Earlier this week, Link Administration Holdings Ltd (ASX: LNK) announced the initial public offering (IPO) of PEXA Group Limited (ASX: PXA).

The business will commence trading on 1 July, at a share price of $17.13.

PEXA operates Australia’s leading digital property settlements platform providing efficient, secure and reliable property transfers for home buyers and vendors.

We’ll be taking a closer look at the biggest IPO of 2021 and delving deeper into a relatively unknown Australian technology success story.

Quick lesson #1: land titles

Australia adopts the Torrens Title land registration and transfer system. Each Australian State and Territory operates a land titles registrar that records and registers ownership of land. It is a centralised system aimed to increase reliability and mitigate against disputes of land titles.

Other countries which adopt a similar system include England, Wales, New Zealand, Ireland, Canada, Malaysia, Singapore and India.

Born out of the shift to digital

If you have previously purchased or sold a property, you likely contracted the services of a conveyancing practice. Conveyancers assist with the property transfer process, contract preparation and negotiations, financial terms and submission of relevant documents.

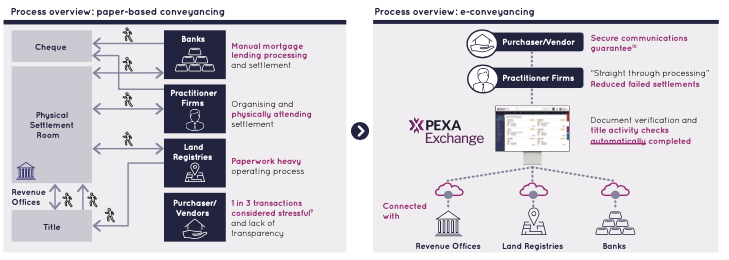

Historically, conveyancing has been a paper-based process that required the exchange of multiple documents to banks, real estate agents, land registries, revenue offices, purchases and vendors. The process is time-consuming, inefficient and prone to errors.

To move conveyancing into the 21st century, the Australian government, states and territories agreed to support a transition to digital property settlements.

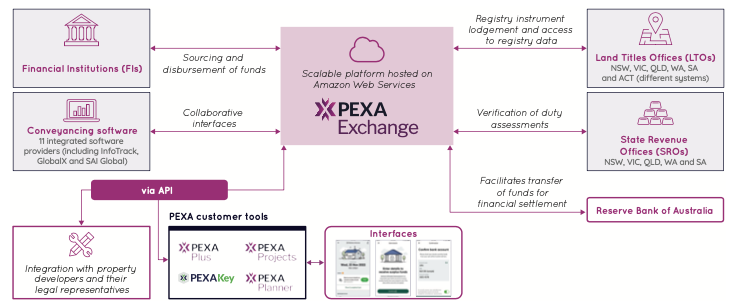

In collaboration with government and private investors, development began in 2011 on Property Exchange Australia Limited (PEAL) to build the digital infrastructure to underpin the shift to digital. Subsequently, PEXA Exchange was launched in 2014 with cloud integrations to the Big 4 Banks, Reserve Bank of Australia (RBA) and Land Title Offices.

Today, PEXA processes approximately 80% of total property transactions in Australia with more than 95% market share in NSW, Victoria and South Australia. Additionally, PEXA has captured 80% of West Australia and 60% of Queensland with both markets growing.

Strangely, PEXA’s primary competitor is not another company but conveyancers who prefer to submit paper-based settlements.

It is the virtual railroads for property transactions in Australia – similar to how Visa Inc (NYSE: V) and Mastercard Inc (NYSE: MA) are the digital railroads for payments.

The company has over 9,400 practitioner firm subscribers and 160 financial institutions providing mortgage-financing integrations. Moreover, the business has backend integrations with the Land Title and State Revenue offices for New South Wales, Victoria, Western Australia, Queensland and South Australia.

Business Model

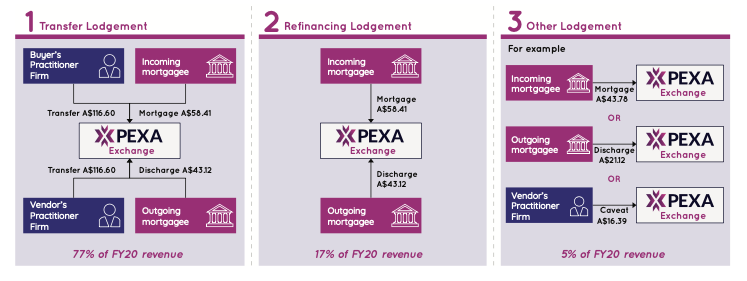

PEXA charges transaction fees on the completion of a settlement. As a result, the two primary drivers of revenue are the volume and lodgement type of transactions.

In FY21 billable transactions are estimated to be 4.2 million. The volume of transactions fluctuates year to year based on movement in house prices, unemployment, new dwellings, interest rates, population size, household size and government incentives. Over the medium term, transactions have averaged mid-single-digit growth.

There are three types of lodgements:

- Transfer – transfer or sale of a property title

- Refinancing – change to the debt facility secured by a mortgage but no associated sale of property title

- Other – discharge of mortgages (loan has been wholly repaid), death-related dealings

PEXA has a mandated pricing policy that allows annual price increases in line with the Consumer Price Index (CPI) and the ability to pass on any increases in inputs costs.

Management

PEXA is led by Glenn King, who joined as CEO in 2019. He has previous experience working in the NSW government in addition to 25 years in Financial Services. His experience in the public sector positions him well to communicate with the multiple regulators and state authorities PEXA works with.

The board has a range of experience in financial services led by Chairman Mark Joiner, who is a current director of Latitude Financial Services Group Ltd (ASX: LFS), and QBE Insurance Group Ltd (ASX: QBE).

Other notable directors include Kirstin Ferguson, who is a non-executive director at EML Payments Ltd (ASX: EML) and Paul Rickard, who is a non-executive director at Tyro Payments Ltd (ASX: TYR).

While no directors currently hold shares in PEXA (due to majority ownership by only 3 shareholders), each director will have a shareholding post the IPO.

The numbers

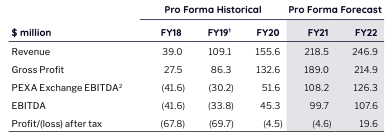

FY21 revenue is expected to be $218.5 million, gross profit of $189.0 million and earnings before interest, tax, depreciation and amortisation (EBITDA explained) of $99.7 million. The PEXA business model is highly scalable, with a gross margin of 86.4%.

After taking into account research & development expenses, free cash flow (FCF) is expected to be $74.4 million for FY21. Given the strong financial metrics, the company has a lofty valuation. The market capitalisation of $3.03 billion at IPO is approximately 40x FY21 FCF flow.

Double moat, doubly entrenched

Most businesses struggle to achieve one competitive advantage. PEXA has two, shielding it from current and new competition.

The first is the inherent network benefits from being the first-mover. As mentioned, PEXA is integrated within the five major states revenue and land title offices. Furthermore, it has integrated with the vast majority of conveyancing firms and banks, in addition to the RBA. The scale of the PEXA Exchange creates a significant barrier to entry. It would take several years and significant capital to replicate the relationships it has built with stakeholders.

Even if a competitor were to replicate the PEXA network, there would be little incentive for conveyance firms to change. The fees charged by PEXA is immaterial relative to the overall cost of a property or mortgage settlement. Additionally, the cost is borne by the vendor and buyer, not the conveyancing firm or bank. There is relatively low visibility on costs between competitors, entrenching PEXA as the incumbent.

PEXA’s second competitive advantage is its proprietary technology platform, which was built in conjunction with Accenture. PEXA has had a multi-year headstart on competition and currently offers the best functionality and customer experience. This is evident from its Net promoter score of +55 and brand trust score of 8.7 – both industry-leading. Additionally, the company is able to process more transfers than any other competitor.

Similar to the network effect, building an identical technology platform would take years with no guarantee of success. Whether the government admits it or not, it has built a monopoly in property transfers.

Future growth opportunities

PEXA is looking abroad for adjacent opportunities to spur further growth with the Australian market largely conquered.

PEXA International is focused on bringing the digital property platform to new countries. England and Wales have been earmarked as the first international markets, with a dedicated team and partnership with ThoughtWorks established. The United Kingdom (UK) is estimated to be between 2.5-3.0x the size of the Australian market, with several similarities including the Torrens title system and a reliance on paper-based documents. PEXA believes it is the only digital player in the UK and has plans to launch a re-mortgage product during calendar 2022.

Like Australia, building a digital settlements platform abroad will take a number of years and require communication with various stakeholders, including the Bank of England (BoE) and Her Majesty’s Land Registry. The UK opportunity is relatively nascent, and will largely depend on PEXA being able to first arrange a partner, and second, a ‘slot’ with the BoE Real Time Gross Settlement system by August 2021 to undertake testing before market release. The next available testing window is in 2024, so it is integral that PEXA expedites this process.

PEXA Insights leverages the wealth of property and transaction data captured within PEXA Exchange. The team is developing products and services to generate data insights for real estate agents, conveyancers, vendors and home buyers. This will offer an adjacent revenue stream for PEXA.

Finally, PEXA Ventures is focused on building relationships with industry participants and developing new opportunities. Given the team is in its infancy and competition will mature, it’s integral for PEXA to look for complementary acquisition opportunities.

Quick lesson #2: ARNECC

The Australian Registrars’ National Electronic Conveyancing Council (ARNECC) is the regulatory body established to oversee the shift to paperless conveyancing in Australia. To undertake e-conveyancing, ARNECC must approve a new entrant as an Electronic Lodgement Network Operator (ELNO). This is an extensive process that requires the entrant to:

- Pass ELNO assessment by ARNECC by meeting the eligibility criteria required of the Model Operating Requirements

- Achieve approval from each state and territory land title registrar to operate as ELNO

- Adhere to ongoing compliance requirements

For clarity, PEXA is an approved ELNO.

Interoperability – fancy word, big consequences

So it also sounds pretty good so far. Entrenched monopoly. Juicy margins. Experienced management. Actually profitable. What could go wrong?

Just as the government effectively created a monopoly, it now wants to undo it.

Interoperability refers to the ability of computer systems and software to exchange data and communicate together. Currently, if you are using PEXA, you are locked into using the exchange regardless if you are a conveyancer, bank or another stakeholder.

The government has tasked ARNECC to develop a regulatory regime to facilitate interoperability between ELNO’s by the end of 2021. Effectively, each ELNO will be mandated to be able to communicate with other ELNO’s. Much of the regime has been agreed upon and will take 1-2 years to implement.

The overall effect on PEXA is negative. Opening the PEXA Exchange will increase competition, likely eating away at PEXA’s margins. Additionally, it will also allow stakeholders to choose the software that best suits their needs, rather than being locked in the PEXA Exchange.

For more on interoperability, check out this useful FAQ.

Competitive landscape

PEXA competes with two much smaller but growing players in the market. Both are immaterial competitors to PEXA today but with the introduction of interoperability, will become much stronger foes:

- Sympli – approved ELNO rolling out a soft launch of its platform to test volumes and functionality

- LEXTECH – facilitates digital mortgage settlements undertaking full ELNO approval

Other risks

As a result of the IPO, Morgan Stanley will sell its 40% stake in PEXA, while Link and Commonwealth Bank of Australia (ASX: CBA), will increase their respective stakes. The fact one major shareholder is selling out isn’t a big concern, however, it’s interesting that Link and CBA chose to increase their ownership. Time will tell who made the wrong move.

Furthermore, while not a direct risk, none of the proceeds raised in the IPO will be used by PEXA to grow the company. Rather, proceeds will be used to primarily allow owners to sell down.

Given the platform was built with Accenture, PEXA risks being reliant on Accenture for critical maintenance services relating to the platform. This gives Accenture bargaining power relating to consulting fees paid, which may increase over time.

Arguably the biggest risk on PEXA is the risk of further regulation. Australian Competition and Consumer Commission (ACCC) Chairman Rod Sims has gone on the record requesting PEXA to cut its prices and pushing for reform to encourage competition.

My take

Monopoly businesses are bad for consumers but great for investors. PEXA currently has a leading product in Australia, with immaterial competition and the ability to charge premium prices (within CPI limits).

Any competition will be visible well before it reaches the size of PEXA, mainly due to the cumbersome ELNO regulatory process. Even if a formidable competitor is developed, PEXA could acquire or form a duopoly (much to Sims despair).

The Australian operations is a FCF machine. But at 40x FY21 FCF it’s in the price. To look at it another way, buying shares in PEXA would give you a 2.5% annual FCF yield – with most of that reinvested to expanding the international operations.

I think the international expansion has been overhyped. It’s in the preliminary stages and any market product for England and Wales is at least a few years away. Expanding abroad is no easy task. Given it took PEXA 10 years to develop the Australian business I’m not willing to pay the IPO price for what could eventuate years away in a foreign market.

Wonderful business, but the IPO prices it like one.