The ELMO Software Ltd (ASX: ELO) share price is rising after announcing a new software product module.

ELMO is a cloud-based software company for HR and payroll processes. It operates as a software as a service (SaaS) company with recurring subscription revenue.

ELMO’s new launch

ELMO said that its new release, called ‘Experiences’, is a new module to “facilitates smooth, efficient employee journeys through key life cycle stages”.

The company said that the new product increases engagement within an organisation. The Experiences module will assist with onboarding, promotions, office moves and more.

ELMO said that the program has a ‘drag and drop’ journey builder and managers can create templates and workflows.

The company said that it will be available to new and existing customers and a mobile friendly portal will also be available.

ELMO said that the Experiences module broadens its product suite and comes at an advantageous time, with many businesses having employees currently working from home.

ELMO CEO and Co-Founder Danny Lessem said: “The Experiences module will add to our Engage product family and provides organisations with a valuable tool to manage key employee journeys. These journeys can now be handled much more efficiently than a manual process, while also driving employee engagement.”

ELMO share price

Summary thoughts on the ELMO share price

It looks like this could be a good move for ELMO. Becoming a ‘one stop shop’ by broadening its software offering for businesses could strengthen its recurring subscriptions.

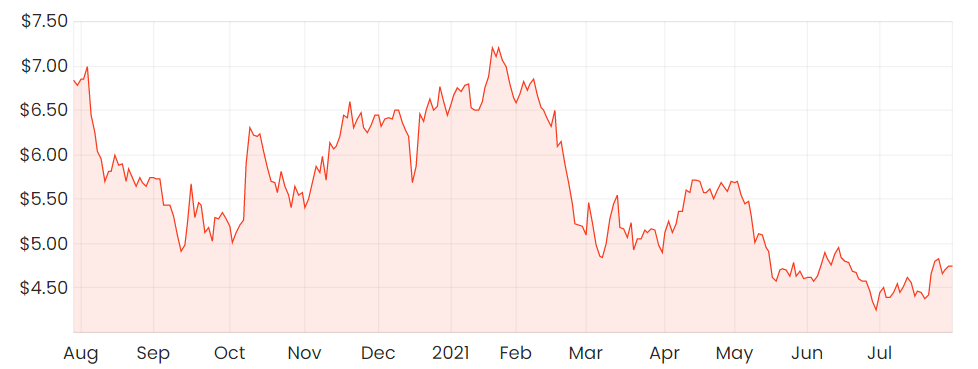

The ELMO share price has had a bumpy ride over the last year, reaching a high of $7.20 in January 2021 and has been trading at under $5 since its FY21 update in May 2021. At the time of writing the share price is $4.91, up over 3%.

However ELMO still doesn’t make a profit and the market wasn’t too pleased with the FY21 update. I’m happy for other investors to take the lead on this one, I’m currently looking for shares that produce growth and dividends.