On the hunt for ASX tech shares? I’m liking these three at the moment.

Technology One

Software company Technology One (ASX: TNE) just recently provided the market with its H1 FY21 results and updated its full-year guidance.

Shares haven’t moved too dramatically since the release on Tuesday, so it’s likely there have been some fairly optimistic results priced into its valuation.

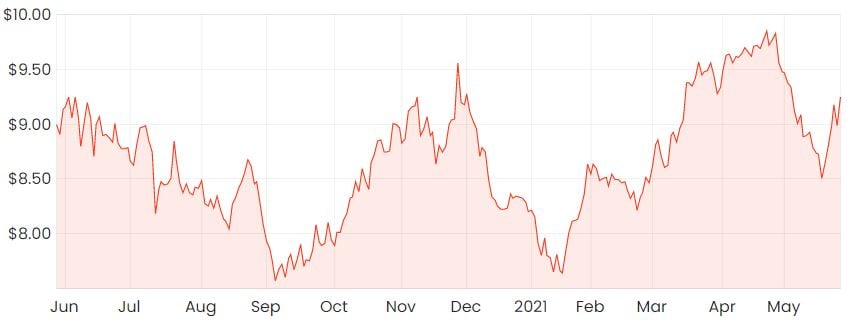

TNE share price

As my colleague Lachlan Burr-Jensen, pointed out in his article, the results paint a slightly cloudy picture due to some of the accounting methods used. Free cash flow is a good metric to look at, although it recorded a current year loss of $4.3 million due to annual licence sales being received at year-end.

Annual recurring revenue (ARR) is still growing as a proportion of total revenue, and there’s still a $180 million ARR runway as customers migrate from on-premise to Software-as-a-Service (SaaS) by FY26.

TechnologyOne has managed to grow earnings per share (EPS explained) at a compound annual growth rate (CAGR) of around 11% over the past 10 years. Although this doesn’t guarantee future returns, I think it’s quite likely this trend can continue through the expansion into new geographies and verticals.

TechnologyOne is able to boast an impressive customer retention rate of 99%, which is fairly clear evidence of how compelling its product offering is. Although, CEO Edward Chung indicated the biggest risk was execution rather than competition.

With shares trading at over 9x forward sales, I do think there is a certain level of optimism priced in. Still, for over 10% EPS growth per year, TechnologyOne is one that I’m quite liking at the moment.

If you’d like to learn more about Technology One, click here to read: Why I like Technology One shares.

Smartpay

Smartpay Holdings Ltd (ASX: SMP) is a New-Zealand based company that distributes EFTPOS terminals to its customers both domestically and in Australia. It’s quite a similar product offering to that of Tyro Payments Ltd (ASX: TYR), but without the banking function.

SMP share price

Its New Zealand business is quite mature, but the real growth story has been from its Australian segment that’s been growing rapidly behind the scenes recently.

Smartpay differentiates itself from other EFTPOS providers through its Smartcharge plan, which works by passing on merchant service fees to customers. Given the high amount of fees that small businesses pay every year, I believe this a compelling product offering that seems to be extremely popular among new customers.

Smartpay also has some structural tailwinds working in its favour. On ground-level, I’ve noticed more small businesses that were previously cash-only start accepting card payments due to COVID-19.

With Smartpay offering a much more attractive fee structure compared to most other providers, this has likely been a driving force behind the recent uptick in new terminals added to its fleet. While Smartpay operates on a fairly slim transaction margin, I think the company is on track towards profitability if it can maintain strong merchant growth.

For more reading on Smartpay shares, click here to read my in-depth article: My deep-dive into Smartpay Holdings (ASX:SMP) shares.

Dubber Corporation

Another stock that’s come onto my radar recently is software company, Dubber Corp Ltd (ASX: DUB). Over the past year, its shares have rallied over 130% on the back of some impressive financial results.

Dubber provides cloud-based software used for call recordings. It can allow businesses to record and access voice data to improve call quality as well as compliance monitoring.

Its artificial intelligence (AI) platform is able to detect vocal sentiment, identify specific words and identify trends – all of which can be used to derive insights, retain more customers and provide an improved customer experience.

DUB share price

Dubber has proven to be a beneficiary of the “work from home” thematic from COVID-19 as it recently announced it’ll become available on Zoom Video Communications Inc (NASDAQ: ZM) and Zoom Phone.

Dubber’s unified call recording (UCR) will allow businesses to record calls and deliver transcriptions, sentiment data and real-time search to enrich content.

In its last Q3 update, Dubber revealed that annual recurring revenue (ARR) had grown 20% QoQ to $34 million and 158% on the prior corresponding period (pcp)

User growth is also at record levels with over 380,000 subscribers during the March quarter, up 152% on the pcp.

Dubber seems to be a pretty competitive position due to some of the exclusive partnerships it has. It has recently become one of only two vendors approved for compliant call recording for Microsoft teams. Additionally, it’s the only current offering for Cisco’s Webex calling platform.

If you’re looking for other share ideas, I’d highly recommend getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.