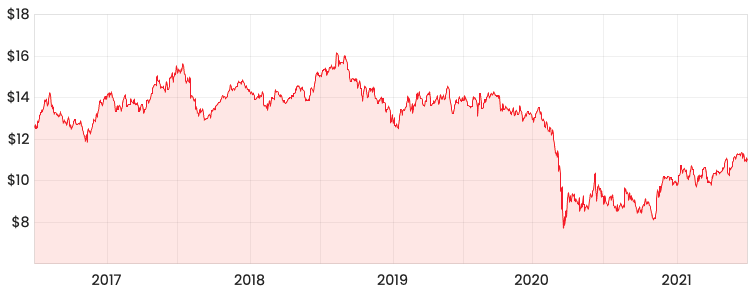

Suncorp Group Ltd (ASX: SUN) shares are still making a slow recovery towards pre-COVID levels. Will simplifying the business drive the Suncorp share price higher?

SUN share price

Sale of 50% interest in RACT Insurance

Suncorp has decided to sell its 50% Joint Venture (JV) interest in RACT Insurance Pty Ltd (RACTI) to its JV partner, the Royal Automobile Club of Tasmania Ltd (RACT).

It will be sold for $83.75 million made up of upfront cash proceeds, reflecting a Price to Earnings (P/E ratio explained) multiple of 18.1x based on expected FY21 earnings.

The deal will deliver a pre-tax profit of up to $70 million, resulting in a capital release of around $50 million.

Simplifying and focusing on core segments seems in trend with Westpac Banking Corp (ASX: WBC) recently announcing its exit from the auto loans business.

CEO of Suncorp, Steve Johnson, noted the sale will enable it to broaden awareness of its wholly-owned brands like AAMI, Shannons and APIA across Tasmania.

My thoughts

It seems like the JV was a way to determine the value opportunity in providing auto insurance in Tasmania and Suncorp didn’t like its prospects.

I think this is a prudent and measured approach.

Given Suncorp generated $10.48 billion of its revenue from its insurance services in Australia for FY20, the JV interest represents a really small cut of the pie.

I wouldn’t spend too much time reading into this announcement and would rather understand the flat trend of revenue over the past five years.

Also, margins will likely be compressed due to the rise in insurance claims stemming from not only the pandemic but recent severe weather conditions.

If you’re looking to become a better investor, I’d recommend signing up for a free Rask account to gain access to our stock reports.