Yesterday, cybersecurity company Tesserent Ltd (ASX: TNT) released an update that was extremely well received by the market.

Even though the update was not marked as price-sensitive, Tesserent’s shares finished the day over 26% higher.

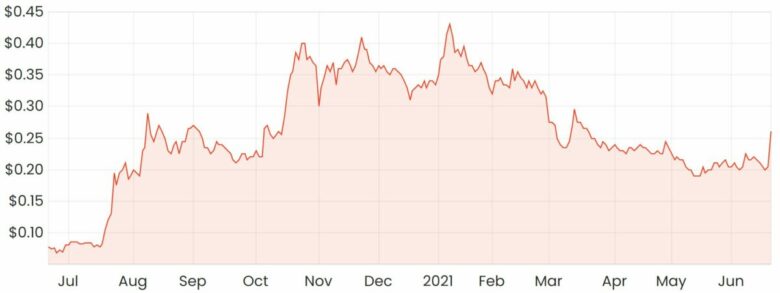

The last 12 months have been wild for the company’s shareholders. After reaching highs of 44 cents per share, Tesserent’s shares have gradually trended downwards since the start of the year.

TNT share price

Tesserent background

Tesserent offers a broad range of cybersecurity services and products to its clients, assisting them in achieving full end-to-end protection of their digital assets.

Tesserent has embarked on aggressive growth through acquisitions and has bought up a variety of other businesses in areas such as consulting and security advisory, cloud migration, risk and compliance, governance and many more.

It caters to industries including enterprise, governments and critical infrastructure (utilities, transport & logistics).

Trading update

Management advised yesterday that it expects to comfortably exceed its prior annualised turnover run rate of $150 million which was based on the month of June 2021 annualised.

Now, management is expecting this number to be around $180 million based on June.

My take

It’s worth noting that a revenue run rate is different to revenue guidance. In this case, the former is calculated by extrapolating one month of revenue and annualising it over the year.

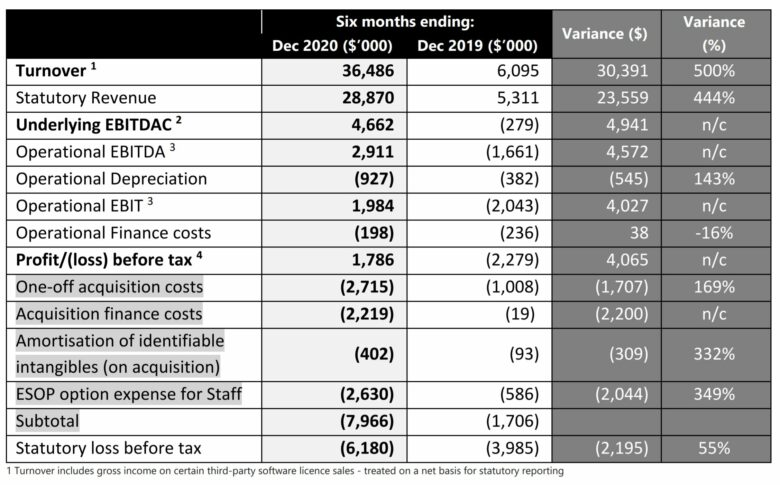

Tesserent reported $36 million in turnover for the first half of FY21, so it will likely not be reporting $150 million of actual turnover in FY21. Investors will have to wait for either the next quarterly or the full-year results to see how this translates into actual turnover.

A slightly more meaningful metric to look at is EBTIDA, or in Tesserent’s case, Operational EBITDA (Op EB), which excludes one-off acquisition and finance costs, as well as its employee share ownership plan expense.

This is where it gets tricky. Firstly, share-based compensation is a real expense to a business. In my view, it makes little sense that it’s omitted when using Op EB as a proxy for cash flow/profitability.

Secondly, Tesserent excludes its “once-off” acquisition costs, but they seem to have occurred a little more than on a once off basis. This could make sense given the number of businesses the company’s bought recently, but it definitely requires some trust in management in regards to what is being included as once-off expenses.

If we give Tesserent the benefit of the doubt and exclude these previously mentioned costs and also assume that Q4 will be a bumper quarter, Tesserent looks like it could be on track to achieve Op EB between $7 million to $10 million based on revenue somewhere between $80 million to $100 million – This gives an underwhelming EBITDA margin of around 10% even with some optimistic cost exclusions.

Does Tesserent’s valuation make sense?

Again, I’ll give Tesserent the benefit of the doubt and assume it can deliver $10 million of Op EB in FY21. Tesserent’s current share price of 26 cents commands a market cap of $270 million, but Enterprise Value (EV) is probably more meaningful given that it carries leverage.

From the last quarterly, Tesserent has $15 million in borrowings around $7.5 million in cash and cash equivalents. This could give an EV of around $277.5 million, putting Tesserent’s shares on a forward EV/EBITDA of 27.5 assuming it reaches $10 million Op EB in FY21.

My research based on comparable peers suggests that the mean EV/EBITDA is around 15, in other words, nearly half of what the market has assigned to Tesserent’s valuation.

If Tesserent’s shares are going to trade on such a relatively high multiple, I’d want to see what could potentially justify it.

The company’s aggressive growth by acquisition strategy has seen Tesserent’s shares outstanding balloon to over 1 billion as it’s partly issued shares to fund its various acquisitions.

Now, sluggish organic growth will see the company potential reach an EBITDA margin of around 10%. But in reality, Tesserent still isn’t profitable if you take even a slightly less delusional view on profits.

What to do with Tesserent shares?

The thematic around cybersecurity is undeniably positive, so I think there’s a compelling argument for Tesserent offering a durable service over the long term.

I question why the market is prepared to pay such an expensive multiple for its shares. Tesserent is a low-margin services business that has funded its acquisition spree partly at the expense of shareholders.

Only time will tell if these acquisitions have added significant value to the firm, but the current valuation seems to imply a blue-sky scenario where the risk is now skewed to the downside.

For more reading, I’d recommend getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.