Yesterday, Redbubble Ltd (ASX: RBL) shares recovered most of Wednesday’s losses and finished the day over 7% higher.

Shortly after the market closed, Redbubble released an update relating to ongoing litigation proceedings against the company.

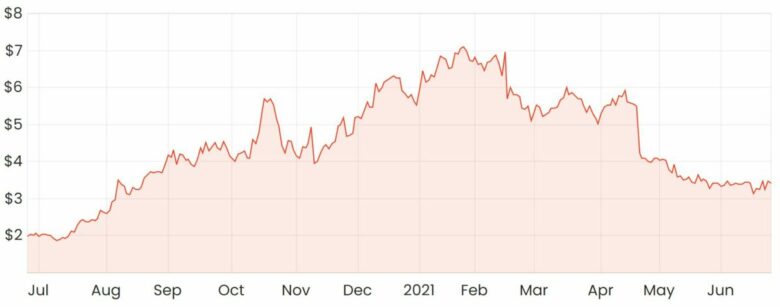

RBL share price

The details

This update refers to ongoing legal proceedings commenced by teen-favourite women’s fashion label, Brandy Melville regarding alleged intellectual property infringement.

Redbubble noted recently that despite receiving a jury verdict, it’s one of many steps in the overall litigation process, so there hasn’t been a definitive outcome yet.

Management seems confident that critical findings were not supported by evidence at the trial. As such, it will be asking the court for relief from the verdict on this basis.

The story so far

Redbubble operates an online print-on-demand marketplace where artists can advertise their own designs on things like t-shirts, stickers and phone cases.

Once an order is placed, Redbubble takes care of the rest of the process and handles the production of the item, shipping, payments and customer service.

Back in 2019, Brandy Melville became aware that Redbubble was selling and distributing items with the former’s name and logo printed on them. After not being able to resolve the dispute between the two parties, Brandy Melville filed a lawsuit against Redbubble and the case has been ongoing ever since.

Not the first time

After having a quick dig around, this isn’t the first time Redbubble has been accused of intellectual property infringement.

Here in Australia, Redbubble faced legal proceedings from the Hells Angels Motorcycle Corporation and The Pokemon Company International. Neither resulted in any significant financial or operational impacts.

In a previous case in 2019, Ohio State University (OSU) sued Redbubble for a similar reason, in that it had been producing and distributing products with the OSU trademarks on them.

Redbubble’s argument made the clear distinction that in this case, the artists were the sellers of the items, rather than Redbubble itself. Redbubble held no title to items and simply acted as a transactional intermediary between buyers and sellers.

This case has been passed between various courts, so the outcome is still unknown at this point.

What now?

While I’m not overly concerned about this most recent case, it definitely highlights some of the potential risks that should be monitored closely.

That being said, the field of intellectual property law is incredibly esoteric that would likely go over the average investor’s head.

As an investor, it’s encouraging to knowing that Redbubble management is taking some actions to prevent further infringement allegations.

Corina Davis, chief legal officer of Redbubble has previously said that the company works with other brands to detect and eject counterfeit items.

What’s more, it’s also been securing licencing agreements with musicians to lawfully produce and distribute products that contain registered trademarks.

What to do with Redbubble shares?

Redbubble’s shares were brutally sold off following a Q3 update that showed a slowdown in growth and a long-term plan that will sacrifice short-term profits while it deploys capital back into the business.

For some holders with a shorter investment horizon, I can understand why some may have sold out on the news. In fact, I think the coming years are likely to be challenging for Redbubble.

The online e-commerce space has become a saturated place, which has increased customer acquisitions costs (CAC) for many businesses. With such low-value items (stickers etc), one might question how profitable Redbubble might be considering it already earns a fairly low take rate of around 30% of the transaction value.

While this low take rate might give the impression of a capital intensive business, it actually doesn’t have too many expenses after this step, so in fact, I think it runs a fairly capital-light business model that will enjoy further benefits of operating leverage.

The business is highly cash flow generative and is now sitting on a huge sum of cash. I think it has the ability to incrementally compound reinvestment back into the business through its three-sided flywheel network.

If Redbubble can retain high-quality artists and its repeat customers, I think the long-term outlook remains bright.

If you’re looking for more ASX share ideas, click here to read: 3 ASX growth shares for your watchlist this week.

Also, if you want to become a better investor, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access all of our free analyst reports.