Global healthcare leader ResMed Inc. (NYSE: RMD) Resmed CDI (ASX: RMD) recorded a 14% increase in quarterly sales upon “incredible demand”.

The company is “doing everything [it] can to increase manufacturing” however is hampered by supply chain bottlenecks.

Originally founded in Australia, Resmed provides hardware and software solutions to treat sleep apnea, chronic obstructive pulmonary disease (COPD) and asthma.

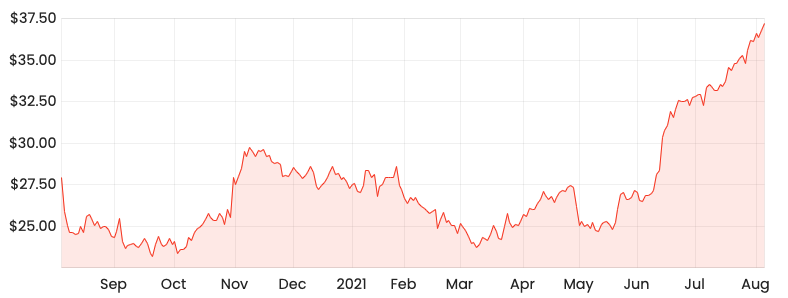

RMD share price

Q4 results

Revenue for the fourth quarter increased to $876.1 million, up 10% on a constant currency basis. For the full year, revenue increased 8% to $3.2 billion.

Device sales soared 30% across the United States, Canada and Latin America, led by a product recall by one of ResMed’s biggest competitors.

The company is seeking to take market share from this event however is unable to meet current demand.

CEO Mick Farrell noted on the investor call he is “personally calling supplier’s CEOs” to try and source parts.

Across Europe, Asia and other markets total sales increased 11% for the quarter.

Quarterly gross margin contracted 230 basis points to 56.0% due to lower-margin device sales, lower average selling prices, and unfavourable foreign currency movements.

Net income for the quarter equalled $198.4 million, an increase of 3% on the prior year quarter. Full-year net income increased 13% to $780.6 million.

The company announced a quarterly dividend of US$42 cents per share. This translates to AUD$5.7 cents per share (once accounting for the 10 for 1 CDI split).

Operational update

The company is now cycling elevated quarterly and annual prior year numbers. During the midst of COVID-19, ResMed incurred an abnormal spike in demand for ventilators totalling $125 million. This demand has now subsided to $20 million in sales.

Management noted the ongoing recovery of sleep apnea and COPD patient flow across the business as markets reopen. Some countries remain at 75% whereas others are back up to 95%.

Furthermore, the company is driving accelerated adoption across its digital health solutions, which keep patients out of hospitals thus reducing the total cost of care. Subsequently, software-as-a-service revenue increased 5%.

ResMed remains on track to deliver on its 2025 strategy of improving 250 million lives through out-of-hospital healthcare.

My take

It’s difficult to get a read on ResMed’s progress. On one hand, the company is experiencing great demand for its product as it poaches clients from competitor Koninklijke Philips NV (AMS: PHIA).

On the other hand, growth is mitigated by elevated comparison numbers and supply shortages. Moreover, free cash flow for FY21 actually fell 11% compared to FY20.

The company currently trades on an enterprise value to free cash flow multiple of 61. That looks expensive at face value, but the company invests significantly in research and development to spur future growth.

The share price has soared almost 50% since June. Therefore I’ll need to do some further digging to uncover if ResMed offers value at today’s price of $36.37.