Can you believe it’s June already? Before you know it you’ll be scribbling down your deductions and hoping for a chunky tax refund from the Australian Tax Office

(ATO).

One benefit of selling shares in June is that it allows investors to offset any capital gains incurred throughout FY21.

Below are three companies I think have subdued outlooks for the foreseeable future and therefore prime candidates to offset any capital gains.

1. A2 Milk Company Ltd (ASX: A2M)

The once market darling, A2 Milk, has a negative 68.83% return since June 2020. The company has been plagued by the COVID-19 pandemic, effectively shutting down its daigou channel.

News of Chinese customers – its most lucrative market, embracing nationalism and favouring domestic products rather than imported alternatives such as A2 has weighed on the share price. Furthermore, insider selling at the share price peak and the subsequent four profit downgrades has led to a potential class action

against the company.

The reopening of borders will be positive. However, the strength of the brand will certainly be tested.

2. AMP Ltd (ASX: AMP)

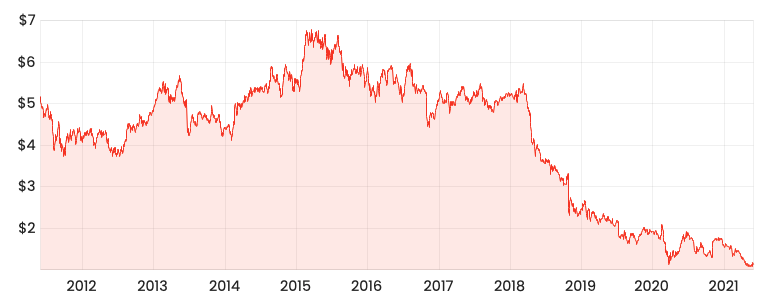

Where to start? Since listing in 1998, the AMP share price has never been lower than it is today. Investors who bought in at the float and held are sitting on a 91% capital loss. More recent shareholders have a one-year return of negative 30.98%.

The Royal Banking Commission, rising redemptions, loss of investment mandates, cultural issues and failed talks of spinning off the firm’s assets have seen the share price continue to spiral.

There was a time I thought AMP was too cheap based on its history and funds under management. However, with no near-term catalyst for the share price rerating, I think it’s best for investors to accept the loss and move onto greener pastures.

3. AGL Energy Limited (ASX: AGL)

AGL is involved in the production and retailing of electricity and gas. With the share price hovering around lows reached all the way back in 2004, it’s a grim outlook for long-term shareholders. Moreover, for investors who purchased this time last year the share price has fallen 51.55%.

Post announcement of the demerger, Managing Director and CEO Brett Redman resigned after 15 years with the company. Redman was unwilling to make a long-term commitment beyond the demerger and therefore felt it was in AGL’s best interest to step down.

Now investors are left holding the bag. With much uncertainty remaining around the demerger and management, I’d be steering clear of AGL for now.

A final note

Readers should note that crystallising capital losses is not the sole reason to sell shares. Make sure to speak to your financial and tax advisor for individual advice.

If you’re looking for shares to replace your holdings, check out Patrick Melville’s top 3 ASX software shares for June.