The A2 Milk Company Ltd (ASX: A2M) share price has shown a bit of promise. However, the slight growth in the a2 share price may be short-lived.

The small increase was driven by news of China’s decision to allow couples to have up to three children

.

A2M share price

Digging further into China

I can understand why some investors have regained some optimism on China’s move to reverse the birth rate decline. But will allowing couples to have up to three children actually work?

Let’s take a step back and understand a bit of the history behind China’s downward trend.

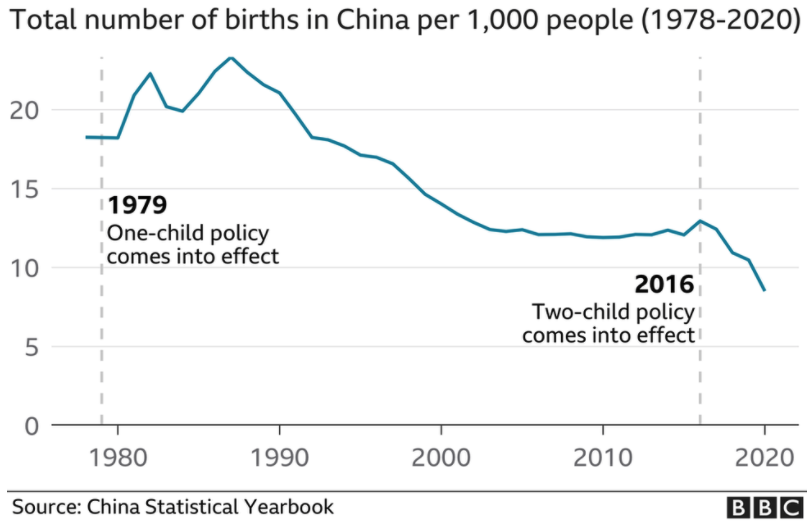

The birth rate took a sharp downward trajectory ever since the one-child policy came into effect in 1979. But the Chinese government actually revised this to two children in 2016.

This resulted in a sharp rise over the following two years but plummeted thereafter.

I believe the main forces driving down China’s birth rate are the rising costs of raising children and growing debt is eating into income.

As you can see below, both household debt and mortgage to income ratios have been steadily increasing.

So, if the Chinese government doesn’t implement policies that will incentivise and economically encourage people in China to have children, I do not think the three child policy will have much effect.

A2 rival gives up in China

According to the Australian Financial Review, British multinational consumer goods giant, Reckitt Benckiser Group decided to sell its struggling baby formula business in China.

Reckitt will sell the business unit for $US2.2 billion, a small fraction of the $US16.6 billion price it paid US-based Mead Johnson for the business in 2017.

Investors should note Reckitt’s Chinese baby formula unit generated earnings before interest and tax (EBIT) margin of 10%. A2 is forecasting an EBIT margin of 22% by FY24 for its Chinese infant baby formula segment.

My take on a2

Any potential value play on a2 is reliant on the recovery of its daigou channel with China.

If I was to consider a2 as a value play, I would carefully consider the headwinds it faces over the long run.

The dwindling interest in having children in China combined with growing nationalism may force a2 to focus on other geographies like the US.

I would evaluate whether the competitive advantage is either eroding or strengthening as per the Rask Investment Philosophy.

If you’re on the hunt for ASX small-cap shares, check out the Rask Rockets Beyond program. You might want to hurry – the mission is opening to new members tonight!