The Plenti Group Ltd (ASX: PLT) share price may shoot up on a strong set of full-year results (FY21). How will the Plenti share price fare over the long run?

Plenti uses its proprietary technology to provide borrowers with automotive, renewable energy and personal loans.

On top of this, it also provides investors with opportunities to invest in consumer loans.

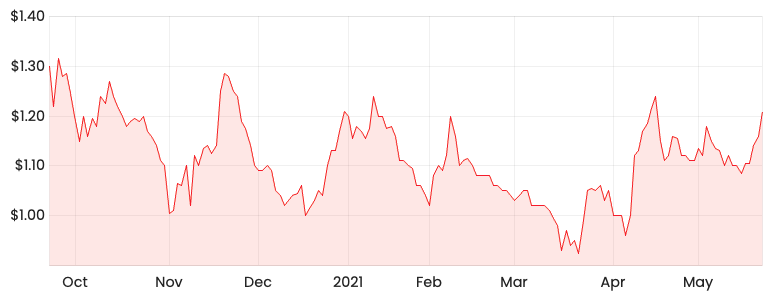

PLT share price

Revenue and loans rise

Subsequent to experiencing a slow first half due to COVID-19, Plenti knocked the lights out in the second half, reaching 88% growth on the prior year.

This contributed to record revenue of $53.1 million, up 28% from the prior year. This was driven by strong growth in the volume of loans.

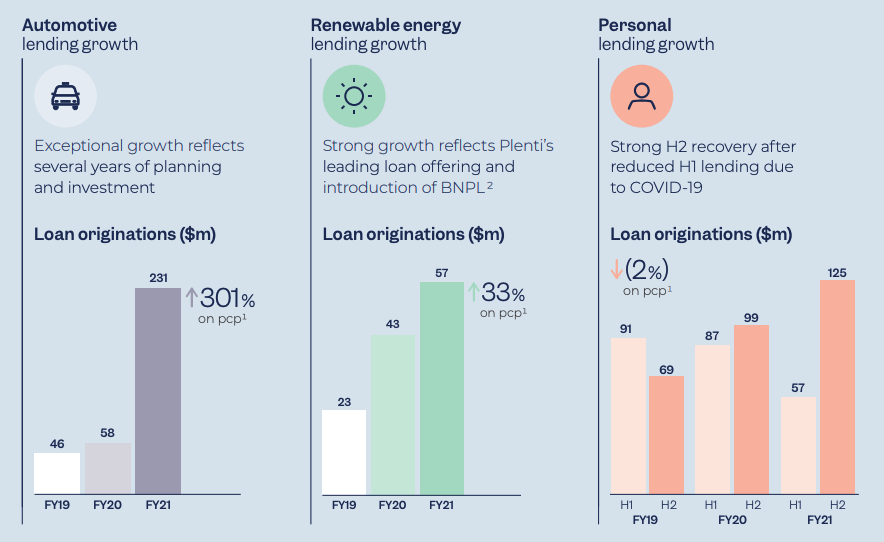

The rise in loan volumes was spearheaded by the automotive segment, which surged by 301% on the prior year.

Despite a strong performance on the top-line, Plenti still recorded a net loss after tax of $15 million.

BNPL offering proves to be popular

Plenti released an app for investors and a buy-now-pay-later (BNPL) finance offering for renewable energy customers.

Following a trial period, finance applications from participating renewable energy referral partners increased by 80%.

Over the year, Plenti has expanded its network of referrals, which introduced 74% of new borrowers.

More credit and funding

Plenti seems to be strengthening its credit line with a substantial increase in its secured automotive funding facility.

It also established a second facility to fund renewable energy and personal loans.

Plenti is relying less on a marketplace funding model as it expands its facility funding model, which has reduced its average cost of funds on new loan originations.

Plenty to think about

Plenti has capitalised on a record low-interest rate environment by expanding its funding facilities. However, should interest rates rise, this will ultimately affect its margins over the long run.

In saying this, there appears to be high demand for loans, in particular in the automotive sector. This spike may have been due to COVID restricting people to domestic travel.

I do see a long runway of growth ahead for the renewable energy segment and it could become the key driver of future growth.

If you’re on the hunt for other ASX growth shares, I’d recommend signing up for a free Rask account to gain access to our stock reports.