Digital advertising business REA Group Limited

(ASX: REA), widely known for its realestate.com.au platform, has completed the acquisition of Mortgage Choice Limited (ASX: MOC) today.

REA acquired 100% of the shares in Mortgage Choice for $1.95, valuing the business at $244 million.

Amicable takeover process

The acquisition was unanimously recommended by the Mortgage Choice board. Additionally, an independent valuation by Grant Thornton

valued the company between $1.66 to $1.97 per share. Given REA’s $1.95 offer, this was at the upper end of the independent valuation.

Subsequently, the majority of Mortgage Choice shareholders voted in favour of the acquisition.

Prior to the March takeover announcement, Mortgage Choice shares traded for $1.175 and a market capitalisation of $146 million.

Why is REA interested in Mortgage Choice?

Mortgage Choice is a mortgage and home loan broker with over 380 franchises and 500 mortgage brokers across Australia. The company also operates financial planning services.

Mortgage Choice provides its franchisees with access to over 28 lenders (major banks, credit unions) at rates negotiated with lenders directly by Mortgage Choice. The company then receives commissions from lenders for facilitating the mortgage process.

The acquisition of Mortgage Choice aligns with REA’s financial services strategy. The company is seeking to leverage the 12 million monthly visitors to realestate.com.au to provide adjacent mortgage services.

The idea is to enable buyers to secure loan approval prior to purchase so they can browse properties within their borrowing capacity.

REA Chief Executive Officer, Owen Wilson commented:

“The acquisition of Mortgage Choice represents an exciting opportunity for REA to create a leading broking business. It builds on our success to date, accelerating our financial services strategy while leveraging our existing strengths and capabilities.”

Moreover, the Mortgage Choice takeover complements REA’s previous acquisitions in mortgage broker Smartline and more recently in loan application solution Simpology.

Short on details

Despite the apparent alignment with REA’s financial services strategy, the Mortgage Choice acquisition has been short on specific details.

Other than the purchase price, transaction funding and that the transaction will be ‘EPS accretive’, no revenue, profit or return on capital estimates have been revealed.

Additionally, a closer look at Mortgage Choice paints a picture of a business that has been flatlining.

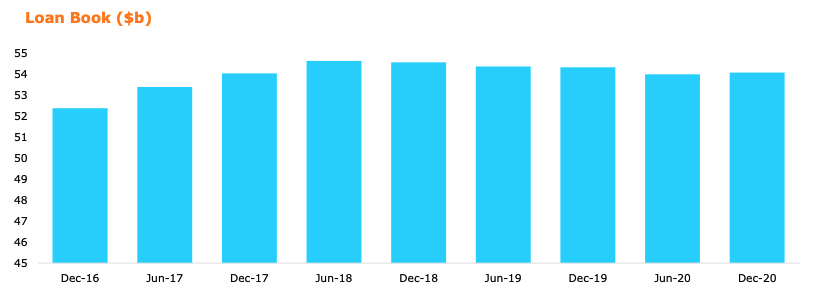

Despite a roaring property market over the past year, Morgage Choice failed to grow its loan book in its most recent half-year report. Similarly, over a longer time horizon, loan book growth has been stagnant.

Falling interest rates and the Royal Banking Commission have weighed heavily on the broader mortgage broker industry. However, the 65% premium REA forked out for MOC shares is somewhat perplexing.

My take

Overall, the Mortgage Choice acquisition isn’t impressive from a financial standpoint. Despite remaining profitable, revenues and earnings have been falling over the past 5 years.

This suggests REA is looking to leverage other parts of the Mortgage Choice business, such as its franchisee and broker network to scale up REA’s lending business.

The recent acquisition of Simpology – an innovative mortgage solution that enables brokers to lodge home-loan applications directly into a lenders back-end system, could be the missing piece in the puzzle.

Partnering the Mortgage Choice and Smartline broker network with Simpology will create a differentiated product offering to property buyers, speeding up the loan process and reducing administration.

While I remain cautious of execution risk, Simpology plus a national mortgage broking network is an interesting value proposition.