin has been decreasing for some time. This is due to management passing on fee reductions as the business scaled.

Management has noted the “heavy-lifting” of fees reductions is over and should moderate into the future.

Positively as per the APRA Super Heatmap, Australian Ethical ranks in the middle threshold for total fees on a $10,000 balance and the low-medium threshold for a balance of $50,000. It will never be the lowest cost product (given its for-profit and differentiated ethical strategy), however, it is reassuring fees remain competitive compared to competitors.

I expect the revenue margin will moderate around 0.85%-0.95% in the medium-term (for reference it is currently 1.05%).

As investments and fee cuts moderate, I expect the operating leverage inherent in the business model to kick in and spur revenue growth and profit margin expansion.

Favourable customer demographics

Per the Annual fund-level superannuation statistics which can be found here, Australian Ethical customer demographics differ greatly from its industry peers.

68.9% of Australian Ethical members have member benefits less than $49,000, compared to 53.4% for the industry. Similarly, 72.3% of members are less than 44 years of age or younger compared to the industry of 39.7%.

Why is this important to the investment thesis?

Firstly, most Aussie’s salary increases rise with age. Given Australian Ethical’s relatively young member cohort, super guarantee contributions (the mandatory 9.5% withdrawn from your wage) will increase with time. As a result, future growth in FUM will be higher than the average.

Secondly, a younger member demographic leads to more members in the accumulation phase of superannuation, rather than the drawdown phase. Australian Ethical will experience relatively fewer fund outflows for the time being until its member base matures. Consequently, FUM outflows will be less than average thus retaining greater FUM for which it clips the ticket on.

This is important when we start to think about valuation.

Transparent operations

A key benefit of funds management is the transparent nature of the business. Information regarding fund performance, inflows and outflows is disclosed monthly if not quarterly.

As a retail investor, the information asymmetry between you and professionals is relatively low. Furthermore, it’s very difficult for management to fudge the performance of its funds, fee revenue and expenses.

You’re able to get a feel for the product yourself and don’t have to be an industry expert.

Valuation and final thoughts

Australian Ethical currently trades on a price to earnings ratio (P/E ratio explained) of 100. It’s no doubt expensive, but the structural tailwinds, favourable customer demographics and capital-light business model make a compelling investment case.

For long-term investors looking to delve deeper, I recommend modelling out over a 20-year period using a Discounted Cashflow Model (DCF). Be sure to account for the maturing member base and slowing revenue margin.

If you’re new to DCF analysis check out the free Rask Education Share Valuation Course (I have personally completed and vouch for it). To reiterate, it’s free!