The long-awaited IPO of PEXA Group Limited (ASX: PXA) is finally here with the company to begin trading with a share price of $17.13.

PEXA will initially trade on a conditional and deferred settlement basis before normal trading commences on 5 July.

Open for inspection

Born out of a desire to digitise conveyancing by federal and state governments in 2008, PEXA now operates Australia’s leading digital property settlements platform.

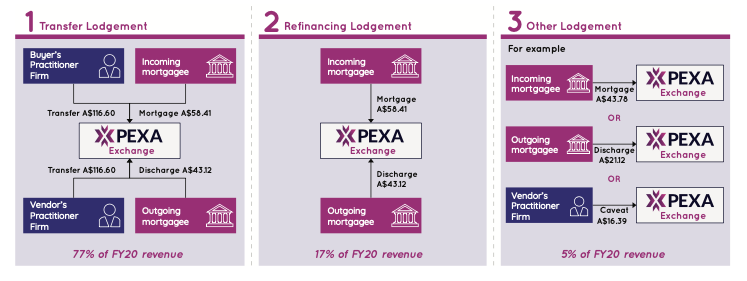

PEXA has a monopoly over the Australian conveyancing market, with 80% of all property transfers occurring on the PEXA Exchange platform. This market share is only increasing as more conveyancers move to digital transfers.

PEXA has no material competitors. Since PEXA’s fees are immaterial relative to the overall cost of a property or mortgage settlement there is little incentive for conveyancers to move to a competitor. Additionally, the cost is borne by the vendor and buyer, not the law firm or banks.

The company is looking to take its leading Exchange overseas to new jurisdictions with similar Torrens Title land registry systems. The first international market expansion will be into the United Kingdom, which has a property transfer market 2.5-3.0x larger than Australia.

Additionally, PEXA is looking to leverage its wealth of property and transaction data. PEXA Insights is developing products and services to generate data insights for real estate agents, conveyancers, vendors and home buyers. This will offer an adjacent revenue stream for PEXA.

Concerns over global expansion

Despite establishing a local team and CEO for expansion into England and Wales, PEXA’s international aspirations are relatively nascent.

PEXA’s ability to launch its product largely depends on its ability to secure an integration testing ‘slot’ with the Bank of England’s (BoE) Real-Time Settlement System prior to August 2021.

As of 2022, the BoE will be undertaking a multi-year upgrade to the settlement system where no testing slots will be available until 2024. PEXA also needs to arrange at least one financial institution to partner its integration testing with the BoE.

The company has provided no update thus far on the testing slot or partner. This is concerning given the deadline is only a month away.

It should also be noted PEXA does not have the government and private sector support it previously had in Australia abroad.

David Jabbari, CEO of a local law firm in the UK argues little improvement is possible without the initiative and cooperation of Her Majesty’s Land Registry (the land registry for England and Wales).

My take

The PEXA IPO values the company at 40x free cash flow, a hefty price for any company.

The valuation is somewhat justified given the dominant Australian business. However, a lot of the international growth is also baked into the current price.

Personally, I believe the valuation is too rich currently. I’d consider purchasing shares if the company fell to valuation around 25x free cash flow.

For a more detailed analysis of PEXA, check out the full deep-dive here.