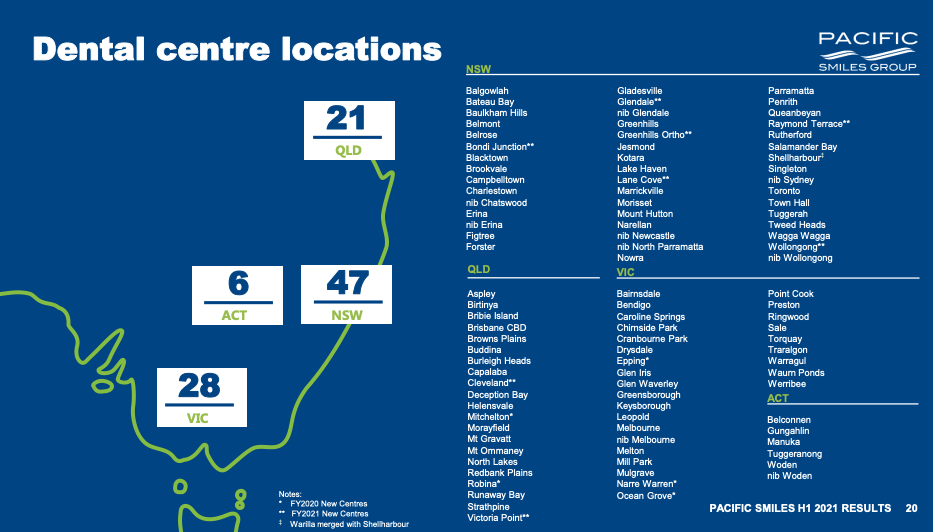

Founded by two dentists in 2003, Pacific Smiles Group Ltd (ASX: PSQ) operates 109 dental clinics across the eastern seaboard of Australia.

I recently added the company to my watchlist after the company announced it is supercharging its rollout of clinics. Let’s take a closer look.

Common problem, simple solution

Founded by Dr Alison Hughes and Dr Alex Abrahams, Pacific Smiles was created to answer a common issue amongst dentists.

“I want to treat patients well but we have to do all this administration. There must be a better way”.

Hughes and Abrahams set out to remove this pain point by managing all aspects of a dental practice, other than looking inside patients mouths.

Think about it like a serviced apartment except for dentists.

Pacific Smiles provides the clinic location and fit-out, equipment, dental assistants, consumables, training, patient IT systems and head office support.

By taking care of the operation side of the business, Pacific Smiles enables dentists to focus on what they do best – patient care.

Dentists can choose their own hours, work from multiple locations and incur no capital cost. Additionally, there are no financial or performance hoops to jump through.

Alas, the first branded dental network in Australia was born.

Over the years, Pacific Smiles has continued to roll out dentist clinics along the east coast of Australia where it now has 109 dental centres and 620 registered dentists.

In 2012 private equity firm TDM Growth Partners purchased a stake and the company was subsequently listed on the Australian Stock Exchange in 2014.

After TDM, Abrahams and Huges are currently the second and third largest shareholders.

McKenzie takes over

Current CEO and Managing Director Phil McKenzie joined the business in October 2018.

Prior to joining he was CEO for an audiology services business with over 200 locations based in the United States. He also held leadership positions at Apple retail where he led the companies initial market entry in Australia in 2008.

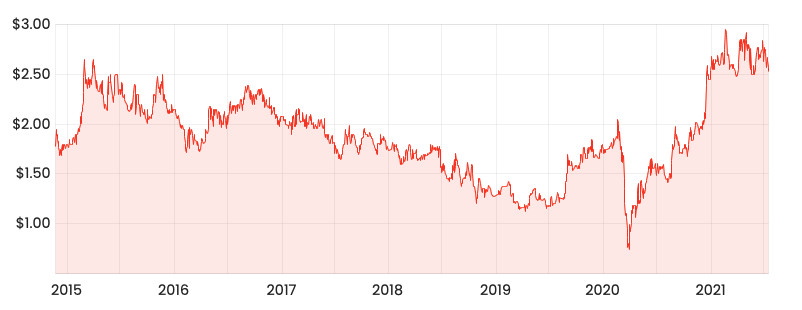

At this point, the share price had been sliding for years and sat below the 2014 IPO price. The business fundamentals remained sound, however, a fresh direction was needed.

He lasered in on both the customer and dentist experience. Improvements to the graduate programme and establishment of mentors bolstered training for the dentist workforce.

Underperforming centres were downsized to increase profitability. Processes were automated and technology shifted to cloud applications across the network.

As a result of these changes, same centre patient fees and dentist chair utilisation increased. Additionally, the company’s Net Promoter Score rose above 80.

Pacific Smiles’ strong emphasis on culture continued to shine, with group employee retention above 80% and a 90% retention rate for dentists.

Australian dental market

The market for dental services in Australia is estimated between $10-11 billion per annum. As of March 2020, there were 18,157 registered dentists.

Most patients fund dental services out of pocket in addition to private health insurance support, which paid out more than $2 billion.

The market is largely fragmented, with most providers being dentists operating at a single location with one or two chairs.

Clinic economics

Each clinic location works on a revenue share model. Pacific Smiles will take between 60-65% of the patient fee and dentists will keep the remaining for 35-40%.

Unlike its competitors, Pacific Smiles operates a roll-out rather than a roll-up business model.

Instead of acquiring existing dental centres, Pacific Smiles opens new clinics in greenfield locations with high foot traffic such as shopping centres and office buildings.

This benefits patients because clinics are in convenient locations and open seven days a week.

The company doesn’t own the clinic location, rather taking out long-term rental leases over 10 years.

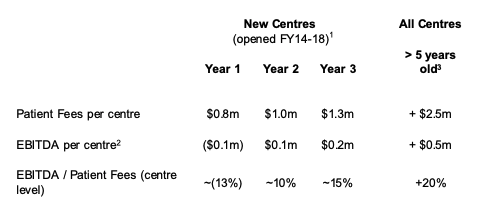

The average upfront capital cost of building a clinic is $850,000. Once opened, the typical clinic will become EBITDA positive within two years and the average upfront capital cost is repaid within around five years.

Growth ambitions

The company recently undertook a $20 million capital raising to supercharge its store rollout in the medium-term.

Pacific Smiles opened 15 centres in FY21. The business is aiming to up this to 20-25 over the next 24 months.

The company believes it currently has a 2.5% market share in Australia. The aim is to double this to 5% in the next five years.

Unsustainable dividend policy

The business still retains a 70-100% net profit after tax (NPAT) dividend payout ratio. This is somewhat perplexing given the apparent growth opportunities.

If the business is to rollout 25 stores in FY22, it will require $21.25 million in upfront capital ($850,000 x 25). This would utilise all of the capital recently raised.

A potential reason for the incongruent dividend policy is a result of the share register. Investors may prefer to receive steady, fully-franked dividends rather than the business retaining profits.

The board will announce its updated targeted payout ratio for FY22 in August. Potentially, the payout ratio will be revised downwards to redirect profits into growth opportunities.

Same, same but different

Pacific Smiles is often compared to its competitor and peer, 1300 Smiles Limited (ASX: ONT).

However, there are two main differences. As mentioned previously, Pacific Smiles is a roll-out model, whereas 1300 Smiles typically acquires existing practices in addition to building new clinics.

This makes the financials of each company quite different. 1300 Smiles clinics for the most part are profitable from day one. Pacific Smiles will have a combination of newer clinics that are breakeven and older clinics that are profitable.

Secondly, Pacific Smiles has more of a reliance on health insurers compared to 1300 Smiles. The company has relationships with 75% of health insurers. Furthermore, it has agreements in place to operate dental centres for NIB Holdings Limited (ASX: NHF), Medibank Private Ltd (ASX: MPL) and HBF.

Valuation

Given the varying revenue and profitability of each centre, the financials don’t give an accurate picture of Pacific Smiles underlying earnings.

The following table outlines the clinic economics for new and existing centres.

The company opened 15 centres in FY21 bringing the network to 109 clinics. Most will be a drag on profitability at this stage.

Using the conservative guidance of 20 new stores each year for the next two years, this gives a total store network of 149 by FY23.

Assuming each centre achieves an EBITDA of $0.5 million, this would imply a total EBITDA of $74.5 million once each clinic is 5 years old by FY28.

With a current market capitalisation of $400 million, this puts Pacific Smiles on an FY28 EBITDA multiple of 5.3.

The above valuation does not account for any clinic maintenance costs. Additionally, EBITDA does not equal cash flow. FY28 is also seven years away.

However, it hopefully provides a yardstick for the underlying profitability of Pacific Smiles and why it may be misunderstood by the market.

Risks

Pacific Smiles has ambitious growth plans, and if management can execute then shares will likely rerate upwards. The big question is if management can execute. High foot traffic locations are competitive and not endless in supply. Additionally, a 36% increase in dental centres of two years will result in new operational challenges such as finding quality dentists and building patient lists.

While dental clinics may seem like a relatively defensive investment, mismanagement could be its downfall. This was the case with previously listed Smiles Inclusive, which after listing in 2018 subsequently went into voluntary administration in 2020.

Dental rollouts is not a particularly high moat business. Competition may erode margins or new entrants may emerge. Pacific Smiles relies upon its culture and support network to entice dentists to partner with them. A fall in net promoter score or staff churn would flag potential issues at the company.

Notwithstanding that it remains the largest shareholder, TDM recently reduced its shareholding from 24% to 14% at $2.40 per share. The share price is hovering near that level currently. Given TDM’s longstanding relationship with the business, this isn’t a huge concern. However, TDM will have a good read on Pacific Smiles future prospects.

Lastly, as mentioned earlier the existing dividend policy remains a barrier to Pacific Smiles growth plans.

Final thoughts

If you believe the management team at Pacific Smiles will be able to roll out 20-25 stores over the medium term then I believe shares are undervalued today.

Full-year results will be released in August. From the updated data I expect to undertake a more comprehensive valuation for the company. Additionally, I’ll be taking a closer look at the board’s updated dividend policy.

Did you enjoy this Pacific Smiles analysis? If so, consider signing up for a free Rask account to gain access to our stock reports.