FY21 profits of furniture retailer Nick Scali Limited (ASX: NCK) doubled as consumers spent big upgrading the family home.

The company exceeded its guidance provided in May, recording an underlying net profit after tax (NPAT) of $84.2 million.

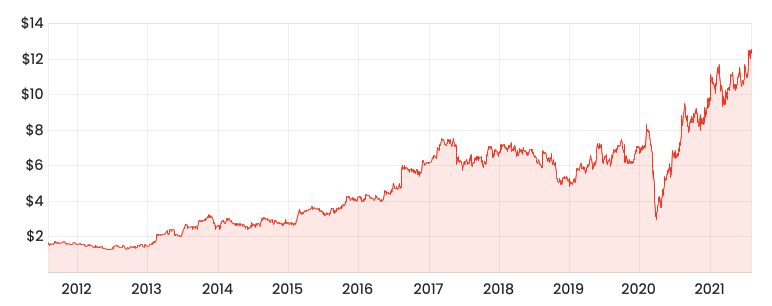

NCK share price

FY21 results

Sales increased 42.1% in FY21, from $262.5 million $373.0 million. This was largely a result of same-store sales growth of 34% in addition to online sales.

Demonstrating the shift to e-commerce, online sales orders swelled 6-fold, increasing from $3.0 million to $18.3 million.

Three new showrooms were opened during the year, contributing $5.1 million to revenue.

This brings the total store network to 61 showrooms, with 57 in Australia and 4 in New Zealand.

Notwithstanding rising freight and supply chain costs, gross profit margin for FY21 was 63.5%, up from 62.7% in the prior year.

This was a result of increased levels of demand leading to reduced promotional activity.

Despite strong revenue growth, operating costs remained similar to previous years.

As a result, the company experienced positive operating leverage. NPAT increased 100% to $84.2 million despite sales only rising 42%.

The company has declared a fully franked dividend of 25 cents, bringing FY21 total dividends to 65 cents.

This represents a payout ratio of 63% and a trailing dividend yield of 5.27%.

Nick Scali’s balance sheet remains healthy, with net debt (cash minus borrowings) of $73.2 million.

Operational highlights

Inventory levels remain elevated to support demand, with distribution centre inventory rising $5.3 million and showroom inventory increasing $1.1 million.

Despite intermittent lockdowns across Australia – including 11 stores shut from three months in Melbourne, the company experienced “buoyant” demand throughout the year.

Nick Scali was able to negotiate rental concessions as a result of store closures, lowering lease expenses. The company also returned $3.56 million in Jobkeeper subsidies.

Management has not provided guidance due to an uncertain retail outlook, however, noted trading remains strong.

New store rollouts and increased online penetration will be primary growth drivers moving forward.

My take

The elevated trading volumes won’t stick around forever. Positively, online sales are gaining material traction.

The burning question is how much will demand drop off once borders reopen and discretionary spending is reallocated to travel?

Regardless, the Scali family have done a tremendous job building the store network without compromising returns. This is evident by this years return on capital of 57%.

Its hard to justify investing in a company when it’s at the peak of its cycle (and share price).

Due to the quality of the company, I would remain a holder but I’d consider waiting for a better entry price for new investors.