Data#3 Limited (ASX: DTL) and Megaport Ltd (ASX: MP1) shares fell by 4% yesterday. I think these 2 ASX growth shares could be sound long term businesses.

DTL share price

Data#3 provides IT solutions to enterprises, which include cloud, workplace, security, data and analytics and connectivity.

It generates around 85% of revenue from its infrastructure and software segments. This has really ramped up as enterprises move to the cloud.

Data#3’s HY21 results revealed 62% of revenue was recurring, derived from contracts with government and large corporate customers.

The company has sticky customers, an integral service offering and has no debt. However, the business is capital intensive with gross margins falling to 3.3%.

In saying this, Data#3 declared a fully franked interim dividend of 5.5 cents per share.

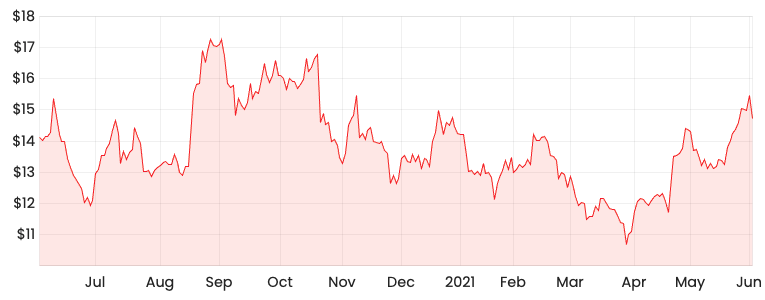

MP1 share price

Megaport is a global provider of elastic interconnection services, enabling over 2,000 customers to connect to 700 data centres around the world.

The business is operating in a structurally growing industry as organisations across the globe become reliant on data centres.

The market reacted negatively to its HY21 results but I think a lot of investors were too focused on the short term. The market wasn’t a fan of the deceleration in growth and the uptick in Megaport’s net loss.

However, investors should remember Megaport is building the rails so more businesses can adopt cloud services.

Once these rails are built, it’s extremely difficult for competitors to pull them out.

If you are on the hunt for small-cap ASX shares, you may be interested in the Rask Rockets Beyond program.