TechnologyOne Ltd (ASX: TNE) has released its first-half results and updated the market on its full-year guidance due on September 30.

The market has reacted positively, with the share price up 1.89% to $9.16.

Looking under the hood

The headline results are impressive. Software as a Service (SaaS) recurring revenue increased 41% to $155.8 million, flowing through nicely to profit after tax growth of 48% to $28.2 million. However, the headline numbers are somewhat misleading.

Much of the SaaS revenue increase results from existing customers transferring from on-premise to cloud solutions. Broader revenue growth was softer, up 5% to $144.3 million.

Similarly, the impressive profit growth is mostly the result of accounting rules and staff reallocation. Like most technology companies, TechnologyOne amortises approximately 50% of its research and development (R&D) costs. The justification for this is R&D is consumed over a number of years rather than in the year the expense is incurred.

The effect is that all ’employee costs’ are not accounted for in the profit result. Employee expenses occur in year 1 (cash outflow) however is recognised over 5 years in the profit and loss. As a result, profits are temporarily overstated in earlier years.

A more accurate metric is free cash flow. On this basis, the business went from a prior-year profit of $2.3 million to a current-year loss of $4.3 million.

Management noted the extension of payment terms in the current year and a favourable sales cycle for the previous year adding to the weaker performance.

Long runway for growth

In addition to the HY21 update, management outlined long-term aspirations and the market opportunity for TechnologyOne.

The company reinforced its strategy to double in size every 5 years with revenue expected to grow at 15% per annum post-consolidation of legacy fee customers. Recurring revenue is expected to reach 95% by FY27 (currently 85%) and the profit margin to improve to 35% (currently 26%).

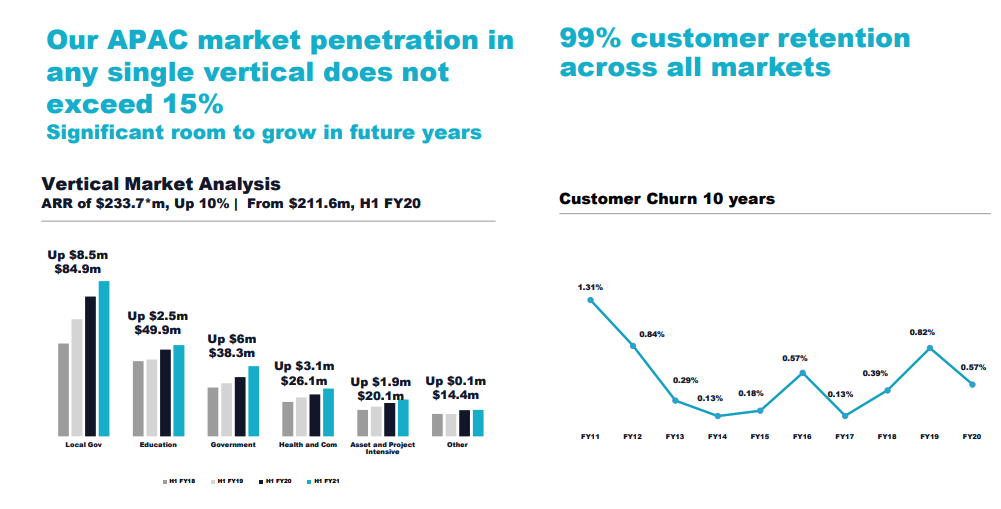

As shown above, TechnologyOne has a large addressable market with the potential to expand into new geographies or verticals.

Additionally, the business recorded a profit in the United Kingdom (UK) of $0.5 million. To illustrate the market opportunity, the UK has an addressable market three times the size of APAC.

A note on capital allocation

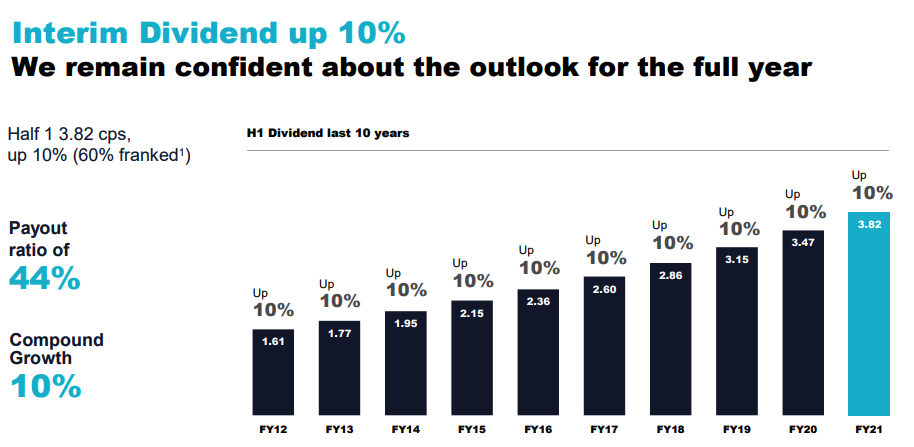

Management announced a 10% increase of the interim dividend to 3.82 cents. The slide from the investor deck demonstrates a strong track record of growing dividends.

Usually, as investors, this is what we want to see. A bottom left to top right growth in revenues, profits and dividends.

Call me a pessimist, but the consecutive 10% increase in dividends makes me question capital allocation decisions.

Is management increasing the dividend at 10% to make themselves look good? Would the dividend be better reinvested back into the business given the 40% return on equity?

I am likely being pedantic, but this could warrant further investigation.

My take

Overall, the result is positive. SaaS is gaining strong adoption amongst existing clients, which enables TechnologyOne to upsell on average of 1.5 more products. Moreover, first-half results are traditionally weaker than the second-half as annual license payments are received at year-end.

The company boasts 99% customer retention demonstrating the stickiness of its software. On the investor call, CEO Edward Chung noted the biggest risk to the business is not competitors but execution.

Investors need to remain mindful of the financial accounts and adjust for accounting rules to get an accurate read of profitability.

I would like to see stronger growth in new customers to reinforce TechnologyOne’s market position. If the company continues to attract new business, revenue growth and margin expansion will take care of itself.