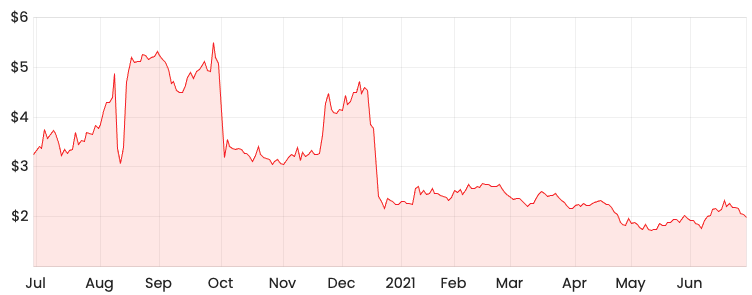

Mesoblast Limited (ASX: MSB) shares have had a horrid twelve months, falling by 40%. Can this new lower back pain drug lift Mesoblast shares?

MSB share price

Mesoblast in talks with the FDA

Mesoblast has announced it has engaged with the US Food and Drug Administration (FDA) about a drug that could address chronic low back pain (CLBP) after its latest phase of trials.

The discussion will centre around the pathway to US regulatory approval for this drug.

Why is Mesoblast focused on this drug?

The company notes CLBP affects around 10-15% of the adult population. CLBP is caused by inflammation and degeneration of the intervertebral discs (lower spine) due to a number of factors like age, trauma or genes.

There are currently few treatment options and patients with CLBP have become reliant on opioid prescriptions as a pain relief solution. However, Mesoblast notes opioids are associated with serious and potentially life-threatening side effects.

My take on Mesoblast

It appears Mesoblast is developing a drug that has the potential to provide a better solution to treat CLBP.

On top of this, the market is quite big.

However, this falls outside of my circle of competence, meaning it’s quite difficult for me to gain an analytical edge.

In saying this, if you do have expertise in this field, it may be worthwhile considering the potential upside of this drug development.

If you’re looking to become a better investor, I’d recommend signing up for a free Rask account to gain access to our stock reports.