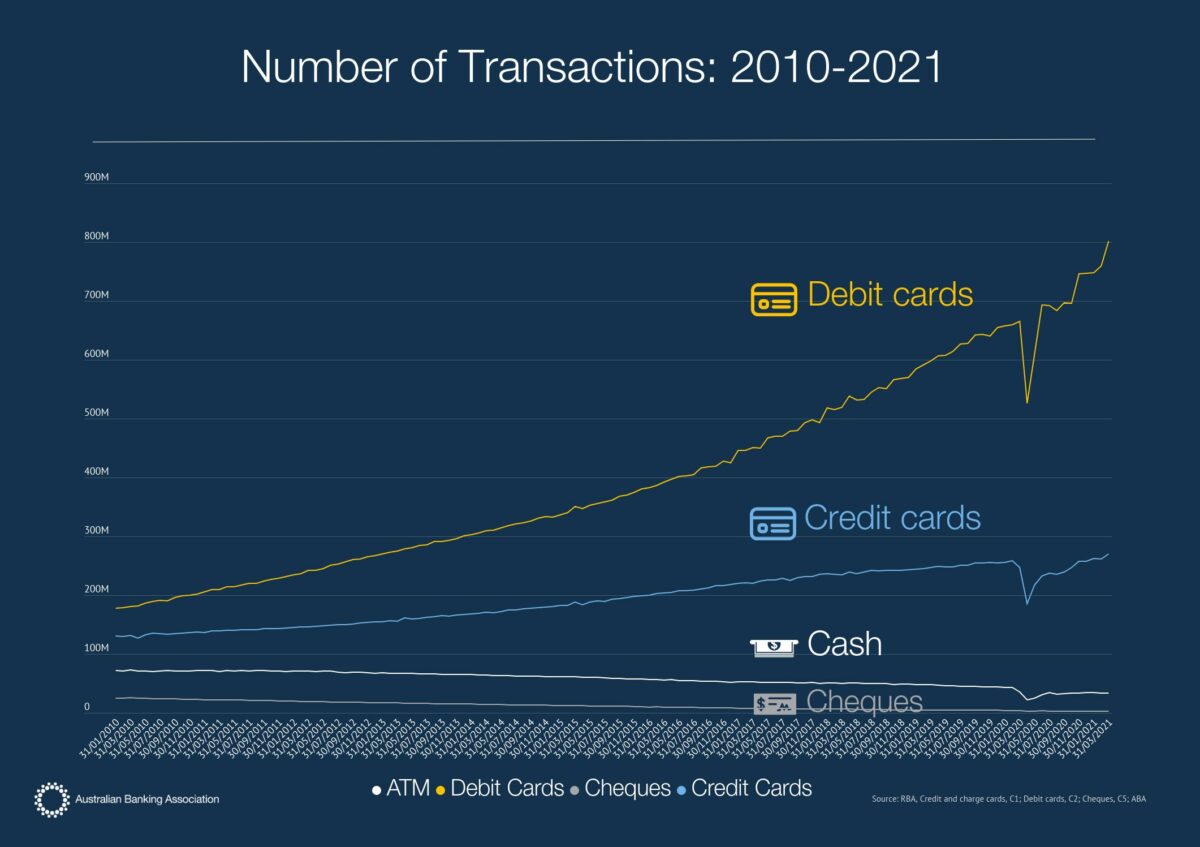

The Australian Banking Associated analysed data from the Reserve Bank of Australia, which revealed some interesting trends.

I think Tyro Payments Ltd (ASX: TYR) and Smartpay Holdings Ltd (ASX: SMP) stand to benefit over the long term.

Payment by debit is the way to go

Over the last decade, debit cards has continued to stretch its lead as the preferred method of payment, beating second-placed credit cards by almost 3x.

And when was the last time you used cash? Evidently, the use of cash has declined significantly.

As seen from the above, the pandemic accelerated the use of debit cards, jumping by 17% in 2020. This was a much sharper rise than credit cards.

What this means is that a lot more Australians are preferring to use their savings instead of credit when purchasing something in person or online.

Also, Aussies are withdrawing less cash, instead preferring to pay digitally.

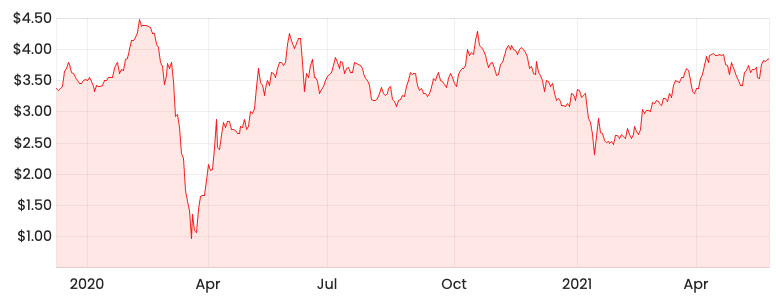

TYR share price

Tyro is Australia’s 5th largest merchant bank that provides credit, debit and EFTPOS card acquiring, Medicare and private health fund claiming and rebating services to Aussie businesses.

The bank takes money on deposit and offered unsecured cash-flow based lending to Aussie EFTPOS merchants.

Tyro is trying to ‘make good’ for the customers impacted by the terminal connectivity outage in January. However, churn has not materially changed.

SMP share price

Smartpay is a dual-listed New-Zealand-based EFTPOS machine provider to over 25,000 merchants across Australia and New Zealand.

Smartpay earns revenue by collecting a share of the merchant service fee, with the rest split between the issuing bank (the bank that issued the card being used in a transaction), and the card scheme (eg Mastercard/Visa etc).

These two ASX shares are operating in a structurally growing industry buoyed by strong tailwinds as fewer Aussies use cash.

However, it’s also important to consider the valuation of these two ASX shares.