Wealth management disruptor HUB24 Ltd (ASX: HUB) has announced record funds under administration (FUA) and net inflows for FY21.

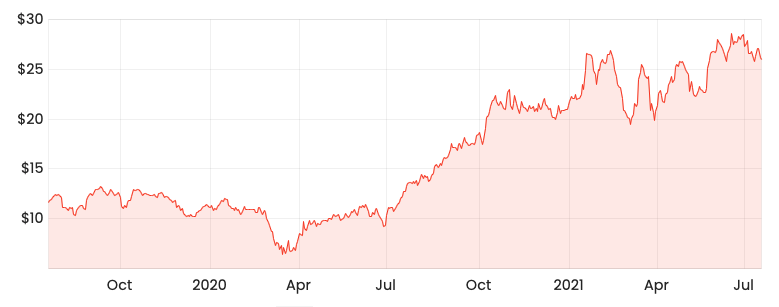

HUB share price

Platform FUA soars on net inflows

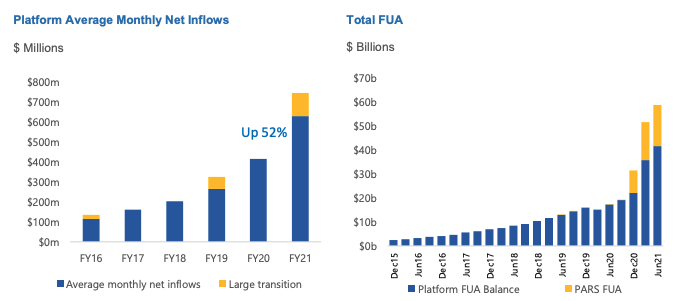

The company recorded quarterly platform net inflows of $3.9 billion.

$2.2 billion resulted from the HUB platform, with $1.4 billion and $0.3 billion resulting from the acquisitions of ClearView Wealth and Xplore Wealth respectively.

Including positive market movement of $1.9 billion, total Q4 platform inflows reached $5.8 billion.

As a result, the total platform FUA was $41.4 billion at June 30, increasing from $35.6 billion recorded on March 31.

Impressively, full-year platform FUA soared 141% from the $17.2 billion in platform FUA just one year ago. Of this, $8.9 billion was a result of net inflows – an increase of 80% compared to FY20.

PARS FUA increases from acquisitions

Portfolio, Administration and Reporting Services (PARS) FUA increased $1.4 billion to $17.2 billion.

Recent acquisitions of Ord Minnet’s PARS and Xplore experienced growth in FUA and the number of accounts.

Including FUA from platform and PARS, total group FUA is now $58.6 billion.

Taking on the wealth giants

HUB24 continued to take market share from the incumbent wealth providers including IOOF Holdings Limited (ASX: IFL), BT Financial Group and AMP Ltd (ASX: AMP).

As of March 31, HUB’s market share increased from 2.5% to 3.9%.

Given the market opportunity and significant growth runway ahead, the company will continue to invest for the future in FY22. The executive and distribution teams will be expanded in addition to investment in technology to support scale and ongoing innovation.

As part of the expansion, today HUB24 announced the appointment of Darren Stevens as Chief Product Officer.

Netwealth and HUB24 fight it out at the top

HUB24 received first place for overall financial advisor satisfaction in the 2021 Wealth Insights Report, which was completed by over 600 professionals.

The company took out first place in five of the nine categories including:

- Platform offering

- Administrative support

- Ease of doing business

- Communications and reporting

- IT and Web functionality

HUB also received 2nd place ranking in both adviser satisfaction and adviser advocacy in the recent Investment Trends Adviser Needs Report. Number one place went to Netwealth Group Ltd (ASX: NWL).

Both companies often score in the top two places for industry awards, highlighting the dominant market position each is carving out for itself.

Update on projects

The private label investment and superannuation offer for IOOF was launched during the quarter.

Additionally, the bulk transition of $1.4 billion from ClearView was completed.

The integration of Xplore is well-progressed. The Xplore team have now moved onto HUB24’s corporate technology environment and a property consolidation strategy is underway.

Finally, the separation of PARS from Ord Minnett systems to HUB24 is continuing and is on track for completion by the end of Q2 FY22.

My take

The operational performance of HUB24 has been exceptional. The headline numbers of 237% growth in total FUA, 141% increase platform FUA and 80% increase in net inflows showcase the market opportunity ahead.

Some of this performance I think is lost because the company reports quarterly therefore the headline numbers don’t reflect the annual growth.

In the long-term, I think both HUB24 and Netwealth will be winners. Both are taking market share and ranking #1 and #2 in industry awards.

You can’t place a multi on the share market, but I’d be backing both these horses going forward.