Today, Altium Limited (ASX: ALU) provided a trading update and strategy presentation with the market reacting favourably to the news.

Altium is the global leader in printed circuit board (PCB) software design systems through its Altium Designer platform.

The company is aiming to capitalise on its market leadership by creating the world’s first cloud platform for electronics hardware – Altium 365

, bringing together designers, manufacturers and producers onto one platform.

Although the market reacted positively to the update, I believe there are three red flags investors should be mindful of.

Altium Designer sales slowing

The guided revenue range of US$190 million to US$195 million infers a sales uplift in the second half of FY21 of 12-17% from the first half. However this is at the lower end of full-year guidance, and management noted on the call depending on deal closures it may be even lower.

Similarly, the guided EBITDA margin of 37-39% is softer than in prior periods.

Given management’s history of execution, you can forgive them for the occasional soft trading update. More concerning is the nature of the slowdown.

A quick review of the Altium website shows advertisements for discounts on its leading products.

The company discounting its flagship products suggests the product may not be as mission-critical as once perceived. Additionally, it infers future sales growth will be tougher to come by resulting in higher marketing and sales costs.

Acquisition risk increases

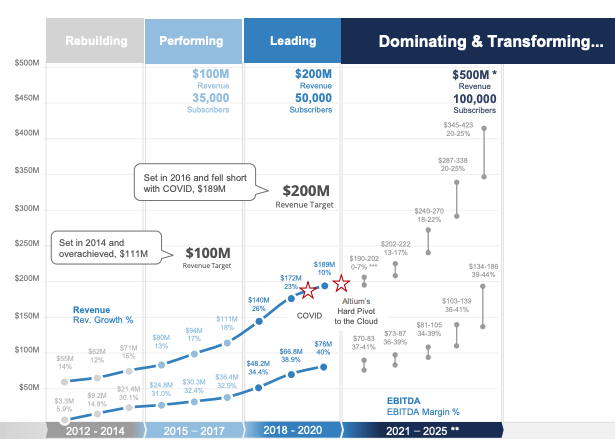

Management reiterated its long-term goal of $500 million in revenue and 100,000 subscribers by 2025. However, the business noted it will be relying on future strategic acquisitions to contribute between 10-20% revenue growth. This up from the originally stated 5-10%. When the ambition was initially declared, no acquisitions were required to reach the target.

CEO Aram Mirkazemi

said the business will only make an acquisition if it makes strategic sense. The market has no reason to not take his word, given the company divested the TASKING division last year as it did not align with the firm’s strategic vision. Retaining the division would have allowed Altium to achieve its short-term goal of $200 million in revenue by 2020 (TASKING contributed $19.8 million in sales).

Nonetheless, the acquisition component is becoming a larger part of Altium’s goal to reach $500 million in revenue. The worst result for shareholders would be if a large acquisition took place to meet arbitrary targets without aligning with the long-term strategy.

Does Altium have another S-curve left to go?

Much of today’s update centred upon Altium’s goal to bring the entire electronics supply chain onto one central platform through Altium 365. This will be the next growth pillar for the business as shown on the below slide.

The initial S-curve from Altium Designer is slowing, evident in the years 2018-2020. If the business can create a marketplace to bring the entire electronics hardware industry online, this will spur future growth and kickstart a new s-curve.

The dilemma for investors is currently the business is trading on 63x implied FY21 EBITDA. With the board declining a $38.50 takeover bid by Autodesk Inc. (NASDAQ: ADSK), which valued the business even more richly than it is today, did Altium miss an opportunity to cash out when the risk may be greater than the reward? Potentially a lot of the growth from Altium 365 is largely priced in?

I originally said to the Rask Media team the takeover bid is “peanuts” for Altium. However, I’m beginning to believe the execution risk may outweigh the potential reward from Altium 365 given today’s price.