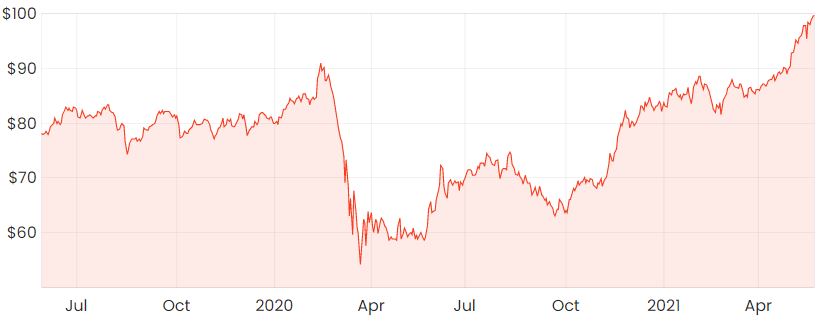

Commonwealth Bank of Australia (ASX: CBA) shares have recently cracked the $100 mark for the first time in its 109 year history.

From the bottom of the market in March last year, CBA’s shares have returned just under 70%, not including dividends.

CBA share price

Why I’ve previously been negative on the banks

Simply put, traditional banks typically haven’t had the characteristics of hyper-growth companies, which I often look for in investment ideas.

Banks are complex organisations that are often misunderstood and there are many macroeconomic factors that need to align in order for banks to perform well.

For a more detailed explanation, I’d recommend reading my article: Future outlook for ASX bank shares: Do you need them in your portfolio?

CBA – not just a bank?

I think management is quite aware of the tough macro environment, which may lie ahead. This is why they’re trying to differentiate the company by heavily investing in technology and gaining exposure to other high-growth areas.

Most notable examples of CBA’s strategy shift include its $500 million (5%) investment in Klarna, a Swedish buy-now-pay-later (BNPL) provider with over 90 million customers and 200,000 merchants in 17 countries.

To compete with the likes of Afterpay Ltd (ASX: APT) and Zip Co Ltd (ASX: Z1P), CBA announced its own BNPL offering just a few months ago, which will allow its customers to pay in four, interest-free instalments.

On Tuesday, CBA told the market it had invested $30 million in a local e-commerce start-up, Little Birdie.

Little Birdie isn’t generating any revenue yet, but the aim is to integrate its platform with CBA’s 11 million customers, which will provide access to over 70 million products.

Summary

While acknowledging CBA’s shift towards innovation and exciting growth opportunities, valuation still plays an important role in the investment decision process.

While it’s admittedly tricky, this article provides a good starting point: CBA share price: 2 ways to start valuing it.

Despite CBA’s shares rallying hard over the past six months, it probably wouldn’t be reasonable to extrapolate this trend out on an ongoing basis.

Many of the ASX banks shares are actually still around their 2015 levels. I think some of the issues, which caused them to underperform over the past five years are still present today, which are definitely worth considering.

For more share ideas, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.