Aurizon Holdings Ltd (ASX: AZJ) shares have been on a downward trend of late. Can Aurizon shares lift itself back up on its FY21 results?

Aurizon is Australia’s largest rail freight operator, moving coal, iron ore, agricultural freight and more across the nation. It generates more than half of its revenue from transporting coal from mines in QLD and NSW to end customers and ports.

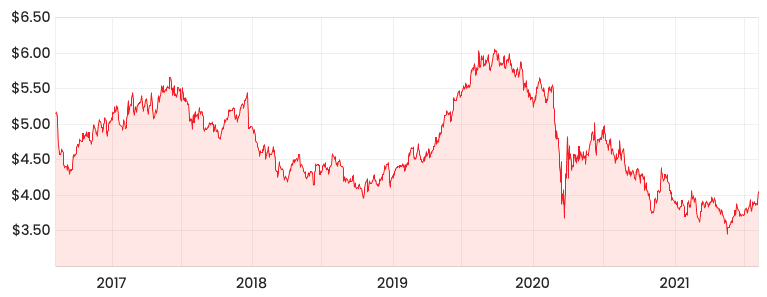

AZJ share price

Same, same for FY21

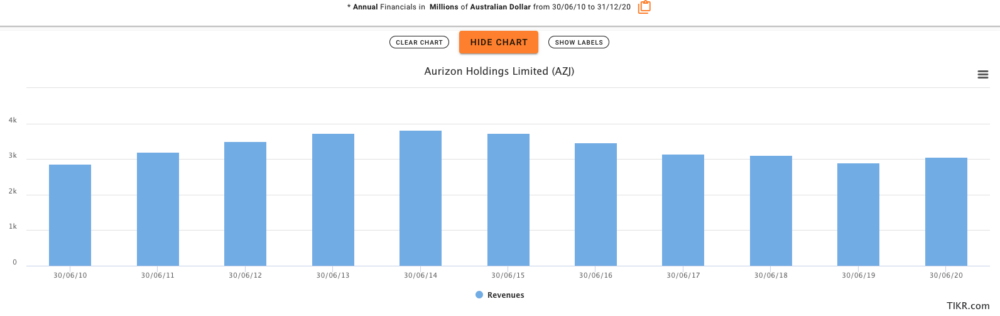

There were no material changes in Aurizon’s financial results with total revenue falling by 2% from $3.065 billion in FY20 to $3.019 billion.

Earnings before interest, taxation, depreciation and amortisation (EBITDA explained) increased by 1% to $1.482 billion.

Not much seemed to happen since last year but let’s zoom out to the last decade. Revenue peaked at $3.812 billion in FY14 and has steadily declined up until FY20, which experienced a reprieve of a 5.4% jump.

It appears the recent record rise in demand for iron ore has contributed to higher revenue in FY20 and FY21 relative to FY19.

FY21 results were driven primarily by an increase in volume for the Bulk business segment. This includes the transport of bulk mineral commodities, agricultural products, mining and industrial inputs.

However, the amount of coal transported went down by 6% due to COVID related disruptions and China import restrictions, resulting in Coal EBITDA falling 13% compared to FY20.

As for the Network business, it delivered a 6% increase in EBITDA.

Overall, the underlying net profit after tax increased by $2 million to $533 million for FY21.

Aurzion will be paying a final dividend of 14.4 cents per share (70% franked).

What’s ahead for Aurizon?

Aurizon has provided guidance of EBITDA to fall in between $1.425 billion to $1.5 billion for FY22. This includes sustaining capital expenditure in the range of $475 million to $525 million.

The estimates are based on the following assumptions.

- Around 5% increase in the volume of Coal with lower costs offset by lower contracted rates

- Continued growth in Bulk revenue from the impact of recent contract wins and port acquisitions

- A one-off retrospective fee of $49 million from a project and a reduction in the cap on revenue for the Network segment.

My thoughts

A big part of Aurizon’s competitive advantage lies in its 99-year lease over the Central Queensland Coal Network with the QLD State government. This expires on 30 June 2109 (a long, long time away).

By possessing access to the rail network, Aurzion essentially has a monopoly over rail routes for particular areas in QLD.

The business will only benefit from its monopoly power if demand for whatever that can only be transported via these rail routes continues to grow.

In light of this caveat, I believe it’s prudent for investors to evaluate the future demand for such things.

Given the growing shift away towards renewable sources of energy, demand for Aurizon’s freight services could well dry up in the long term.

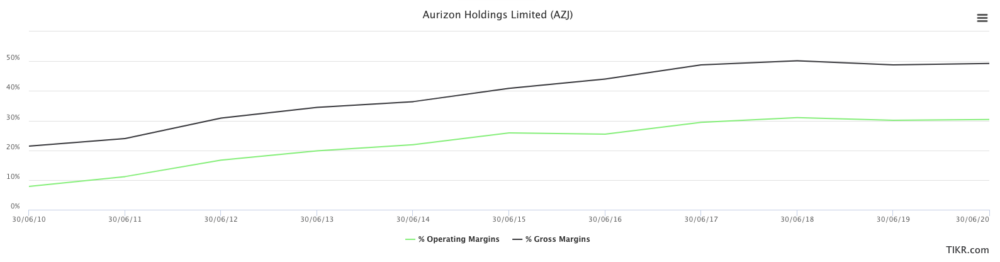

Further, the below graph illustrates gross margins and operating margins have hit record highs and begun to stagnate. Its main channel of value creation seems to be maturing, which doesn’t bode well for the long term.

As you can see, Aurizon’s future growth is dictated by external market forces of demand and supply. I prefer to find businesses that are less influenced by such factors as per the Rask Investment Philosophy.

If you’re more interested in ASX growth shares, I suggest tuning into this awesome interview.