Mainfreight Limited (NZE: MFT) is a global transport and logistics business based in New Zealand.

Essentially the company helps firms move and store goods from A to B via land, air and sea.

Aligned with shareholders

The company was co-founded by current Chairman Bruce Plested in 1978.

Plested decided to start up his own freight business after he was fired over “allegedly swinging a portable heater at a telephone switching system after a disagreement with his superiors about the size of his phone bill”.

Remaining passionate to this day, Plested is the largest shareholder owning 14.8% of the company. He also has not drawn any director fees since 2014.

Overall, the board of directors has an average tenure of 20 years.

Managing Director and CEO Don Braid owns 2.8% of the company. He has been a part of Mainfreight for 27 years joining in 1994. Signalling his confidence in the company’s future prospects, he purchased 30,000 shares in June for a price of $76.11.

Together, the board and management team own 20% of the company. This illustrates strong alignment between shareholders and the people running the business.

First class culture

You can’t get a read on culture by looking at the numbers. It’s intangible. It’s a feeling. But it’s super important.

Admittedly, I have never met someone who works for Mainfreight. But the anecdotal evidence is hard to dispute.

Let’s start with the company’s 100-year vision. A year after founding the business, the founding partners including Plested pledged to create a company that would stand for 100 years. All decisions are made on this basis including strategy, customer relationships and people.

In the most recent annual report, the company dedicated 12 of 118 pages to thanking its 9,000 staff. Mainfreight individually listed the name of each employee. The company also increased its discretionary profit bonus pool by 61% for the year.

Mainfreight periodically releases a team newsletter written entirely by employees. It talks about the business and employee roles. July’s update was 72 pages long.

It’s not just internally that the culture shines through. Mainfreight repaid the job keeper subsidies it received last year as it felt it was the right thing to do.

“It’s about integrity and it’s about what we stand for. We are a pretty proud business and we see those things as important.” – Don Braid

Moreover, Plested’s address March annual general meeting spent 77 words on financial results. He then moved onto discussing climate change and the importance of social housing.

All this is possible due to a strong foundation of accountability. Each warehouse branch manager manages their own P&L, which is reported weekly to management.

Financials go up on the cafeteria wall, so every employee is aware of branch performance. Management is decentralised, empowering staff to make decisions therefore preparing them for future leadership roles.

For a more in-depth look at Mainfreight’s culture, I highly recommend reading this interview.

Glass half full

On the surface, global logistics isn’t a particularly attractive industry.

It doesn’t scale well. Margins are usually low. Abundant competition. Capital intensive (you have to buy or rent warehouses). The industry is expected to grow albeit at a modest annual rate of 6.5% from 2020 to 2027.

So how has Mainfreight managed to differentiate itself?

The company has lasered in on quality.

Its key operating performance metric is delivery-in-full-on-time (DIFOT). Customers rely on Mainfreight to move products around the globe and know it will be there in full and on time.

The company has also focused its efforts towards less-than-truckload (LTL) freight, which refers to moving pallets of goods. Given the smaller order sizes and increased complexity of LTL, Mainfreight earns higher margins. Additionally, the company optimises freight across its network to retain these higher margins.

Relating back to the 100-year mission, the company develops relationships with its customers for the long term. Customer service and satisfaction are paramount.

History of outperformance

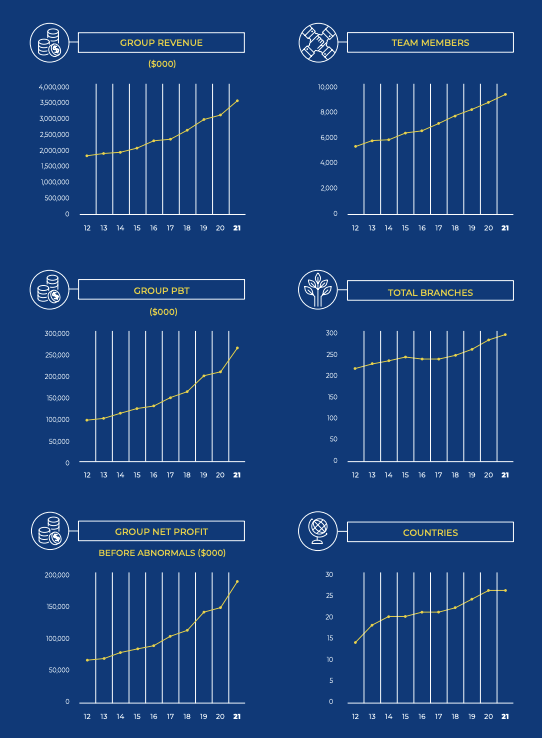

It’s rare a business records revenue and profit growth over such a long time horizon. Yet Mainfreight continues to deliver (figuratively and literally).

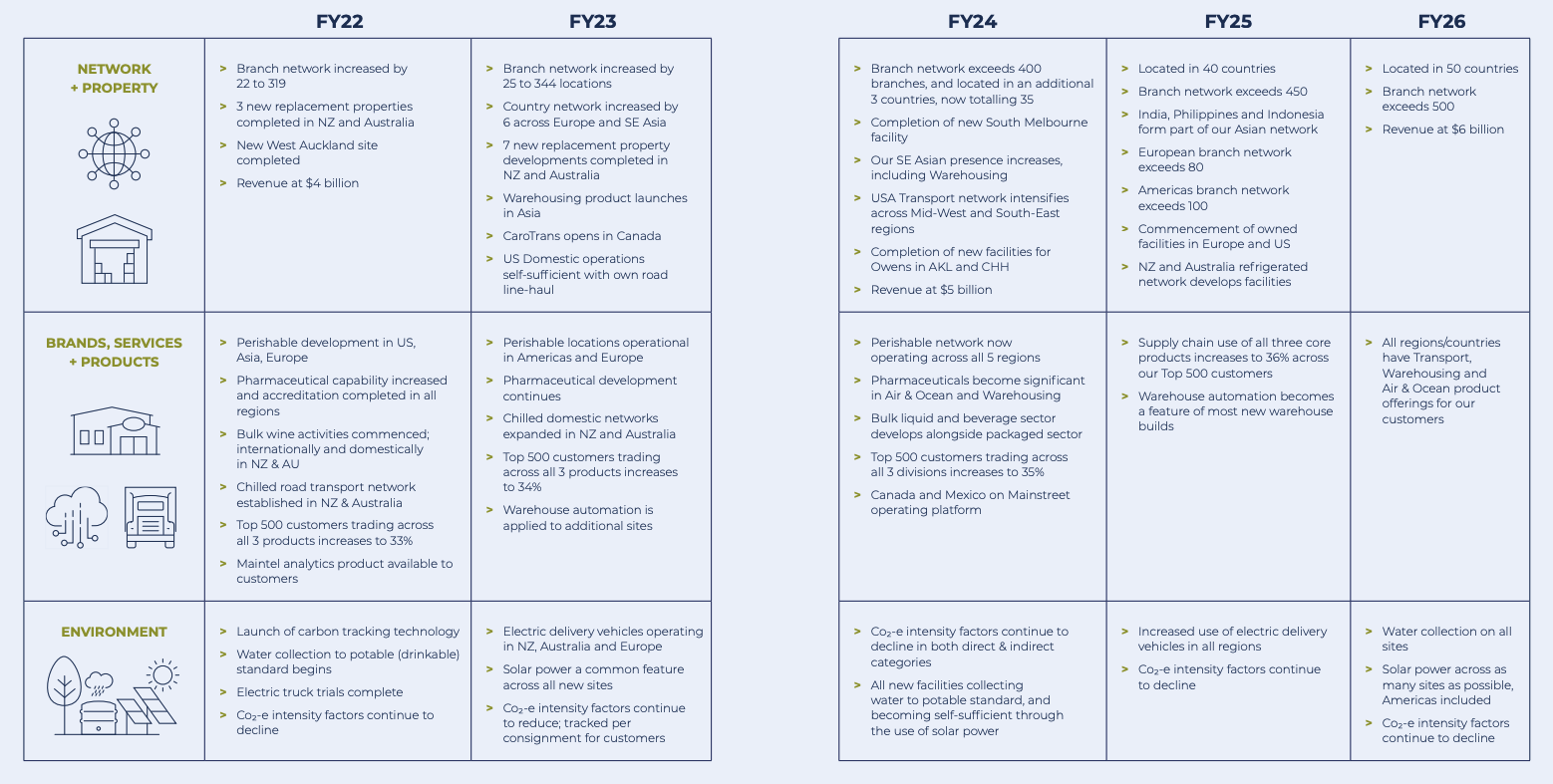

Below shows the performance of key metrics over the past 10 years. Go back further and you will see much of the same.

In the recent FY21 result, Mainfreight recorded revenue growth of 14.5%, normalised net profit growth of 27.2% and the dividend increased to 75 cents per share.

All five of its operating regions experienced growth, largely on the back of congestion in global supply chains and high freight costs.

Despite a record year for the business, Braid apologised for delays experienced by customers. Management remains cognisant that rising demand does mean standards can slip.

Final thoughts

Mainfreight is by no means a splash in the ocean with a market cap of around $8 billion. It is one of the largest public companies listed in New Zealand.

If it was listed in Australia, it would be the 67th largest company.

The Mainfreight share price has been on a tear this year therefore the valuation relative to its history is stretched – to say the least.

I’m not a buyer at these prices, but I’ve added it to my watchlist for now.

This is a quality company steered by competent management thinking about not the next financial year but the next 100 years.