The buy-now-pay-later (BNPL) has seen a strong recovery recently. Shares in Zip Co Ltd (ASX: Z1P) and Afterpay Ltd (ASX: APT) were the 1st and 9th most traded on the ASX last week, respectively, according to Commsec data.

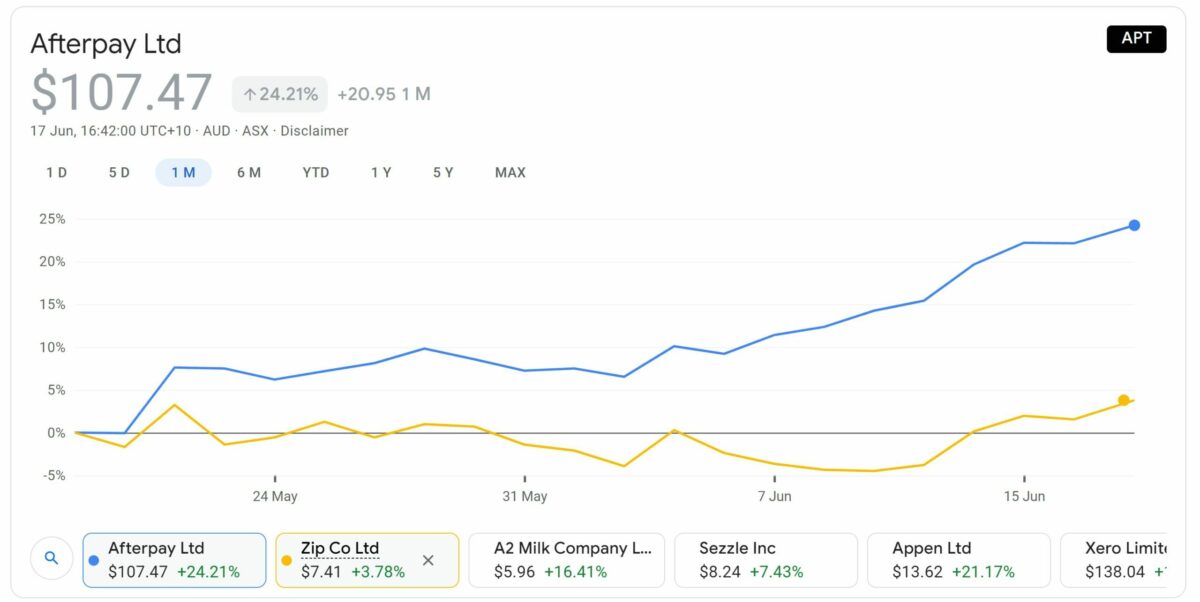

Both companies have also seen strong share price growth recently. Zip and Afterpay shares have returned 8.81% and 8.6% over the past five days.

Afterpay shares have returned an even more impressive 20.9% in the past month as shares reached lows of around $85 last month.

Why is the sector recovering?

Growth stocks like Zip and Afterpay were put in the crosshairs earlier this year after yields of US treasuries rose to over 1.75%, which implied inflation was on its way.

Growth and technology companies are often expected to generate future cash flows in many years to come, meaning there’s a larger discount effect when valuing the company’s shares using a discounted cash flow analysis.

US bond yields have since fallen to around 1.5% as demand for bonds has increased, pushing up their prices and causing yields to fall. So, it makes sense that this has had a positive effect on the share prices for companies like Zip and Afterpay.

What else?

Aside from the macro environment, both these companies seem to be continuing to accelerate at a rapid pace as BNPL is further embraced particularly by millennials and Gen Z consumers.

Afterpay has recently introduced its contactless Mastercard that is able to be stored in both Google Pay and Apple Wallet. These platforms have a user base of 100 million and 507 million, respectively. So, this addition could really open up the Afterpay platform to a huge existing addressable market.

Zip is also accelerating at a rapid rate that’s adding an estimated 8000 customers per day. It’s recently announced some acquisitions that will see it establish itself in Europe and the Middle East.

Management has flagged the possibility for cryptocurrency trading, share trading and high return savings accounts.

Summary

The bull case for the BNPL sector certainly does look promising from certain perspectives. Of course, it’s always worth considering an investment’s risks as well its valuation.

It’s no secret that the BNPL has become a crowded place, so high customer growth rates might not be too significant if they have to pay substantial amounts to acquire and retain customers in the long run.

For more reading, you should check out my recent article: One simple way I value Zip (ASX: Z1P) shares… Is now a buying opportunity?