The Freedom Foods Group Ltd (ASX: FNP) share price bounced back on its recapitalisation. However, will the lost appeal push the Freedom Foods share price down?

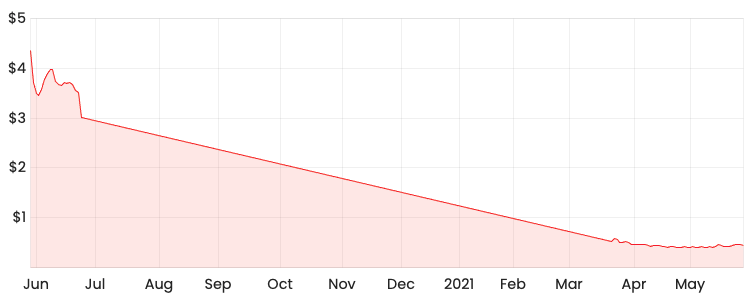

FNP share price

Freedom Foods loses appeal

Freedom Foods holds a licence agreement to manufacture and distribute the Blue Diamond Almond Breeze product in Australia and New Zealand.

The almond milk supplier alleges Freedom Foods had used their almond base to develop a superior product.

Freedom Foods attempted to throw out Blue Diamond’s $US16 million lawsuit in California.

However, the Federal Court of Australia rejected Freedom Foods’ claims against Blue Diamond.

As a result, Freedom Foods must now try and convince that the licensing deal was anti-competitive or Blue Diamond has engaged in illegal conduct under Australian law.

What this means for Freedom Foods

If Freedom Foods fails, it will not be able to sell its key growth brand, MilkLab and will be liable to Blue Diamond for damages.

Investors should note these proceedings will likely go on for some time, which is often costly.

I think these issues will linger for some time before things get better, so I’ll be watching from the sidelines for now.

As part of the Rask Investment Philosophy, I prefer to find businesses that are founder-led with strong shareholder alignment.

If you are interested in small businesses with similar traits, you may want to check out the Rask Rockets Beyond program for 2021.