A2 Milk Company Ltd (ASX: A2M) shares have risen by 27% since hitting a low of $5.12 on 18 May. Will positive news keep driving up a2 Milk shares?

A2M share price

Marketing is the name of the game

After suffering a brutal fall in its share price, a2 Milk has channelled its focus on marketing as it announced the appointment of Edith Bailey as Chief Marketing Officer.

Bailey was previously the Consumer Marketing Director of Danone Nutricia, with 14 years experience at the organisation.

Most importantly for a2 Milk, Bailey has experience in the infant nutrition category across China and South East Asia.

Why is this key?

As reported by my colleague, Patrick Melville, a2 Milk has found it challenging to sell in China given the growing shift towards local suppliers.

So, a2 Milk is planning on deploying more capital towards marketing in an attempt to maintain and amplify its brand exposure. Bailey seems to have the right mix of experience and skills to execute this strategy.

Mataura Valley Milk acquisition given the green light

Here is a summary of the acquisition written by my colleague, Jaz Harrison.

The New Zealand Overseas Investment Office (OIO) has approved a2 Milk’s proposed 75% acquisition in Mataura Valley Milk (MVM).

MVM is the new kid on the block when its comes to dairy suppliers in the south of New Zealand, it only started producing milk in August 2018.

I’ve previously flagged this acquisition as a negative because it means a2 Milk will be taking on more capital intensive operations. However, there are some positives to this move.

1. Leading manufacturing plant

Fonterra (NZE: FCG) and Open Country have historically dominated the New Zealand dairy industry since being established in 2001.

MVM set out to differentiate itself from its peers by building a business that could quickly tailor production to specific customer requirements while guaranteeing best-in-class quality.

It built a manufacturing plant that is data-centric focused, providing real-time data on every process.

A2 Milk seems to see value in acquiring this manufacturing plant as it may provide greater operating efficiencies relative to incumbents, Fonterra and Open Country.

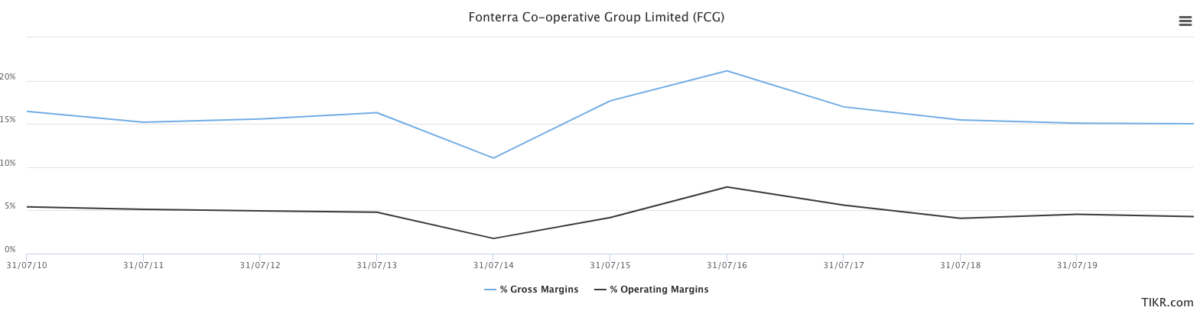

Fonterra’s gross margins and operating margins are back to 2010 levels, so not much has changed in the last decade.

This shows the limited efficiencies Fonterra achieved, which may present a big opportunity for disruptors like MVM.

If you combine this operating efficiency with a2 Milk’s market reach, this could turn out to be a sound long-term play.

2. Strengthen ties with its Chinese distribution partner

MVM’s current majority shareholder is China Animal Husbandry Group (CAHG) and following the acquisition, it will retain 25% interest.

CAHG is a 100% subsidiary of China National Agriculture Development Group, which is also the parent company of a2 Milk’s logistics and distribution partner in China, China State Farm.

As you can see, it’s a bit of a I scratch your back and you scratch mine moment at play.

Given MVM’s infancy, it has struggled with growing sales and that’s where a2 Milk comes into play. MVM will be able to use its existing China Food and Drug Administartion approved facility and leverage a2 Milk’s existing sales channels to lift revenue.

Whilst a2 Milk’s daigou channel continues to experience headwinds, it’s now ever more reliant on its Chinese distribution partner.

Final thoughts on a2 Milk

In light of the stall in Chinese demand, a2 Milk is relying on the re-opening of borders and its brand to sway Chinese consumers back their way.

This may result in more and more marketing expenditure, which could prove costly.

Whilst MVM’s cutting-edge plant may provide operating efficiencies, it won’t mean much if a2 Milk is unable to grow sales.

If strengthening ties with its Chinese distribution partner was one of the key reasons for the acquisition, well it will prove to be an expensive one. Also, it would highlight how dependant a2 Milk’s competitive advantage is on such a relationship.

In saying this, a2 Milk still has a formidable balance sheet that could be deployed towards its US segment.

I prefer to invest in businesses that are capable of widening their competitive advantage as per the Rask Investment Philosophy.

If you’re interested in reading about potential catalysts and roadblocks that may lie ahead for a2 Milk, check out these articles: