Upon the conclusion of a three month strategic review, Tabcorp Holdings Limited (ASX: TAH) has announced the company will split itself in two.

Tabcorp will demerge its Lotteries & Keno division home to the TattsLotto, Powerball, Oz Lotto brands into a separate company. The remaining Wagering and Gaming segments will be retained by Tabcorp.

The spin-off comes less than four years after its merger with Tatts Group.

In 2017, management spruiked operational synergies, increased earnings and a $500 million share buyback from the initial merger. So why unravel all of this now?

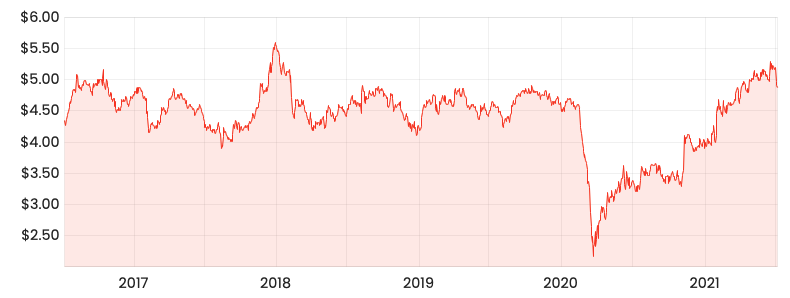

TAH share price

Diamond in the rough

Despite the optimism conveyed by management in 2017, the buyback never eventuated and earnings failed to fire.

In fact, wagering segment revenue has decreased since the demerger with the emergence of online bookmakers such as Sportsbet and Ned’s.

Similarly, gaming services has gone backwards.

The only segment to have performed is Lotteries and Keno, which has seen revenue increase 9% and EBITDA jump 14% per annum since 2015.

Notwithstanding Lotteries admirable performance, the overall group’s performance has been weighed down by wagering and gaming. As a result, the share price has failed to move over the past five years.

By spinning off lotteries, the board hopes the conglomerate discount applied to the broader Tabcorp group will no longer apply. This allows the market to price lotteries on a higher multiple as an independent company.

What’s so special about Lotteries?

I recall as a kid visiting the newsagents after school with my Archi (grandma in Sinhalese) and marking our ticket with lucky numbers – often family birth dates.

Then later that night eagerly awaiting in front of the television for the number draw. In most cases, we’d lose. On the odd occasion, we might win a division five or six prize.

Ironically, the returns for the owners of a lottery business is much more predictable than for customers.

This is largely due to the high barriers to entry. When Tabcorp merged with Tatts in 2017 it acquired the licences to operate public lotteries in each state and territory except Western Australia (which is owned and operated by the WA government under Lotterywest).

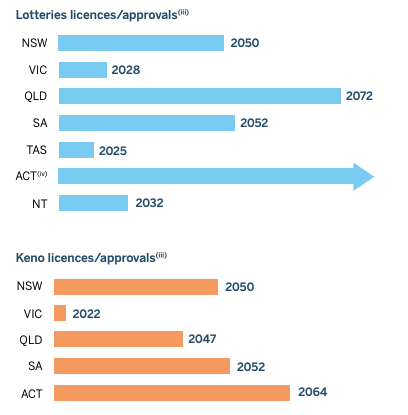

Tabcorp owns exclusive licenses to Victoria, New South Wales and South Australia. Additionally, it holds non-exclusive licenses where there are no other license holders in Queensland, Tasmania, Northern Territory and ACT. Licenses are typically long-term agreements providing certainty for the respective state revenue offices and Tabcorp.

As a result, Tabcorp has a monopoly position in Australian lotteries minus WA. Post-approval of licenses, lotteries require minimal ongoing operational or capital costs. To illustrate, operating expenses were only 7.6% of revenue in the most recent half-year result.

Most of the licensees are multi-decade agreements, likening lotteries to infrastructure assets. Predictable, long-duration cash flows with no effective competition. Surprisingly (at least to me), lotteries proved resilient even in the most recent economic downturn.

When many companies were impacted by the COVID-19, lotteries experienced growth in active customers, revenue and profits.

Shift to digital

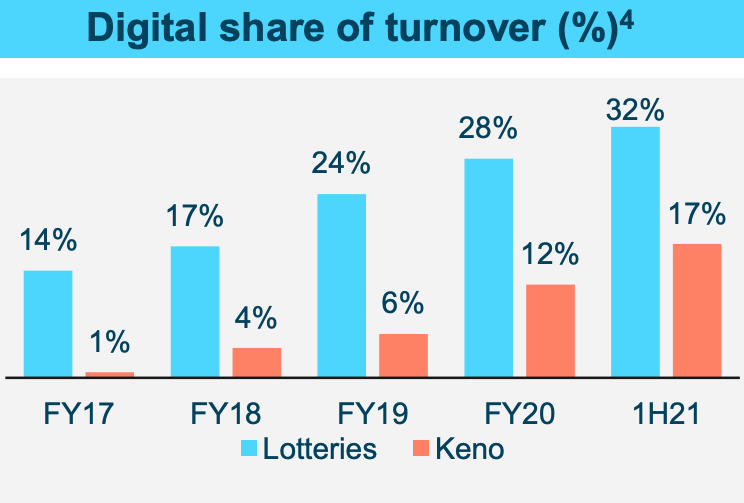

Traditionally, lotteries were typically distributed through retail outlets such as newsagents and convenience stores.

In recent years, online offerings via websites and mobile apps have become more prominent.

The move to digital is positive for Tabcorp as it removes the intermediary retailer for which it pays a commission.

Additionally, it makes lotteries more accessible to occasional customers. Rather than needing to visit a newsagent between 9-5, customers can purchases tickets from the comfort of their couch.

Highlighting the growth in online sales is Jumbo Interactive Ltd (ASX: JIN), a pure online reseller of lotteries licensed by Tabcorp.

Jumbo and Tabcorp recently extended their existing 15-year relationship for another ten years on more favourable terms for Tabcorp. From 2024, Jumbo will pay a service fee of 4.65% per ticket sale to Tabcorp.

Lottery economics

It all sounds pretty rosy. Monopoly asset. Long-term government agreements. Little competition. Minimal expenses.

The piece missing from the puzzle is the taxes, levies and fees paid to the governments.

In return for allowing Tabcorp to operate and profit from lotteries, each state and territory takes a share of the sales.

The percentage depends on each government and varies anywhere from 41%-90% of Tabcorp’s gross revenue. In FY20, total taxes, levies, commission paid was 73.9% of revenue. This leaves roughly 26 cents on every dollar to run the lotteries operation.

Valuation

Fortunately, lotteries are extremely capital light. Using the aforementioned percentage of operating expenses, a rough estimate of operating margin is 18.4% (26% minus 7.6%).

Revenue in FY20 was $2.9 billion. This infers an operating cash flow of $536 million.

I believe the lotteries business could trade on a multiple of operating cash flow upwards of 20 given its low capital expenditure and growing earnings stream. This values the lotteries business alone at $10.7 billion.

For context, the current Tabcorp market capitalisation is $10.6 billion.

The above napkin valuation doesn’t account for any capital expenditure or emergence of Jumbo as a competitor.

However, it gives a ballpark estimate of lotteries value.

Final thoughts

I was initially bearish on the demerger. The absence of management change (given past underperformance) and $225 million in demerger costs didn’t seem shareholder accretive.

However, upon further analysis of the lotteries and Keno business, I see why management has chosen to spin it off.

It’s a wonderful licensing asset, with durable long-term cash flows.

I’d need to do some more in-depth valuation but work, but the current Tabcorp share price of $4.80 looks compelling.