Shares in lithium producer Pilbara Minerals Ltd (ASX: PLS) have been some of the most traded on the ASX in recent weeks.

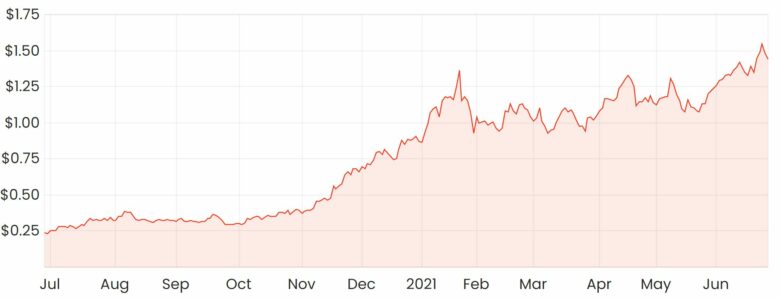

The recent rally behind Pilbara’s shares has maintained its momentum and have returned 60% in the past six months and a huge 500% over the past year.

Can the rally continue?

PLS share price

Pilbara background

Pilbara Minerals is an Australian pure-play lithium miner located in Western Australia. The company operates its 100%-owned Pilgangoora Lithium-Tantalum Project – one of the largest lithium ore deposits in the world.

Lithium is commonly used to power electric devices such as mobile phones, tablets and Laptops. However, much of the recent hype has been due to the compound’s integral role in the use of lithium-ion battery packs used in electric vehicles (EVs).

Recent developments

One of Pilbara’s projects is its Pilgangoora Project, located 120km from Port Hedland in Western Australia.

Management told the market last week that it had received significant assay results and had identified zones of high-grade pegmatite mineralisation adjacent to the tenement’s boundary.

Drilling is ongoing, and management expects to update the market again in the September quarter this year.

Drilling to restart Ngungaji plant

Pilbara also told the market last week that it plans to ramp up production in response to strong demand conditions.

As a result, the Ngungaju operation will be staged to restart during the December quarter this year. The company will target production output between 180,000 and 200,000 dry metric tonnes (dmt) by the middle of CY2022.

Once this operation is producing at full capacity, management estimates the total capacity of the combined Pilgangoora Project to be between 560,000 and 580,000 dmt per year.

Can Pilbara’s shares keep climbing?

Pilbara seems to be in a competitive position due to the sheer size of its Pilgangoora deposit, which is said to be one of the largest in the world.

However, there doesn’t seem to be a supply shortage of lithium. The challenge lies within processing the compound – in Pilbara’s case, the compound is extracted from spodumene rocks.

Long-term forecasts of lithium demand seem to vary significantly, but they all seem to have one thing in common, which is that EV production is likely to increase as the world continues to seek cleaner forms of energy.

While the outlook does look positive, a price-taking commodity business does have some downside risks. With Pilbara being a pure-play on lithium, it would take some strong conviction that the compound is going to be an integral part of EVs and other devices in the long term.

To read more about companies that align with our Rask investment philosophy, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access all of our free analyst reports.