The Zip Co Ltd (ASX: Z1P) share price could be put under pressure with Klarna’s latest plans to capture market share.

Klarna and CBA’s plans

Klarna and Commonwealth Bank of Australia (ASX: CBA) are on the hunt for buy now, pay later (BNPL) market share. The partnership have decided to promote a special offer to CBA merchant customers.

Klarna said that the offer to merchants is zero fees for the first six months with “dedicated marketing support to help them grow and prosper”.

According to the Australian Financial Review, sources close to Klarna said that its Swedish management were frustrated that Klarna’s growth numbers in the United States were not being replicated in Australia.

Is this the start of the race to the bottom?

The BNPL space in Australia is filling up very fast and is arguably already oversaturated. Is this the beginning of the race to the bottom for BNPL fees?

The telco industry in Australia faced similar turbulence when disrupters came into the market, such as Aussie Broadband Ltd (ASX: ABB) and offered competitive pricing. It didn’t take much to turn into a slippery slope of further price reductions fighting for market share.

The BNPL industry as a whole isn’t making profits yet either, instead choosing to build their brands and market share in this low interest rate environment. The fact that most aren’t making a profit could make the race to the bottom even more worrisome for the industry.

What are Afterpay and Zip doing?

Afterpay has been under the spotlight this month with the Afterpay board recommending a takeover by Square.

The deal is still subject to approvals, assuming it goes ahead Afterpay shareholders will be issued Square shares instead.

Zip is growing well internationally with its offering in the US doing particularly well. Its US revenue grew by 280% making it Zip’s biggest revenue stream. Zip has also recently launched into Canada and Mexico.

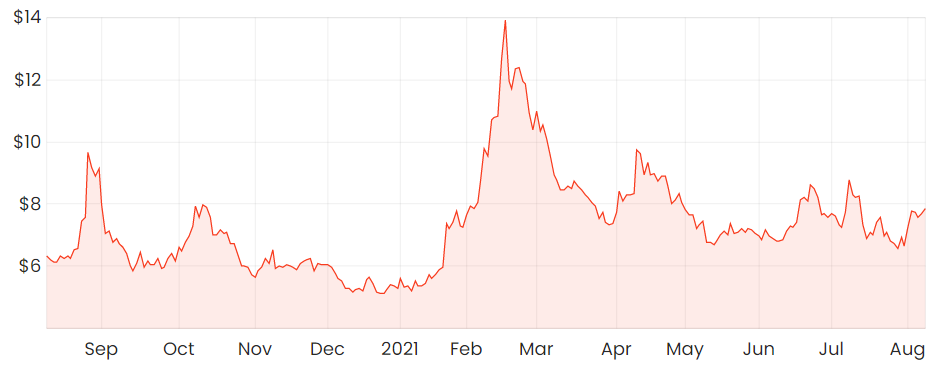

Zip share price volatility

Final thoughts on the Zip share price

The Zip share price has been a bit of a volatile rollercoaster and is down over 25% over the last six months. At the time of writing it is up over 1% today.

Zip is seeing good growth in its international expansion and strong traction in the large US market. However, it isn’t immune to the potential ‘race to the bottom’ competition.

BNPL is a sought-after offering and is fast becoming the go-to option over credit cards. I have no doubt that some businesses will do well with BNPL, but I don’t believe all of the current players in the market will make it long term.

I unfortunately don’t have a crystal ball to see which BNPL will win the market-share race, and which ones will fade into obscurity. I’m always looking for share ideas though and this is one of my favourite places to get inspired.