The Afterpay Ltd (ASX: APT) and Zip Co Ltd (ASX: Z1P) share price is breathing a huge sigh of relief today. Let me explain why.

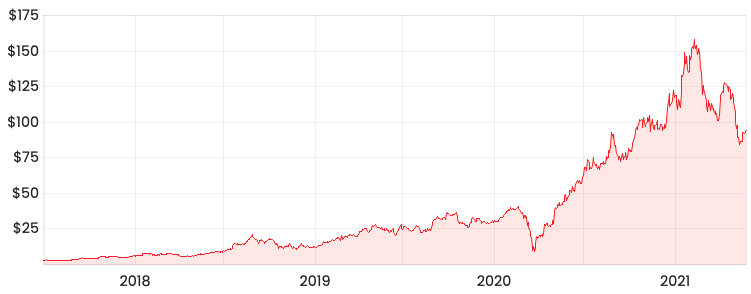

APT share price

Z1P share price

RBA holds off on BNPL surcharge reforms

The Reserve Bank of Australia (RBA) announced it is not proposing to require buy-now-pay-later (BNPL) providers to remove their no-surcharge rules at this time.

However, the RBA advised it could emerge in the future and will continue to review this issue.

Despite the commotion from the CEO of Commonwealth Bank of Australia (ASX: CBA), Matt Comyn, why has the RBA decided to hold off?

BNPL providers like Afterpay and Zip currently benefit from no-surcharge rules. This means merchants are unable to pass on a surcharge to customers when they use BNPL services.

BNPL players have a leg up on the banks.

In the case of debit cards and credit cards, merchants have the right to levy a fee on a customer. However, there is a limit imposed on how much merchants can levy, which is enforced by the Australian Competition and Consumer Commission.

So, you can see why Comyn was calling for the same rules to be applied towards BNPL players.

Striking the right balance

The main reason for RBA’s decision is it wants to form a regulatory environment that encourages innovation.

RBA doesn’t think there is a strong public interest case for these no-surcharge rules to be removed for the BNPL sector because it still accounts for a small portion of payments in the economy.

Also, RBA is aware that growing BNPL competition will naturally compress merchant costs without regulatory intervention.

In saying this, RBA will re-consider if the BNPL becomes a bigger part of the payments landscape.

What now for Afterpay and Zip

Afterpay, Zip and other BNPL players are cheering now but how long will this last?

On a positive note, Afterpay and Zip will continue to benefit from the no-surcharge rule. But on the flip side, it appears inevitable should they get bigger.

As part of the Rask Investment philosophy, I prefer to find businesses with a strong and sustainable competitive advantage, which can withstand regulatory challenges.

This is why I think optionality will play a crucial role in identifying the BNPL winners.

If RBA does follow through with the removal of the no-surcharge rule, then it will become a level playing field between the BNPL players and the banks.

Merchants will likely prefer those that help them bring in customers. As a merchant, I know who I’d prefer in this situation – the BNPL player with the better brand.

If you are interested in other ASX growth shares, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.