EML Payments Ltd (ASX: EML) has provided a third-quarter trading update which was presented at the Macquarie Emerging Leaders Conference today.

The share price has reacted favourably to the presentation, closing the day up 4.19% to $3.48.

Q3 Trading update

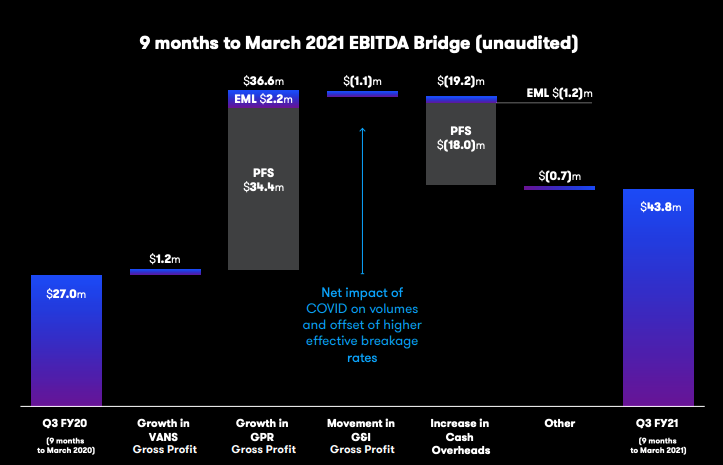

Gross Debit Volume (GDV) – the dollar amount of transactions processed by EML, increased 52% on the prior corresponding period to $14.9 billion. Similarly, revenue increased 65% on the prior corresponding period to $143.5 million, and EBITDA increased 62% to $43.8 million.

Operating cash flow increased to $15.7 million, equal to 117% of EBITDA inferring EBITDA is a strong proxy for cash flow.

Almost all growth is attributable to the PFS acquisition as illustrated by the EBITDA bridge below.

EML payments has signed 123 new contracts estimated to yield $8.3 billion in GDV in the nine months to date, with 368 deals in its pipeline. Notable program wins include Zenith, CherryHub, Colossalbet and Raise.com.

Additionally, the company provided an acquisition update regarding Sentenial and Nuapay. EML has submitted a change of control application to the relevant authorities in the United Kingdom and France. The transaction is expected to be approved in July or August.

Central Bank of Ireland (CBI) regulatory update

Two weeks ago, EML advised the market it had received correspondence from the CBI regarding potential Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) breaches.

The company remains engaged in ongoing communication with the CBI, with no set timeframe to conclude the investigation.

Noticeably, EML is “proactively communicating with, and providing information if and when requested, with other regulators”. This infers central banks abroad are keeping tabs on the CIB investigation and may undertake independent investigations if required. The company also noted the potential for delayed program launches.

Furthermore, EML expects to incur one-off costs relating to the investigation of $2 million in FY21. The financial impacts for the forthcoming FY22 have not been determined.

EML Payments isn’t the only Australian company to come under the eye of regulators. National Australia Bank (ASX: NAB), SKYCITY Entertainment Group Limited (ASX: SKC), Crown Resorts Ltd (ASX: CWN) and Star Entertainment Group Ltd (ASX: SGR) all announced investigations by AUSTRAC today for AML and CTF breaches.

For more information about evaluating small-cap shares like EML Payments, listen to Rask founder and lead analyst Owen Raszkiewicz’s latest episode on the Australian Finance Podcast.