Spark Infrastructure Group (ASX: SKI) has received a third offer for the company by a consortium led by KKR and Ontario Teachers’ Pension Plan (OTPP).

The revised offer values shares at $2.95, to be reduced by any distributions made by the company prior to the agreement of the transaction.

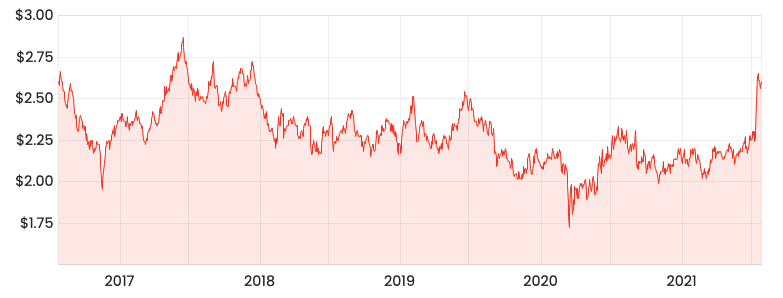

Shares have reacted positively to the news, up 5.38% to $2.74.

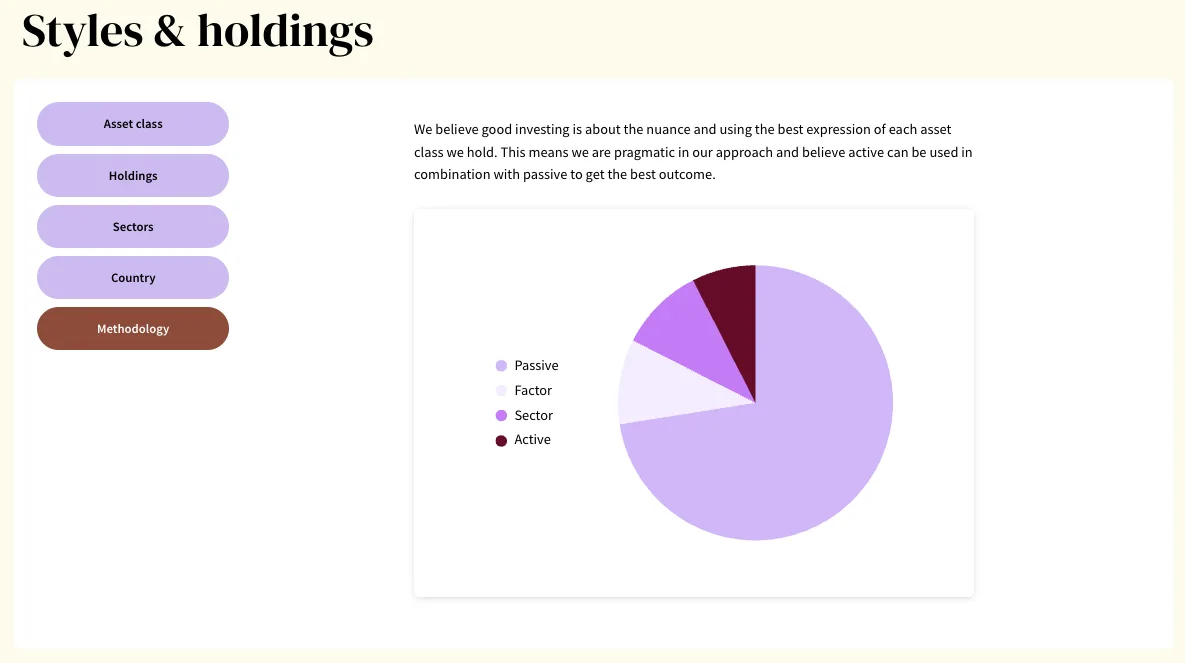

SKI share price

Updated proposal

Given Spark has already declared a distribution of $0.0625, the proposal values shares at an implied price of $2.8875.

The updated proposal valued shares at 26% premium to the closing price of $2.30 before the first takeover offer was declared.

Additionally, the offer is a 31% premium to the three-month volume-weighted average price of $2.20 per security.

As a result of the updated proposal, Spark will engage with the consortium with the opportunity to conduct due diligence.

The offer is still conditional on a number of milestones including due diligence by the consortium, foreign investment review approval and a unanimous board recommendation.

“The Board remains focused on maximising securityholder value and will carefully consider any proposal that is consistent with this objective”.

Third time lucky

The initial offer proposed by the consortium valued Spark shares at $2.70. This was declined by the board concluding the offer undervalued the company.

A revised proposal valuing shares at $2.80 was then tabled. Again, the board chose not to proceed as the offer still undervalued the company.

However this time the board was willing to provide limited information to the consortium to initiate further discussions.

Subsequently, the consortium provided a third offer after reviewing the limited information.

Infrastructure in vogue

Spark owns investments in four key Australian energy assets:

- 49% of SA Power Networks, the sole operator of South Australia’s electricity distribution network

- 49% of CitiPower and Powercor (together known as Victoria Power Networks), distributing electricity to Melbourne and western Victoria

- 15% of TransGrid, the largest high-voltage electricity transmission network in the NEM, connecting generators, distributors and major users in NSW and the ACT

- 100% of the Bomen Solar Farm north of Wagga Wagga in NSW

Pension funds such as OTPP are looking for stable, long-term assets that provide regular distribution for its members.

This makes infrastructure assets such as those owned by Spark obvious candidates. Other Australian infrastructure assets to have been offered recent takeover proposals include Sydney Airport Holdings Pty Ltd (ASX: SYD) and Vocus.

The Spark board has done an admirable job increasing the consortium’s offer not once but twice. Impressively, this has been done without a second bidder.

With Spark’s books now open for due diligence, I suspect this transaction will go through unless another bidder emerges.