I recently came across a company I had never heard of. The name doesn’t give much away. If anything it sounds kind of boring.

The company is called PWR Holdings Ltd (ASX: PWH). Based in Queensland, the company produces cooling systems for the automotive industry.

Doesn’t sound that interesting right? Wrong.

PWR designs and manufactures customised radiators and cooling solutions for high-performance motorsports and the racing industry.

Think Formula 1, NASCAR, the World Rally Championship, the Dakar Rally and V8

Supercars.

The products are mission critical and can make all the difference in an industry that is decided by milliseconds.

Let’s take a closer look at what makes the company interesting and why I added it to my watchlist.

PWH share price

From Queensland to Silverstone

The company is led by the founder, Managing Director and CEO Kees Weel. His journey is an Aussie success story.

Kees started the business in 1987 on the Gold Coast manufacturing automotive radiators out of a small factory.

In 1997, Kees and his son Paul Weel saw an opportunity to produce quality and lightweight cooling systems for performance vehicles.

The market was demanding high-performance products backed by flexible manufacturing to adjust coolers to custom specifications.

The design, manufacturing and assembly were all done in-house allowing the business to offer flexible designs and quick turnaround times – essential for motorsports where specifications will change from race to race and car to car.

This business grew into what we know today as Paul Weel Radiators (PWR) Performance Products.

Today, the company is the leading niche high-performance cooling systems provider. PWR currently provides radiators to all Formula 1 teams after recently signing up Mercedez Benz.

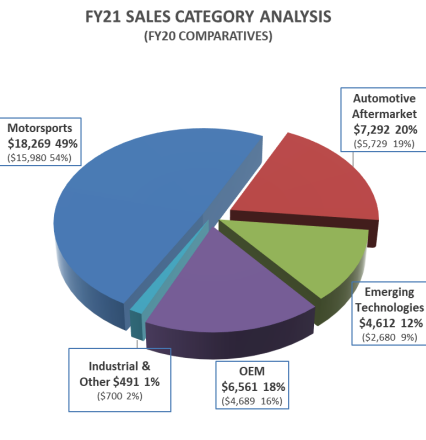

Additionally, PWR provides cooling systems in the high-performance automotive aftermarket, emerging technologies (such as military, aerospace, battery vehicles) and for original equipment manufacturers (OEMs).

Financial profile

The nature of PWR’s sales means revenue can be lumpy based on the racing calendar. For example, in the first half of 2021 sales declined as races were postponed globally due to COVID-19.

The condensed schedule released in the second half of 2021 led to a big pick up in demand.

This resulted in a 25% rise in revenue to $37.2 million and a 90% jump in net profit after tax to $6.6 million for the half ending 31 December 2020.

The company has no outstanding debt and $16 million of cash on hand.

Interestingly, the company does not capitalise its research and development costs. $7.3 million in R&D was expensed in FY20.

Well protected from competition

Due to the mission critical nature and technical expertise required to develop products, PWR has entrenched an enviable competitive advantage in the cooling systems market.

The company has high gross margins of 72% and a profit before tax margin of 24%, showcasing its ability to charge premium prices for its products and earn superior returns.

Positioned for growth

Currently, the majority of the PWR’s revenue is derived from motorsports. However, this sales mix will change moving forward as the business shifts its focus to emerging technologies.

In the most recent half-year update, emerging technology sales grew 72%, compared to 40% for OEM and 14% for motorsports.

Kees noted emerging technologies is expected to outpace motorsports potentially by 2024. He has since said this forecast will likely prove optimistic.

PWR recently received its AS9100 accreditation enabling the business to build a presence in the aviation, space, and defence industries. It has a pipeline of developments including cold plates, micro matrix, hydrogen fuel cell heat exchangers and battery cooling systems.

Additionally, the company has rolled out an online store supported by a digital marketing campaign to increase PWR’s global brand.

Risks to consider

While PWR currently has a dominant market position, the company is up against much larger and better funded competitors.

Its product offering is unique, but if a competitor was to create a superior product, its market share will quickly diminish.

As the old racing cliche goes, “if everything seems under control, you’re not going fast enough”.

Due to the highly specialised nature of the products, the company does not scale well. It will never be a business manufacturing millions of radiators a year. Rather it will make hundreds of high-quality systems. This is an advantage as well as a limitation.

Given its market share in motorsports – particularly F1, this segment offers relatively low growth. Management may find it difficult to find growth in future years as a result of the small total addressable market. This risk is somewhat mitigated by the company expanding into new areas in emerging technologies.

While I don’t believe Kees will going anywhere soon, he is an integral part of the company. Over the years he has been selling down his shareholding in the company, which currently sits at 20.3%.

Key-person risk is associated with most founder-led companies and would alter the investment thesis if he were to depart.

Currency movements also affects the business. 86% of revenue is derived outside of Australia.

My thoughts

I’m no expert in the automotive industry. My limited knowledge is based on the Netflix series Drive to Survive (highly recommend).

Therefore I need to do more due diligence of competitors, industry structure and growth opportunities before investing in PWR.

Given the disruption caused by COVID-19, using the financials from FY20 for valuation doesn’t make much sense. I’ll be waiting for the FY21 report in August to get a better handle on the business and its subsequent value.

With a market capitalisation hovering $690 million, it’s worth adding PWR Holdings to your watchlist. Don’t let this one race away.