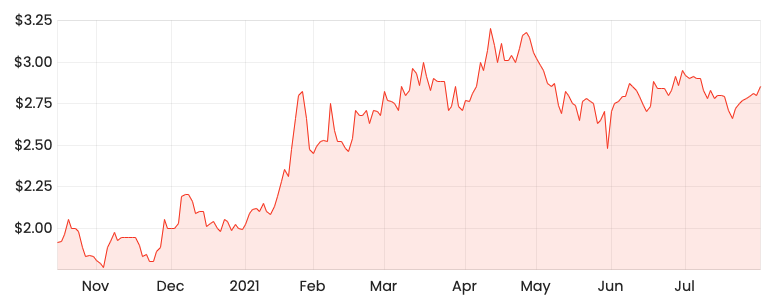

Australian telecommunications provider Aussie Broadband Ltd (ASX: ABB) shares are up 5.25% to $3.00 after the company provided a Q4 trading update.

ABB share price

Operational update

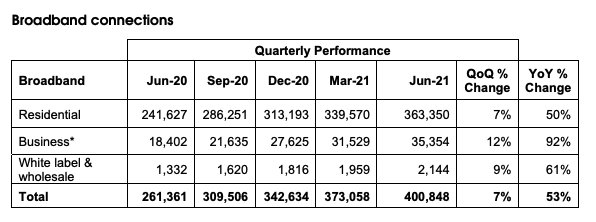

The company grew broadband connections by 27,790 during the quarter, bringing total connections to 400,848. This was a 7.4% increase on Q3.

While residential connections made up most of the new sign-ups, positively new business connections increased by 3,825 or 12% quarter on quarter.

Overall, management achieved both residential and business guidance.

Management noted its debtor days (the amount of time to collect money from customers) increased to 19.2 days during the period as a result of “relaxed credit management practices”. This was a direct result of the COVID-19 induced lockdowns in Sydney and Melbourne.

Debtor days has since returned to normal levels of around 16.0 days.

Despite elevated home broadband usage as a result of lockdowns, the company only recorded a $1.35 million CVC overage expense. This was a direct result of Aussie Broadband’s proprietary automated CVC-Bot.

In simple terms, CVC (Connectivity Virtual Circuit) charges are additional fees paid by NBN resellers to ensure residences and businesses have sufficient internet speed. The CVC-Bot dials up and down the required bandwidth based on demand.

Notwithstanding restrictions on construction activity in Sydney, the Fibre Project rollout remains on budget and on time.

Moreover, the company’s automated online business platform, Carbon, increased revenues by 46% compared to 3Q FY21.

The company also relaunched its mobile products, which now has access to the Optus 5G network. As a result, active services increased 20%, albeit off a low base.

Aussie Broadband’s market share at the of the quarter stood at 4.9%, increasing from 4.4% at the prior quarter.

Financial update

Q4 revenue was $100.1 million, an increase of 8% compared to the previous quarter.

This implies full-year revenue of $350.1 million, which is at the midpoint of previous revenue guidance.

FY21 EBITDA excluding IPO costs is expected to be at the upper end of guidance.

Previous guidance advised EBITDA of $17-$20 million, which had been upgraded from the initial prospectus range.

Outlook

July 2021 was a record sales month for broadband services on the back of marketing campaigns and promotions.

The company recorded increased CVC charges as a result of the ongoing Sydney lockdown. Utilisation in some areas peaked at 24.5% higher than non-lockdown periods.

The company will release its full-year results on Monday 30 August 2021. I’m looking forward to tuning in and hearing management’s future outlook.

Aussie Broadband continues to deliver, taking market share from incumbents and setting a new standard for customer service.

Check out the bull case for Aussie Broadband shares here or two other small companies I like here.