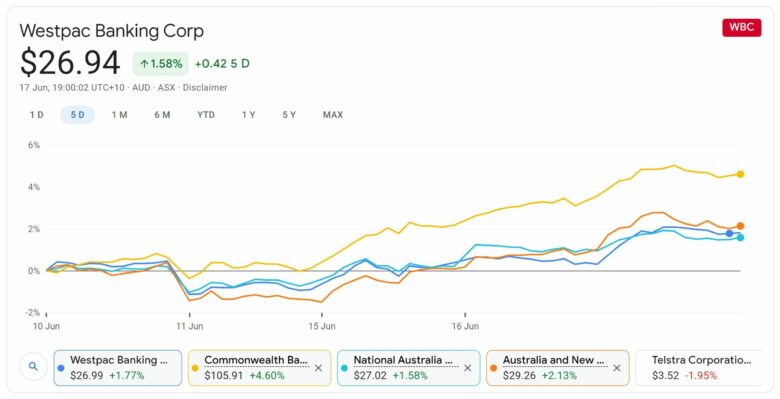

Yesterday, the Westpac Banking Corporation (ASX: WBC) share price hit a new 52-week high of $27.12 per share, representing a return of over 35% over the past six months.

Looking back at the longer-term picture, Westpac shares are just slightly above where they were prior to COVID-19.

If you zoom back even further, its shares are still down around 32% since reaching highs of around $40 back in 2015, although this negative return does not include dividends paid.

WBC share price

Westpac isn’t the only winner out of the financials sector recently though. Large gains have also been made by Commonwealth Bank of Australia (ASX: CBA), National Australia Bank Limited (ASX: NAB), Australia and New Zealand Banking Group Limited (ASX: ANZ) and Suncorp Group Ltd (ASX: SUN).

What’s caused the momentum recently?

The recent share price rally of the financials sector is likely the result of interest rate expectations and the effect this could have on certain companies.

The US Federal Reserve has recently revealed that it expects inflation to come in higher than what was previously expected. Headline inflation – the raw inflation figure based on the Consumer Price Index (CPI) is now expected to come in at 3.4% this year, while originally it was only expected to be 2.4%.

Core inflation – which excludes transitory and volatile inputs such as food and energy, is expected to be 3% this year, up from 2.2%.

As a result, the Fed anticipates it will raise interest rates twice by 2023 as a means to pull the handbrake on the economy.

What does this mean for ASX bank shares?

If central banks target higher interest rates, this will push up US treasury yields as demand for bonds falls. This will then likely have a flow-on effect to lenders such as banks and other financial institutions like brokers and insurance companies.

In the case of ASX bank shares, they can earn a higher percentage return on their income-generating assets such as mortgages, but their interest paid on deposits can remain relatively low. As a result, banks can generate a much higher net interest margin (NIM) and can be more profitable.

Another company that could stand to benefit would be Suncorp. Insurance companies like Suncorp earn part of their revenue by investing the money they receive from insurance premiums. If they can invest this money and generate a higher return, they’re likely to run a much more profitable operation.

Who are the losers?

The companyies that have previously benefitted from an extremely low interest rate environment will struggle when interest rates turn in an upwards direction.

Companies that hold a lot of debt on their balance sheets and growth/tech companies with earnings far out into the future will be worth less today with higher borrowing costs.

In valuation models that discount future earnings back to today, higher interest rates will increase the amount of discounting involved, reducing present value estimations.

Some companies that could struggle in these conditions would be Afterpay Ltd (ASX: APT), Altium Limited (ASX: ALU), Xero Limited (ASX: XRO), Wisetech Global Ltd (ASX: WTC) and Sydney Airport (ASX: SYD).

Time to buy Westpac shares?

Given the outlook for interest rates in the coming years, it certainly looks like this will be a nice tailwind for the Westpac share price.

Of course, one’s prediction of future interest rates would only be one of many factors that you might look at to evaluate an investment in Westpac.

Banks are cyclical beasts that are leveraged to the state of the underlying economy. If things are going well, confidence will be high, which will increase the demand for loans leading to higher profit and more dividends being able to be distributed to shareholders.

There are many other moving parts that should be taken into account, such as unemployment figures and the future outlook for the housing market.

Westpac’s valuation should also be considered, which you can read about here: WBC share price: 2 techniques to start valuing it.

As part of the Rask investment philosophy, I often try to look for companies that can perform well in most market conditions, as opposed to doing well under certain cycles.

While bank shares would probably be a sound addition to an income portfolio, they’re not something that interests me too much as I’m looking for higher growth areas.

For some more growth share ideas, click here to read: 3 ASX shares to add to your watchlist this week.

Also, if you want to become a better investor, I’d recommend getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.