Further details have been revealed following last weeks search of Nuix Ltd (ASX: NXL) Sydney headquarters by the corporate regulator.

The Australian Financial Review has reported the Australian Securities and Investments Commission (ASIC) sought a secret flight ban to prevent the brother of former Nuix CFO from leaving the country.

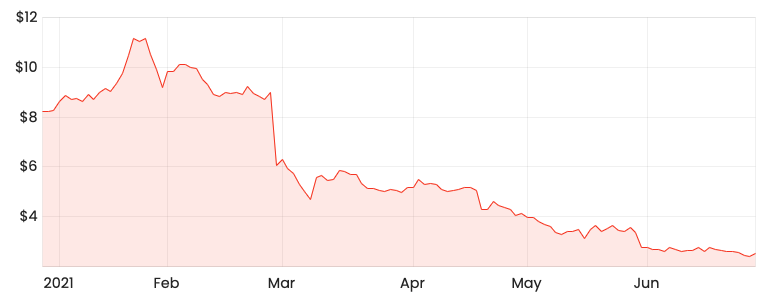

NXL Share Price

Travel ban until October

The travel ban was issued by the federal court on Wednesday last week, one day prior to the head office search.

Ross Doyle, the brother of Nuix ex-CFO Stephen Doyle, is unable to leave Australia until October 25 following an extension of the travel ban. Ross Doyle resides in Switzerland.

In addition to Nuix headquarters, Stephen Doyle’s Sydney apartment was also searched.

ASIC said the raids on Thursday were part of an ongoing criminal investigation into “certain individuals”.

“This concerns matters that have come to light subsequent to Nuix’s IPO and listing in December 2020″

Last week, Nuix released an announcement to the ASX announcing the Australian Federal Police (AFP) on behalf of ASIC were “seeking documents in relation to an investigation into the affairs of an individual”.

Nuix understands the investigation does not relate to any wrongdoing by the company.

Something doesn’t stack up

Last week, a joint investigation by The Sydney Morning Herald, The Age and The Australian Financial Review revealed gaps and contradictions in Nuix’s records.

Stephen Doyle was company secretary at Nuix from 2011 until November 2020. Therefore, he was responsible for the share register and option holders.

Doyle received 50,000 options in mid-2011 and subsequently in September 2012 reported to ASIC he had exercised the options into 50,000 shares in Nuix.

Then in 2015, Doyle notified ASIC he had sold those same 50,000 Nuix shares to his brother – Ross Doyle, who resided in tax-friendly Switzerland in July 2012. This could not be possible, given he only reported owning the shares in September 2012.

Doyle’s employment contract was terminated by Nuix last week along with the announcement that CEO Rod Vawdrey would step down.

My take

Most alarming for the Doyle family and to a lesser extent Nuix is that the investigation is criminal in nature. This suggests the participants knowingly acted illegally.

Given the investigation is ongoing, the full details have not been revealed publicly. However, I doubt ASIC would be conducting search warrants and travel bans unless it believed it had credible evidence of wrongdoing.

If you’re looking for companies with a little more positive newsflow, check out three ASX shares to put on your watchlist by my colleague Patrick Melville.