Endeavour Group Ltd (ASX: EDV) shares are expected to begin trading under normal trading conditions today on the Australian Stock Exchange (ASX).

Endeavour encompasses the liquor stores, hotels, hospitality venues and gaming assets formerly under the control of Woolworths Group Ltd (ASX: WOW).

Notable Endeavour operating businesses include Dan Murphy’s, BWS, ALH Hotels, Pinnacle Drinks, EndeavourX, Jimmy Brings and Cellardoors.

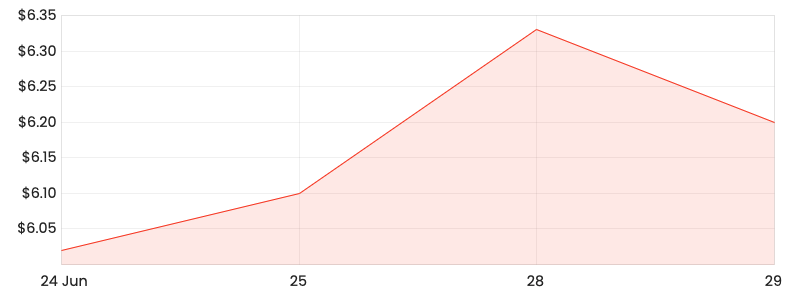

EDV Share Price

What’s going on?

Shares in Endeavour will change from conditional to normal trading upon transfer of Endeavour shares to eligible Woolworths shareholders.

Since 25 June, shareholders of Woolworths were entitled to receive one share in Endeavour for each Woolworths share held.

Why is this important?

Since launching on Thursday last week, shares in Endeavour have been trading on a conditional and deferred basis. This means trades are conditional on Woolworths transferring Endeavour shares to eligible shareholders by 1 July.

Once the transfer is complete and holding statements are dispatched, Endeavour will begin trading on a normal basis from 1 July.

In the unlikely event shares are not transferred to eligible shareholders today, all trades undertaken during the conditional trading period will be invalid and not settle.

Normal trading expected

Rest assured there is no indication the transfer won’t go ahead. Investors should perceive the transfer process as a formality.

Once finalised, Endeavour will trade as an independent company on the ASX and the final step in the demerger process will be complete.

While only a small sample of five trading days, the Endeavour share price has begun to slowly climb. Shares are currently trading at $6.30. The company has a market capitalization of $11.1 billion.

Why did Woolies demerge Endeavour?

The primary reason for demerging Endeavour Group from the broader Woolworths portfolio is to maximise the value of the two businesses. Each company will have its own board, management team, growth plan and strategic direction.

Previously, Woolworths had come under fire by large institutional shareholders for not meeting environmental, social and governance (ESG) criteria.

Much of the criticism related to liquor and gaming assets, which do not comply with pension and industry funds investment mandates. Now investors can choose their level of exposure to both Endeavour and Woolworths.

Woolworths will retain a 14.6% shareholding in Endeavour. Additionally, the two companies have signed strategic partnerships for logistics, technology and business support.

If you’re interested in reading more about Endeavour Group, check the bull and bear case analysis.