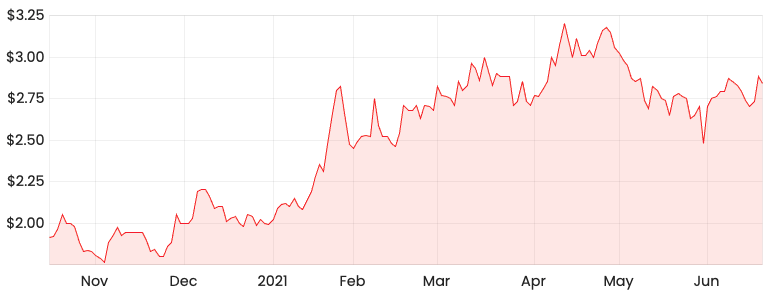

Unlike many recent initial public offerings (IPOs), Aussie Broadband Ltd (ASX: ABB) has exceeded market expectations.

Since its IPO price of $1.00, Aussie Broadband shares have returned 188%.

Aussie Broadband is an internet service provider (ISP), primarily focusing on NBN subscriptions plans for residential and business customers. The company also offers a range of other telecommunications services including VOIP, mobile plans, entertainment bundles and white-label solutions.

ABB share price

Ugly at first glance

Admittedly, reselling NBN subscription plans is not a particularly attractive business model. The product is commoditised, with low margins and large incumbent competitors with established customers bases.

On average, 76.5% of Aussie Broadbands revenue is paid to NBN Co as part of its wholesale agreement. This leaves just 23.5% of revenue to pay for employees, utilities, marketing and other expenses.

Growth within the market is largely limited to population and dwelling growth, meaning your product offering must be significantly better to attract new customers.

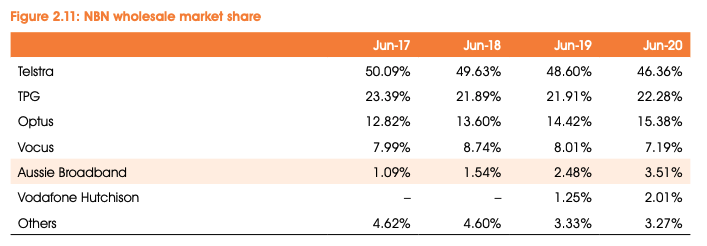

Since forming in 2008, Aussie Broadband has had to battle tooth and nail to gain market share. In more recent years the group’s efforts have been rewarded. The company has accelerated its customer acquisition to take market share from the larger and more well-known telcos including Telstra Corporation Ltd (ASX: TLS) and TPG Telecom Ltd (ASX: TPG).

Aussie’s current market share hovers around 4%. Impressively, the company is acquiring 16.5% of all new connection to the NBN connections, outlining a strong growth runway.

Given Aussie Broadband’s product is largely the same as Telstra, Optus and TPG, what makes customers choose Aussie Broadband? Read on.

Market-leading customer loyalty and retention

To differentiate itself from competitors, Aussie Broadband delivers industry-leading customer service. The company operates a local call centre based in Morwell, Victoria in addition to using proprietary customer management and billing software.

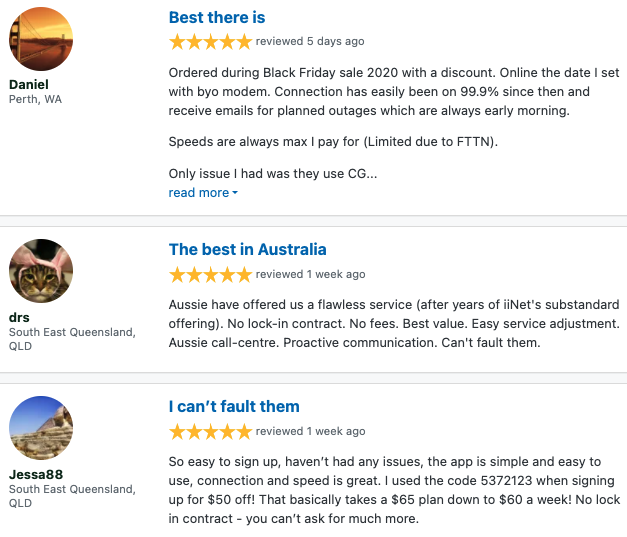

A recent survey of 1,800 respondents by Choice revealed Aussie Broadband customers are by the most satisfied in Australia.

76% of Aussie Broadband customers report no problems with their internet, compared to Telstra (55%), Optus (50%) and TPG (56%).

Furthermore, Aussie Broadband recorded the highest score in every category surveyed including connection speed, value for money and connection reliability.

It’s not just Choice with favourable comments. Aussie Broadband has a 4.5-star rating on ProductReview.com.au and a 4.4-star rating on its Facebook page.

As a result of high customer satisfaction levels, the business has industry low churn rates, recording customer turnover of 1.59%, 1.66% and 1.76% during FY18, FY19 and FY20 respectively.

Optimised network capacity

Aussie Broadband developed an in-house CVCBot to optimise bandwidth across the customer cohort. Without delving into the technical intricacies, the CVCBot increases and decreases bandwidth in response to usage.

This enables customers to receive the best possible speeds during peak hours, thereby improving the customer experience.

In off-peak periods, bandwidth is dialled down. The software allows Aussie Broadband to minimise unutilised bandwidth thus reducing operating costs.

Aligned and established management

Aussie broadband is headed by co-founder, Executive Director and Managing Director Phillip Britt. He co-founded Wideband Networks in 2003 and became Managing Director when it merged with Westvic Broadband in 2008 to become Aussie Broadband. Britt owns 17.9 million shares equal to about 9% of the company.

Executive Director and Chief Technology Officer CTO John Reisinger is also a co-founder of Wideband Networks. Reisinger owns 9% of the company.

Director Patrick Green was the co-founder of Westvic Broadband and owns 12.1 million shares or 6% of the company.

Directors and senior management sold no shares in the IPO. However, both Reisinger and Phillip sold 1.6 million shares this year.

All directors on the board have a shareholding in Aussie Broadband.

Consistent with its customer-centric approach, the company offered existing customers shares in the company before opening the IPO to the wider public. Customers who accepted the offer have likely paid their internet bill for the next five years with the profits.

Well positioned for growth

The company raised $40 million in its IPO last October. All proceeds will be used to grow the business with:

- $26.5 million dedicated to the construction and deployment of its own backhaul dark fibre network across Australia

- $10.0 million for expanding working capital and marketing activities

- $3.5 million for costs of the offer

Once completed, the backhaul network will replace 63% of Aussie Broadband’s leased capacity. Currently Aussie Broadband leases fibre from Telstra Wholesale and other carriers for access to data centres and NBN points of interconnect.

The project is expected to minimise Aussie Broadband’s reliance on third-party carriers and improve margins through reduced costs associated with leasing infrastructure.

The recent addition of the white-label solution offers a new revenue stream, whereby retail providers can sell the Aussie Broadband product range under their own brand. The first major customer to sign up is Origin Energy Ltd (ASX: ORG).

Further, the wholesale agreement with OptiComm now owned by Uniti Group Ltd (ASX: UWL) provides Aussie Broadband with access to new greenfield opportunities and 100,000 additional fibre customers.

Positively, no proceeds from the IPO went to investors exiting the business.

The company is EBITDA positive, expected to grow revenues at 84% in FY21 and has upgraded guidance since its prospectus.

With only a 4% market share and a compelling product offering, I think Aussie Broadband will continue to take market share from the larger telco incumbents.

My take

It’s rare to find extreme customer love and aligned management, especially in the telco industry.

The business will soon reach cash flow positivity and is scaling rapidly where its competitors can no longer dismiss it as a small player.

While the economics of the business model is inherently poor, Aussie Broadband has defied the odds to grab market share. I’m prepared to take a small position today, adding overtime as management executes.