Shares in software company Fineos Corporation Holdings PLC (ASX: FCL) have been steadily climbing – up over 10% since the start of the month.

Here’s what Fineos has been up to recently.

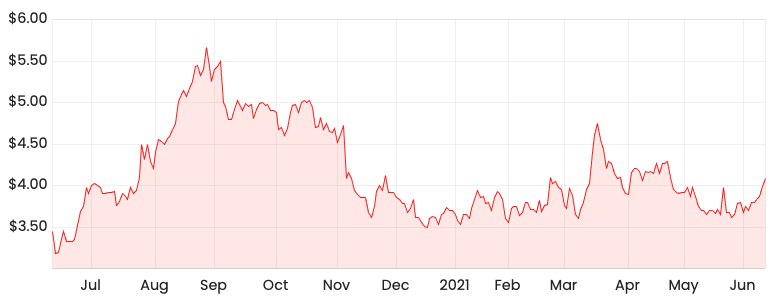

FCL share price

What does Fineos do?

Fineos is a global software provider of core systems for life, accident and health insurers that are based in Dublin, Ireland.

It claims to have 7 of the 10 largest group life and health carriers in the US as well as 6 of the largest life insurers based in Australia.

Put simply, Fineos provides software that’s used for managing client relationships, claims processing, policy administration and billing.

While using Fineos’s software, processes can be automated, which reduces claim duration, resulting in improved customer service and significant cost savings for insurers.

Recent financial performance

Fineos last updated the market in April with a trading update for the three month period ending 31 March 2021.

Fineos told the market that FY21 revenue is expected to come in around the top end of its guidance range of $102 million – $105 million.

Cash collections for the period were €26.6 million, down 6% on the prior quarter due to the timing of collections. However, this represents an 11% increase on the prior corresponding period (pcp).

Customers are continually being shifted from on-premise to the cloud, with the latter now making up 70% of total revenue.

2 large deals were recently closed, one of which being the first cloud contract in the ANZ region with Partners Life. The other being an underwriting contract with American Public Life.

What’s to like about Fineos?

Fineos is operating in a growing industry that’s being propelled by some structural changes.

In the past, insurers have had to heavily invest in their own legacy systems, which quickly became outdated partly due to not being able to be integrated into more modern apps.

From an insurer’s perspective, it can be far more cost-effective to pay Fineos on a software-as-a-service (SaaS) model than to try and build the same platform in-house.

Founder and CEO Michael Kelly started the company in 1993 and still owns the majority of the company’s shares to this day, indicating a high level of shareholder alignment.

Structurally growing industries and high insider ownership are both qualities we look for as part of the Rask Investment philosophy.

If you want to become a better investor, I’d recommend getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.