For the first time in the history of the company, shares in Commonwealth Bank of Australia (ASX: CBA) have recently crossed the $100 mark.

After reaching highs of $106.5, CBA’s shares have since pulled back and are now trading at $100.4 at the time of writing.

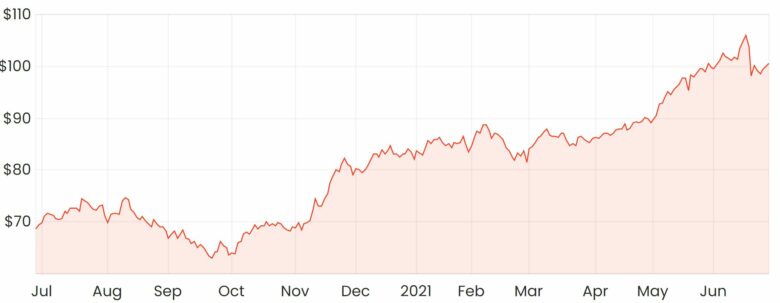

Despite this recent dip, CBA’s shares have still returned an impressive 44% over the past 12 months.

CBA share price

What’s CBA been up to recently?

The bank updated the market last week on an agreement

to sell CommInsure, its Australian general insurance business to Hollard.

The transaction will involve a $625 million upfront consideration and will establish a 15-year strategic alliance where Hollard will distribute insurance products to CBA’s retail customers.

CBA will continue to earn income on the distribution of the insurance products.

Waddle partnership

To remain competitive against other larger players such as National Australia Bank Ltd (ASX: NAB), CBA will be introducing an invoice financing platform that’s built on technology from Waddle.

Waddle was recently acquired by accounting software company Xero Limited (ASX: XRO), so CBA’s new product, Stream Working Capital will be able to be integrated with Xero’s platform.

Invoice financing is a form of secured lending where outstanding invoices are held as security against the loan. This can help businesses free up working capital to help meet shorter-term obligations.

CBA said its new product is aimed at companies with a turnover of up to $30 million and will loan these businesses between 40% – 80% of the face value of the invoice.

What’s been driving CBA’s share price higher?

One of the reasons driving the CBA share price higher could be the expectation of distributing capital back to shareholders in the form of share buybacks and dividends.

The banks had to provision for loan impairments in response to COVID-19. But due to better than expected performance, they’re now sitting on larger cash buffers that can partly be distributed back to shareholders.

Time to buy CBA shares?

For an investor looking for dividends/income, CBA might not be a bad choice. I would rate it higher than the remaining three banks on most aspects aside from its valuation.

If you’re looking for more ASX share ideas click here to read: 3 ASX shares to put on your watchlist this week.

Also, If you want to become a better investor, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.