The Crown Resorts Ltd (ASX: CWN) share price is down on Star Entertainment Group Ltd (ASX: SGR) withdrawing its merger offer.

Star withdraws from Crown offer

Star has withdrawn its conditional, non-binding and indicative proposal to merge with Crown.

Star made the proposal to Crown on 10 May 2021 and Star management said that “to date Star has had limited engagement” with Crown on its proposal.

Star said that Victoria’s royal commission into Crown Melbourne has the potential to “materially” impact the value of Crown, including whether Crown retains the licence to operate its Melbourne casino. If Crown does retain its licence it could have conditions placed upon it.

Management said it “continues to believe substantial benefits could be unlocked” by a merger, however the uncertainty surrounding Crown is at a level that Star is “unable to continue at the present time with its proposal” that was announced in May.

Star said it’s open to exploring potential opportunities with Crown and will continue to closely watch the Victorian and Perth royal commissions. Both royal commissions are expected to conclude later this year.

Crown’s response

Crown said it “remains willing to engage” with The Star in relation to a potential merger on terms acceptable to both Crown and The Star”.

The board said that it is committed to maximising value for all Crown shareholders and will carefully consider any proposal that is in line with that commitment.

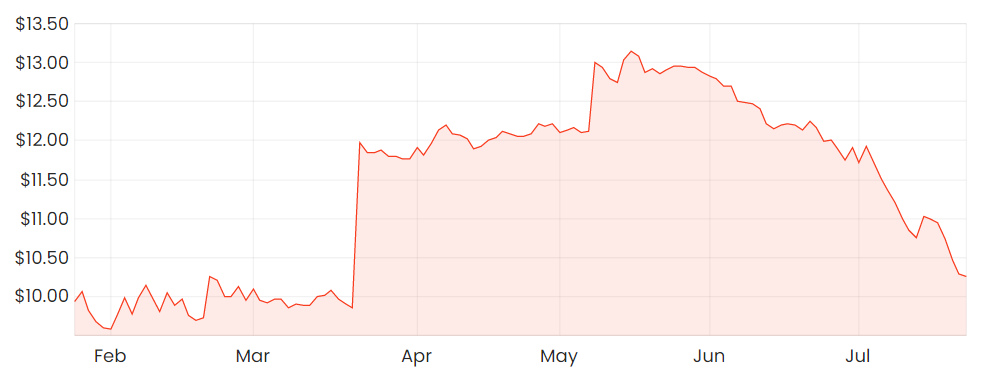

Crown share price

Final thoughts on Star, Crown and the share price

The Crown share price is currently down over 2% and is down over 17% over the last month. It seems a bit like the euphoria of the proposal party may be over for Crown. The Royal Commission hangover could be a bad one.

The Star share price is up around 1% at the time of writing, so it’s possible that shareholders are relieved that Star has decided to withdraw. It might be a long road for Crown to repair its reputation and be seen as a squeaky clean profit making business. COVID-19 also continues to affect casino operations.

I am not a buyer of Crown, there is just too much uncertainty for my liking, there are lots of ASX growth shares looking much more appealing.