Shares in lottery retailer Jumbo Interactive Ltd (ASX: JIN) have been a strong performer on the ASX recently – up over 20% over the past month.

No announcements have been made from the company recently that would explain the rally behind Jumbo’s shares. It’s likely that the broader recovery of the tech sector recently has helped to drag up the Jumbo share price.

Over the past month, the All Technology Index (XTS) has risen nearly 14%. This is thanks to strong gains from other large-cap tech companies such as Afterpay Ltd (ASX: APT), Altium Limited (ASX: ALU), Xero Limited (ASX: XRO) and Wisetech Global Ltd (ASX: WTC).

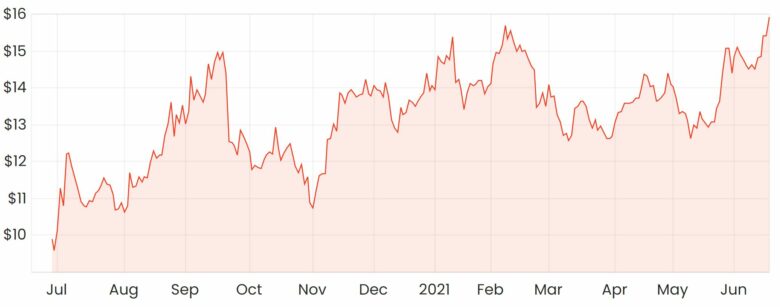

JIN share price

Jumbo background

Jumbo is well-known for operating through its flagship platform Oz Lotteries, which is an official retailer of Australian lottery tickets that’s been operating for the last 20 years.

Jumbo also operates through a partnership with Tabcorp Holdings Limited (ASX: TAH), which allows Jumbo to be a reseller of lotteries such as Powerball and OzLotto that are offered by Tabcorp.

More recently, it’s been pursuing its international growth strategy by leveraging its software-as-a-service (Saas) platform, Powered by Jumbo. It allows other lottery retailers to utilise Jumbo’s pre-built model and gain access to marketing, support and analytics tools.

How’s the business been performing?

Jumbo last updated the market in February when it released its half-year results for the six months ending December 2020.

Some certainty was provided to investors as it revealed it had extended its relationship with Tabcorp through a 10-year contract.

Group revenue had jumped 9% across the period to $40.9 million despite only 15 large jackpots occurring compared to 23 on the prior corresponding period (pcp).

The number of jackpots will influence the number of tickets purchased and therefore revenue collected, so this element is largely out of Jumbo’s control.

Net profit after tax (NPAT) was down 5.8% across the period. Management said this was mostly due to lower interest rates on cash balances and non-cash amortisation expenses related to the Tabcorp agreement.

Time to buy Jumbo shares?

Jumbo has a fairly mature business here in Australia, but I’m more excited about its international expansion through its Powered by Jumbo platform.

New contracts for the platform are being signed, albeit at a fairly slow rate. It signed its first UK partner, St Helena Hospice late last year which is expected to go live next month.

If Jumbo can continue to win new overseas contracts, I think Jumbo could be an ASX growth share to watch out for.

For some more growth share ideas, click here to read: 3 ASX shares to add to your watchlist this week.