Kathmandu Holdings Ltd (ASX: KMD) shares are still hiking through tough terrain. Kathmandu shares have taken another blow after the recent lockdowns in NSW and WA.

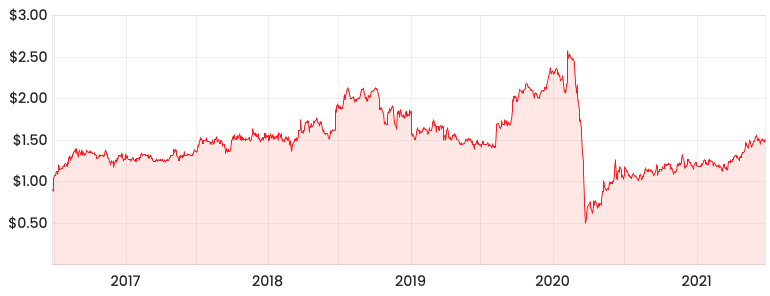

KMD share price

Trading guidance revised downwards

COVID has wreaked havoc again as Kathmandu announced it had to close 40 stores in NSW for at least two weeks and 26 further stores in WA for a minimum of four days.

This follows the recent lockdown in VIC, which affected 62 stores in early June.

Kathmandu’s total sales for FY21 are expected to come in below initial expectations at around $930 million, and underlying earnings before interest, tax, depreciation and amortisation (EBITDA explained) is estimated at around $120 million.

Management advises the estimated impact of these recent lockdowns could be around $13 million on EBITDA.

The business notes trading activity for the Kathmandu brand picked up and reached similar levels to pre-COVID for the winter period.

Kathmandu also owns the Rip Curl and Oboz brands.

Rip Curl continues to perform strongly in key regions of North America and Europe. Direct consumer sales remain well above pre-COVID levels. Wholesale orders received for FY22 continue to record double-digit growth over FY19.

As for the footwear brand, Oboz has reported record sales performance in the second half of FY21. Wholesale orders for FY22 are significantly above FY19 and FY20.

My thoughts on the Kathmandu trail

It’s encouraging to see sales bouncing back to pre-pandemic levels.

Kathmandu’s acquisition of Rip Curl in 2019 proved to be a sound move to build a more seasonal-proof business. However, whether it’s a value-accretive remains to be seen.

Why is this important?

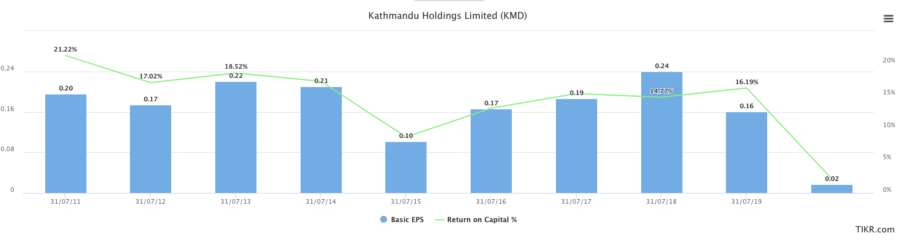

Whilst it’s great to see growing revenue as a retail business rolls out more stores globally, but at what cost? High growth doesn’t always necessarily result in high returns on capital and value to shareholders.

As you can see below, basic earnings per share and return on capital haven’t reached their former highs since 2011.

Kathmandu keeps hiking along new trails but it seems like there is a diminishing rate of return.

In saying this, Kathmandu is currently free cash flow positive supported by strong brands across the globe.

I prefer businesses that are less capital intensive and more scalable as per the Rask Investment Philosophy.

If you’re looking to become a better investor, I’d recommend signing up for a free Rask account to gain access to our stock reports.