Shares in online retailer Temple & Webster Group Ltd (ASX: TPW) have been bouncing around the $10 mark for the past few months. The volatility seems to imply that the market is unsure of what lies ahead for many of last year’s COVID beneficiaries.

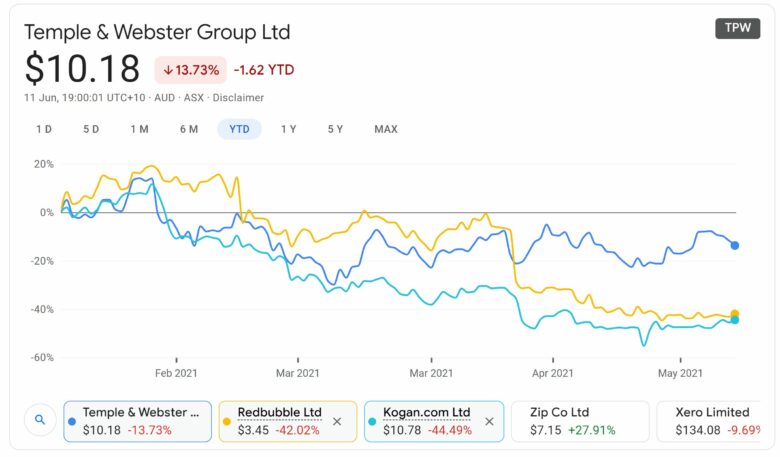

It’s worth taking a look at how similar companies such as Kogan.com Ltd (ASX: KGN) and Redbubble Ltd (ASX: RBL) have performed recently, share price-wise.

As you can see from the below chart, short-term share price movements for companies in the same sector generally move in the same direction to an extent. So, TPW’s shares languishing over the past few months might not be an accurate reflection of the performance of the underlying business.

How’s the business going?

TPW last updated the market in April with a Q3 trading update that confirmed the business was still expanding at a rapid pace.

April revenue was up more than 20% on the prior corresponding period (pcp). The company noted that April 2020 was its fastest-growing month last year, so it seems many people are still redirecting holiday spending into furniture and homewares.

At the end of the quarter, active customers were at 750,000. Management seems to think this number will continue to grow as e-commerce is adopted on a wider scale over the coming years.

Reinvesting for growth

Like many other high growth companies, TPW plans to redeploy capital back into the business to drive top-line growth and grow its market presence.

Management said that it’ll likely drop back to growth rates similar to pre-COVID levels. High double-digit revenue growth is expected with earnings before interest, tax, depreciation and amortisation (EBITDA explained) growth between 2-4%. It aims to remain profitable during this time, but it doesn’t look like any dividends are on the cards at this stage.

As the company further matures, management is expecting scale advantages through better supplier terms, more repeat customers, which drive down marketing spend and a higher proportion of private label sales, which are typically sold on a higher margin.

Time to buy TPW shares?

Now that the market has cooled off a bit, it could be an opportune time to enter into some of these ASX retail shares that have performed strongly recently.

It’s worth considering that they’re unlikely to experience the same record growth on an ongoing basis, however.

As a retailer that mostly distributes third-party brands, I also wonder how much of a competitive advantage

TPW could have. That isn’t to say it can’t do well though… Look at other retailers like JB Hi-Fi Limited (ASX: JBH) for example.

If you want to become a better investor, I’d recommend getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.